Risk Management in Foreign Exchange: Successful Methods24 min read

Reading Time: 9 minutesRisk management in foreign exchange is a crucial process. There are necessary steps to a successful exit and profit. These steps must be learned and implemented.

We will discuss these steps in this article. Online foreign exchange transactions need to integrate fundamental risk management practices in order to function properly.

Currency and economic changes which constantly affect exchange rates demonstrate why exposure minimization strategies must be understood.

Online foreign exchange transactions require essential risk management practices. The volatile nature of currency values combined with economic unpredictability creates exposure risks during foreign currency trades and foreign exchange payments.

Appropriate strategies allow you to protect your funds and lower the risk of financial losses.

This guide will cover essential risk management elements of forex trading while delivering strategic advice for users of The Kingdom Bank’s online fx account services to create robust plans.

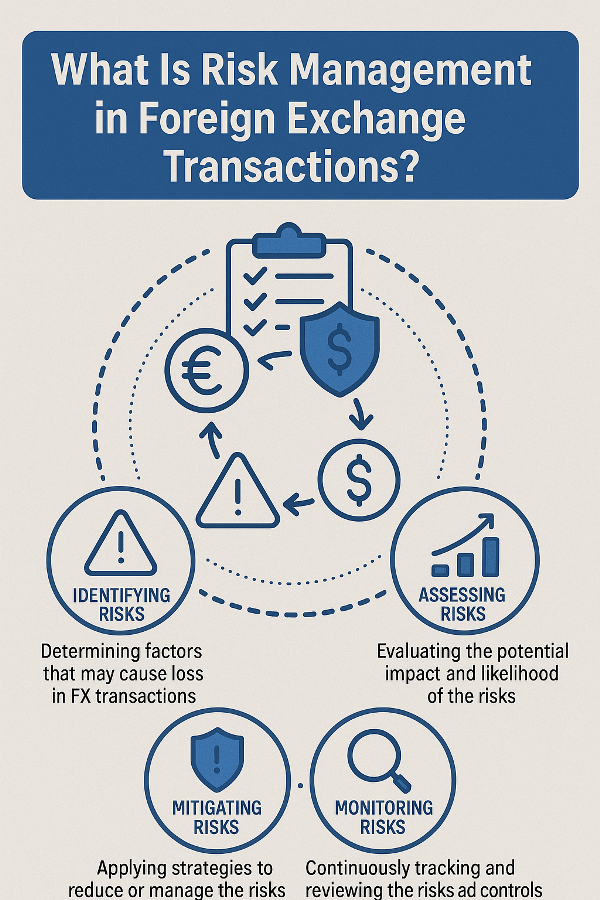

What Is Risk Management in Foreign Exchange Transactions?

Risk management involves using a range of techniques and strategies that aim to protect against financial losses resulting from changes in currency exchange rates. Fluctuations in currency values create transactional uncertainties when multiple currencies exist in the market.

Companies and individuals can protect themselves from harmful exchange rate changes by employing effective risk management practices.

The core elements of foreign exchange risk management include specific strategies and established practices.

- Trading professionals deploy stop-loss markers and price ceilings to automatically close their positions and minimize losses when exchange rates turn unfavorable.

- Financial institutions utilize offsetting transactions to protect against currency exposure risks and generate profits through exchange rate predictions.

- The practice of holding various currencies and transacting with multiple pairs protects investors from becoming too dependent on any single currency pair.

- Financial entities must track economic indicators along with geopolitical changes that affect particular currencies to adjust their exposure levels appropriately.

- Traders use forward contracts as financial tools to set exchange rates for future transactions while removing the risk of future currency value changes.

We work to decrease uncertainty and cut financial losses from unexpected changes in currency values. Let’s explore some practical techniques.

How Can You Minimize Risk in Foreign Exchange Trading?

Through strategic leverage application traders can decrease their forex trading risks. The practice of borrowing money enables traders to manage substantial nominal positions through leverage while keeping their initial investment amount low.

Leverage increases profits when trades succeed but magnifies losses when currency rates move against the position. Safeguard your account against significant losses by capping your trading risk to a maximum of 2% of your total capital per trade when operating with leverage.

Investors need to spread their investments over multiple currency pairs and position sizes to achieve proper diversification.

Traders must keep their single EUR/USD position to a maximum of 10% of their account balance while spreading 2-3% of their total capital between EUR/USD, GBP/USD, AUD/USD and USD/JPY trades.

Through this strategy traders maintain market involvement but protect themselves from large financial losses.

Setting protective stop-loss orders is another must. A stop order triggers at a predetermined worst-case market rate level to close positions which serves to prevent unlimited losses by restricting losses to a defined smaller amount.

Effective forex risk management integrates careful leverage utilization together with correct position sizing and stop-loss strategies.

What Are the Key Elements of Risk Management in Foreign Exchange?

Online foreign exchange trading that involves substantial funds requires robust risk management techniques.

It is necessary to concentrate on these components because they serve as essential elements. Let’s examine it in detail in articles ;

1 – Economic Forecasting

You can predict exchange rate movements by tracking inflation rates together with GDP growth data while considering central bank strategies and geopolitical developments that influence currency values. This helps adjust exposure levels proactively.

