Benefits of Opening an Offshore Bank Account in Panama12 min read

Reading Time: 5 minutesThe benefits of opening an offshore bank account in Panama are numerous. For this reason, many companies are taking action to open an offshore account in Panama.

Quick Note : Panama has long been one of the most popular offshore financial centers in the world due to the many advantages it offers account holders.

With a stable economy, favorable tax policies, strong currency stability and developed banking infrastructure, opening an offshore bank account in Panama can unlock significant benefits both for personal finances and business banking needs.

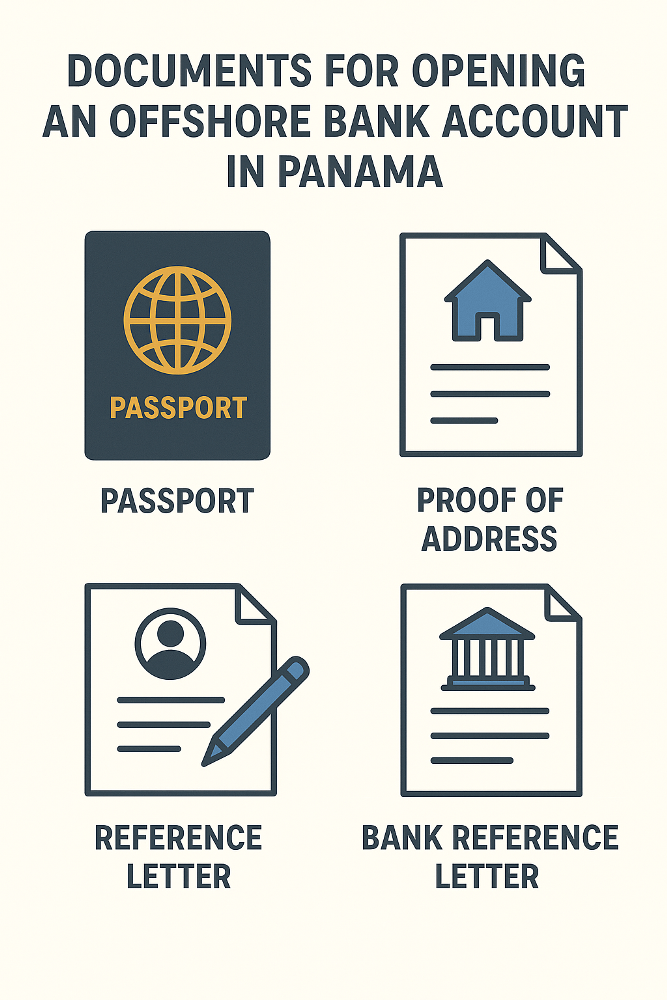

What Documents are Required to Open an Offshore Bank Account in Panama?

The documentation required to open an offshore bank account in Panama can vary slightly between banks, but typically involves submitting:

Documents for Opening an Offshore Bank Account in Panama

- Valid passport or national ID card – Must be notarized with an Apostille or legalized.

- Proof of address – A utility bill, bank statement or lease/title in the applicant’s name from within the last 3-6 months.

- Source of wealth documentation – Pay slips, tax returns, sale contracts, etc. to verify the origin of at least the initial deposit amount.

- References – Contact details for two personal or professional references that have known the applicant for at least 2 years.

- Bank reference letter – From an existing bank where the applicant holds accounts verifying details and standing.

- Occupation details – Evidence of current employment or business activities.

- Basic KYC forms – Providing details like physical address, date of birth, nationality, etc.

With these standard paperwork elements in order, the account opening process in Panama moves quickly. Some virtual/digital banks can even complete it fully online without visiting Panama.

♦ Now let’s show these items as an infographic.⇓

Just be sure documentation is certified, notarized and translated as required depending on country of origin.

Can Non-Residents Open an Offshore Bank Account in Panama?

The short answer is yes – Panama welcomes non-resident clients to open offshore bank accounts within its borders. Unlike other banking destinations, it does not require account holders to be locally employed, own property, or maintain any other residency or citizenship ties to Panama.

As long as proper Know Your Customer (KYC) and due diligence documentation is provided upfront, non-residents can establish themselves as customers of Panamanian banks.

Certain institutions may have small initial deposit minimums as low as $3,000 to $5,000.

However, it’s worth noting that opening a bank account in Panama as a non-resident requires authorization to access account funds from abroad.

