Opening an Overseas Bank Account in Jersey (Complete Guide)24 min read

Reading Time: 9 minutesConfidently open an overseas bank account in Jersey by knowing the procedure, the requirements and the advantages of the offshore account in one of the world’s best international financial centers.

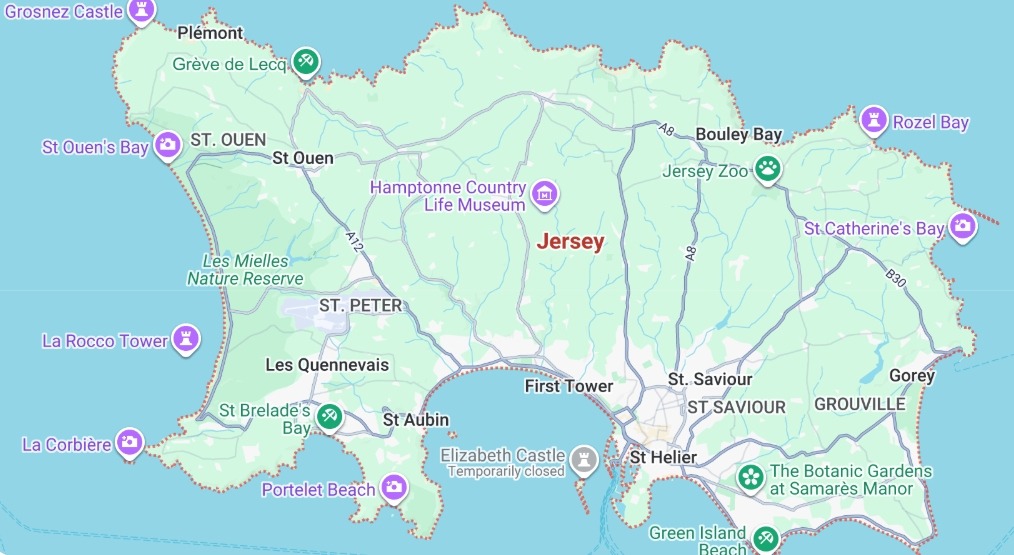

About the Jersey ↵ Jersey is a densely populated U.S. state in the Mid-Atlantic region, bordered by the Atlantic Ocean, New York, Pennsylvania, and Delaware. Jersey’s strong regulatory regime, its multi-currency accounts and digital-first banking services make it a great choice for expats, investors and global organizations.

Private wealth management, corporate banking or seamless cross-border transactions, whatever your needs, Jersey’s financial services sector can meet them.

Quick Note ↵ This guide will explain everything necessary including documentation and opening accounts remotely, as well as the type of account you can open and how safe it is keeping large sums of money.

This article will explain all you need to know about both the requirements that you will have to meet in order to open a regular bank account in jersey and the advantages of Jersey banking for expats and investors.

By choosing the right Jersey offshore bank account, you can manage international payments, benefit from dedicated IBANs, explore advanced Jersey digital banking solutions, while also taking advantage of the island’s solid reputation as a stable Jersey international financial center.

Open an overseas bank account in Jersey to unlock global financial flexibility, whether you’re an expat, investor, or business owner.

Jersey’s reputation as a credible and highly regulated international financial center makes it a perfect offshoring hub when it comes to banking in Jersey.

Offering digital-friendly services, multicurrency options and state-of-the-art security, Jersey banks serve non-residents and companies from all around the world.

Whether you’re exploring how to open a Jersey bank account or comparing the best banks in Jersey for foreigners, you’ll find actionable insights to simplify your Jersey offshore account opening process.

What documents are required to open an overseas bank account in Jersey?

Opening a Jersey bank account for non-residents requires standard due diligence documents, though exact requirements may vary by provider.

Documents required to open an overseas bank account in Jersey

- Proof of identity: a valid passport or national identity card.

- Proof of Address: Utility bill, bank statement or tenancy agreement (not more than three months old).

- Source of funds: Proof of source of income or wealth e.g. tax returns, employment contract, or financials of business.

- Corporate documents (business accounts): Certificate of incorporation, memorandum of association, and beneficial ownership.

Some institutions may also require a reference letter from an existing bank or a professional advisor. For non-residents, additional checks may apply, but Jersey bank account requirements are designed to be straightforward for compliant applicants.

Always confirm the documents required to open a Jersey bank account directly with your chosen provider to avoid delays.

Can non-residents open a Jersey bank account remotely?

Non-resident bank accounts in Jersey are very easy to obtain these days and many applications can be submitted fully online.

The Kingdom Bank and other prominent players in Jersey’s financial services sector provide you with an all-digital onboarding process which does not require any in-person meetings.

The Jersey offshore account opening process generally requires:

- Apply online: Provide basic personal or business information in a secure form.

- Upload your documents: You can now submit scanned copies of your documents via a portal that is encrypted.

- Video verification: Do short live calls to confirm your identity (nowadays it’s standard anti-money laundering compliance).

- Approval and activation: Accounts are typically approved within 24 to 48 hours, with access to digital banking immediately.

Opening an account remotely is the best option for expats, digital nomads, and international companies.

Yet, a few private banking services may still require face-to-face meetings for very high-net-worth customers.

How long does it take to open an offshore account in Jersey?

The timeline for opening a corporate bank account in Jersey or a personal account depends on the provider and complexity of the application.

Here’s a general breakdown:

- Standard personal accounts: 1-3 working days (with pre-approved documents). For the fastest setup, open a multi-currency account in Jersey with a provider offering instant pre-approval.

- Business accounts: 3-7 days (due to extra checks on compliance).

- Private banking or high-net-worth accounts: Up to 2 weeks (may need to go in depth with due diligence).

The Kingdom Bank and other high quality best banks in Jersey for foreigners are known for their ease, with processing of applications in some instances in 48 hours once all is in order.

Hold-ups are typically the result of further verification or additional source-of-funds documentation.

For a smoother experience, follow a step-by-step guide to opening an offshore account in Jersey provided by your bank.

Certified translations (if the documents aren’t in English) can also be pre-submitted to expedite the application.

Are Jersey bank accounts safe for holding large international balances?

Jersey is part of the world’s most secure Jersey international finance center hubs and is renowned for its political stability, strong legal system and strict regulatory regime.

Essential security features include:

- Deposit insurance: Jersey isn’t covered by the FSCS in the UK, but a number of banks keep client money in segregated accounts, or offer full reserve policies (e.g., The Kingdom Bank ensures 100% of deposits are backed by liquid assets).

- Anti-fraud features: Banks now incorporate AI-driven monitoring, multi-factor authentication, and transaction alerts in real-time to mitigate against unauthorized access.

- Regulation: Jersey financial institutions are required to meet international standards (e.g. FATF, OECD) and are subject to ongoing audit.

For large balances, Jersey private banking services often provide additional layers of security, such as dedicated relationship managers and customized risk assessments.

Corporate clients can access custody and settlement services, giving them the confidence that their assets are safe as they extend their reach across borders.

What types of overseas accounts can individuals open in Jersey?

There are different types of accounts for different purposes in Jersey’s banking industry.

Here’s an overview of the most common options:

General-Purpose Bank Accounts

- Multi-currency accounts: Hold, exchange and transfer in GBP, EUR, USD and a handful of other major currencies. Suitable for expats and frequent travelers.

- Savings accounts: Competitive interest rates on offshore savings accounts Jersey, including fixed-term deposits and digital-asset-linked savings.

- Private banking: Personalized wealth management, investment and estate planning for high-net-worth clients.

Business Banking Accounts

- Corporate accounts: Designed for international businesses, with features like bulk payments, payroll services, and Jersey business bank account integration with accounting software.

- Dedicated IBAN accounts: Unique IBANs for seamless cross-border transactions, reducing transfer fees and delays.

- Virtual cards: Single‑use or recurring virtual card, which are secure and usable to make online payments (especially useful for managing subscriptions and making vendor payments).

Specialized Accounts

- Pooled accounts: Consolidate funds from multiple entities under one account for easier liquidity management.

- Custody accounts: Being able to hold and settle assets (such as securities, and even digital assets) in a trusted, secure manner is critical.

- Foreign exchange (FX) accounts: Take advantage of the best rates when making large international transfers.

For entrepreneurs, Jersey’s how Jersey supports global business banking initiatives, such as tax-neutral structures and easy company formation, make it a strategic base for offshore operations.

Benefits of offshore banking in Jersey

Jersey is a leading choice for offshore banking in Jersey as it has a unique mix of stability, innovation and global reach.

Here’s a summary of the benefits of offshore banking in Jersey.

- Tax efficiency: There are no capital gains, inheritance or withholding taxes on non-residents (although you might want to get some tax advice specific to your circumstances).

- Regulatory credibility: Jersey is considered a white list jurisdiction by the EU and OECD, which promotes transparency and adherence regulated standards.

- Digital-first banking: Providers like The Kingdom Bank offer Jersey digital banking solutions with 24/7 access, real-time payment tracking, and API integrations for businesses.

- Flexibility: How to open a Jersey bank account is simpler than in many offshore jurisdictions, with English as the primary language.

- Worldwide availability: With SWIFT access and multi currencies allowed, Jersey bank accounts can be used to make payments anywhere in the world.

For expats, the advantages of Jersey banking for expats and investors extend to easy account management, competitive FX rates, and access to premium private banking services.

Streamline your business payments with batch payments, invoice automation and expense tracking.

How do Jersey banks verify identity for overseas customers?

Opening a Jersey offshore bank account is a strictly regulated process and it is necessary to comply with anti-money laundering (AML) and know-your-customer (KYC) rules.

Banks, such as The Kingdom Bank, combine digital verification with document review to strike a balance between security and user friendliness.

Documents required to open a Jersey bank account

What you need to open an account:

- A valid passport or a national identity card

- Proof of address (utility bill, bank statement).

- Tax Identification Number (TIN) or its equivalent

- Source of funds documentation (for bigger deposits)

A business needs:

- Certificate of incorporation

- Memorandum and the articles of association

- Details of beneficial ownership.