Most financial institutions offering this functionality for remote management will likely limit daily wire transfer amounts for non-residents compared to account services available to resident clients.

So while offshore accounts are certainly achievable without living in Panama full-time, for maximum access, convenience with services like check-writing or branch/ATM use- it’s often ideal to become a tax resident through home purchase, long-term rental agreement, or other residential ties over time.

Can I Open an Offshore Bank Account in Panama Online?

Thanks to the digital banking revolution, it’s now possible to establish an offshore bank account in Panama entirely online without ever visiting the country.

Several reputable, licensee institutions specialize in smooth, tech-powered account opening for international clients from afar.

To open an offshore bank account in Panama online, look for a licensed financial provider that offers:

- A dedicated online application portal or encrypted document uploader for submitting KYC materials.

- Validation of identity, address, source of wealth via electronic database checks rather than notarized hard copies.

- Use of e-signatures rather than wet-ink signatures for agreements and account opening contracts.

- Electronic delivery of account credentials like login, debit card, wire transfer details rather than mailing hard copies.

- Digital banking via online portal, smartphone/tablet app for funds management on the go wherever you are.

By choosing carefully among licensed Panamanian digital banks, any global citizen can gain access to a full-service offshore account without stepping foot in the isthmus nation. Just be sure the provider is fully authorized under Panama’s financial regulator.

Why is Panama the Best Country to Do Offshore Banking?

There are several compelling reasons why Panama has become the destination of choice for offshore banking enthusiasts from around the world:

Why is Pamama Important?

- Stable Economy – Panama uses the US dollar as official currency, eliminating exchange rate risk. Its GDP grows consistently each year.

- Robust Banking System – Over 100 licensed financial institutions provide all expected services competitively. Many operate globally to serve internationals seamlessly.

- Developed Infrastructure – Modern transit and accommodations support living/business needs. The logistical backbone stems from Panama’s historic strategic worldwide trade role.

- Progressive Laws – Regulations facilitate offshore activities beneficially versus restrictive nations. Still, transparency and cooperation temper perception as a “secrecy haven”.

- Tropical Lifestyle – The balmy climate and abundance of outdoor activities lend Panama a relaxed, easygoing atmosphere to relocate or visit when needed.

- Tax Incentives – Panama has no capital gains, withholding, wealth, estate or gift taxes. Profits face only modest corporate tax rates with many exemptions possible.

So whether establishing a base for international business, protecting assets, accessing real estate opportunities or simply banking from a beach, few places surmount Panama as the offshore solution of the present and years ahead.

Which Bank is the Best to Do Offshore Banking in Panama?

Among the many excellent options, The Kingdom Bank stands out as perhaps the leading digital player for offshore account openings in Panama today.

As an organization licensed and regulated under Panamanian law, The Kingdom Bank satisfies local regulatory requirements while bringing a thoroughly modern banking experience.

Some key reasons to consider The Kingdom Bank include:

- Best-in-class online banking portal and mobile app for 24/7 global account access

- Accounts can be opened fully digitally without traveling to Panama

- Top-tier security with bank-level encryption, two-factor authentication and integrated digital wallet

- Wide investment choices including forex, stocks, cryptocurrencies and more via integrated trading platform

- Service in 12 languages catering to an international clientele from anywhere

- Competitive interest rates on fiat and crypto holdings plus fast SWIFT transfers

- Dedicated account manager and multilingual customer support staff

With a strong commitment to blockchain and having become the first bank to integrate cryptocurrency, The Kingdom Bank leads the pack innovating the digital offshore banking future.

For those seeking a best-in-class experience, our cutting edge online platform rises to the top among competitors.

Panama’s strategic location, competitive advantages and evolved financial services ecosystem make it the gold standard tropical country for offshore banking activities.

Whether opening a personal account for asset protection or establishing a corporate presence to take advantage of tax incentives, its stable banking infrastructure paired with progressive regulations provide myriad options.

Meet the Pamama Opportunities

With choice providers like The Kingdom Bank pioneering fully digital account openings, accessing Panama’s opportunities has never been simpler.

Global citizens would be wise to consider researching all an offshore Panamanian bank relationship can deliver to take advantage of international opportunities while enhancing their overall financial security.

If you’re interested in learning more about how to open an account with The Kingdom Bank or would like assistance navigating the application and documentation process, our client representatives are standing by.

Simply visit The Kingdom Bank or chat with an agent today to get started on your offshore banking journey. Unlocking Panama’s benefits is just a click away.

About The Author