- Latest financial accounts

Most Jersey banks now offer online account opening, with video calls or e-signatures replacing visits in person.

While the Jersey bank account requirements are rigorous, the process is designed to be transparent; most applicants receive approval within 24 to 48 hours.

Is it possible to open a Jersey business account online?

Yes, opening a corporate bank account in Jersey is increasingly digital-first. Many entities, such as The Kingdom Bank, provide fully remote onboarding for foreign businesses.

The step-by-step guide to opening an offshore account in Jersey

- Filling out an application online with business details.

- Submit your KYC documents.

- Performing a video verification (if needed).

- Account approval and access to digital banking tools.

Considerations to keep in mind when dealing in Jersey business bank account:

- Regulatory compliance: The financial services industry in Jersey ensures proper due diligence, particularly when dealing with breaches of high-risk areas including crypto, or forex.

- Types of accounts: There are a few types of accounts to choose from, including multi-currency accounts and dedicated IBANs that enable you to execute international transactions without a hitch.

- Global operations support: The Kingdom Bank provides payment control solutions such as batch payments and API integration for businesses crossing international borders.

Banks may also provide special packages for startup or small and medium-sized enterprises (SMEs) with lower requirements for deposits.

Custody and settlement are also available for larger firms, coupled with traditional banking.

Can I manage my Jersey account in multiple currencies?

One of the biggest draws of overseas banking in Jersey is the ability to open multi-currency account in Jersey.

The Kingdom Bank and other top providers allow you to hold 40+ currencies that include GBP, EUR, USD, and CHF with excellent FX rates.

- Keep and exchange money without the need for multiple accounts.

- Accept payments in your own local currency and avoid conversion fees.

- Lock in exchange rates for future transactions via forward contracts.

- Get virtual cards that are associated with various currencies for online shopping.

For businesses, this means simpler global payment solutions; whether paying suppliers in Asia or receiving client payments in Europe. Private clients enjoy offshore savings accounts in Jersey with significantly higher interest than normal banks.

Individuals also benefit from Jersey private banking services that include savings accounts in foreign currencies, often with higher interest rates than domestic options.

The Kingdom Bank also offers virtual cards to be used for online transactions safely, with adjustable limits of expenses. Physical debit cards are also provided, and usually include contactless as well as Apple/Google Pay compatibility.

Do Jersey banks support digital and crypto-related transactions?

Jersey’s forward-thinking approach to fintech has turned it into a hot spot for Jersey digital banking solutions.

Not all banks provide services for dealing in crypto, but plenty (including The Kingdom Bank) offer custody and settlement for digital assets or partner with regulated exchanges.

- Fiat-to-crypto on/off ramps through integrated payment processors.

- Custodial services for institutional investors (subject to licensing).

- Blockchain-powered payment tracking for transparency.

Regulatory safeguards

Jersey’s financial services sector demands banks to:

- Authenticate the source of crypto funds.

- Track transactions for unusual activity.

- Meet FATF travel rule requirements.

The Kingdom Bank also provides dedicated IBANs for digital asset companies to differentiate their crypto dealings from their traditional financial services.

Banks here understand the needs of modern enterprises, ensuring that how Jersey supports global business banking extends to emerging sectors.

What are the main benefits of opening an overseas account in Jersey?

Jersey’s mix of stability, innovation and tax efficiency makes it a prime offshore banking destination.

For entrepreneurs, Jersey international financial center status means access to:

Political and economic stability

As a British Crown Dependency Jersey has provided:

- A AAA credit rating (above the UK and US).

- No exchange controls.

- It has a legal system founded on English common law.

Advantages in terms of taxation

While not a tax haven, Jersey provides:

- No capital gains tax, no tax on inheritance for non-resident.

- Low corporate tax, 0% for most international companies.

- Tax treaties with major jurisdictions.

Global banking infrastructure

- Easy access to SWIFT and SEPA for speedy and inexpensive transfers.

- 24/7 customer service multilingually.

- Full reserve banking (100% of deposits are held safely).

Privacy and security

The confidentiality of the private banking in Jersey is given while abiding to international standards of transparency (such as CRS).

The Kingdom Bank, for example, implements biometric authentication and real-time fraud monitoring to safeguard accounts.

Flexibility for expatriates and investors

With a Jersey bank account for non-residents, you gain access to:

- No residency is needed to open an account or keep one.

- High-yield savings including digital-asset savings for crypto holders.

- Diversified portfolios with wealth management tools.

For those comparing how to choose the best Jersey offshore bank, The Kingdom Bank stands out for its blend of digital convenience and personalized service; whether you’re a freelancer, a multinational corporation, or a high-net-worth individual.

From Jersey international banking guide essentials to advanced multi-currency tools, the island offers a compelling package for non-residents.

Whether you’re drawn by the benefits of offshore banking in Jersey, the efficiency of its financial services industry, or the innovative tools offered by providers like The Kingdom Bank, this jurisdiction delivers a seamless banking experience.

About The Author