2 – Currency Pair Selection

EUR/USD currency pairs demonstrate greater stability compared to other market pairs. Investors lower their market risk by selecting major currency pairs since these pairs demonstrate less volatility than exotic crosses which also face reduced liquidity.

3 – Hedging Techniques

Effective currency risk management during significant transaction exposures requires the use of options together with forwards and futures. Hedging enables traders to fix rates which helps them maintain stability when markets face instability.

4 – Position Sizing

Protect your trading account by limiting risk to only 1-2% of the account value for each trading position. The use of moderate leverage along with position sizing helps traders minimize their exposure when markets move against them.

5 – Stop-Loss Orders

Traders benefit from automatic stop-loss orders because they set definite loss boundaries to protect against unlimited financial damage during major rate shifts against their investments. Stops are critical risk management tools.

Through its online platforms The Kingdom Bank facilitates secure international currency payments and foreign exchange transactions for businesses and individuals by highlighting essential elements that build confidence during market volatility.

How Does Leverage Impact Risk Management in Foreign Exchange Transactions?

Foreign exchange traders utilize leverage to manage larger trading positions with reduced capital but require complete comprehension of leverage’s effects on their risk management protocols.

Increased leverage results in increased risk exposure. Imagine a trader who uses 100:1 leverage on their $10,000 trading account.

With 100:1 leverage, each 1% move in the underlying currency pair results in a 100% gain or loss on the position. An unfavorable exchange rate movement of 1% has the power to eliminate the entire $10,000 trading account balance.

In contrast, with just 2:1 leverage, the same 1% currency move would translate to only a 2% profit or loss on the position. Multiple adverse price movements cannot trigger a margin call in this account because it shows enough stability.

Greater leverage reduces initial margin needs but also leads to exponentially higher risk levels. It’s crucial for forex traders to use modest leverage of 4:1 or less and always keep a prudent margin of safety in their accounts.

Online companies that conduct major foreign exchange operations on platforms such as The Kingdom Bank must prioritize risk management procedures.

When selecting hedging strategies to stabilize payment rates for international transactions and to limit financial unpredictability companies should avoid using leverage.

What Role Do Currency Pairs Play in Foreign Exchange Risk Management?

Selecting specific currency pairs determines the risk profile of forex trading positions. EUR/USD benefits from greater market stability and liquidity unlike exotic currency pairs which exhibit more intense short-term volatility.

The USD/MXN peso pair experiences greater daily fluctuations than EUR/USD due to Mexico’s position as an emerging market and its reliance on commodity price changes.

Investors face more significant risks when they trade exotic currency crosses such as GBP/TRY compared to major currency pairs.

Companies looking to control foreign exchange transaction risk should focus their trading on major currency pairs which deliver stability instead of spreading their transactions across various currency crosses.

To minimize trading expenses, traders need to choose currency pairs that feature high liquidity together with narrow bid-ask spreads.

When using international payment platforms such as The Kingdom Bank for large international wire transfers businesses should select banking partners who provide reliable reputations and appropriate settlement currencies. Less stable exotic currencies pose unnecessary risks.

The outcome of financial market operations in terms of profit or loss is determined by effective risk management particularly in the unpredictable forex market.

To safeguard against currency volatility businesses and traders should combine position sizing methods with leverage control and hedging strategies along with implementing stop-losses and pairing management techniques.

Online international foreign exchange transaction performers receive essential risk management instruments from The Kingdom Bank.

With its private banking, corporate banking and crypto banking solutions The Kingdom Bank delivers strategic risk-aware solutions for expanding wealth worldwide to its clients.

How Do Economic Indicators Affect Risk Management in Foreign Exchange?

Currency fluctuations primarily result from the economic health and performance of various nations.

Various economic indicators including GDP growth together with inflation rates, interest rates and unemployment figures have the ability to influence the demand for a nation’s currency.

When you understand the relationship between economic indicators and exchange rates you can improve your risk management strategy.

When Eurozone inflation forecasts show an increase above established targets then the euro may lose strength against currencies such as the US dollar and the British pound. Higher inflation levels indicate deteriorating economic conditions which lead to decreased demand.

The US dollar could strengthen against foreign currencies when the country delivers a strong jobs report.

Tracking scheduled economic indicator announcements from multiple countries enables traders to protect their positions before major reports affect the markets.

To minimize risk exposure, it’s advisable to distribute currency investments across multiple economies instead of putting all holdings in one place.

Analyzing political and policy risks alongside economic data offers a comprehensive understanding of possible currency market fluctuations.

What Are the Best Strategies for Managing Risk in Foreign Exchange?

Traders utilize several established methods to protect their investments from risks in the volatile foreign exchange market. A risk management method involves setting tight stop-loss orders to automatically close a position when it declines a specific number of pips.

While this approach minimizes losses it also results in missed opportunities for profits.

Hedging serves as an effective risk-reduction method by establishing an offsetting position which minimizes overall currency exposure. You can create a hedged position by shorting an equivalent USD/JPY amount when holding a long USD/JPY position.

When the yen strengthens both trades offset each other with one trade losing value while the other gains value to minimize total risk.

Investors should spread their trades across multiple currency pairs instead of focusing only on one or two to achieve diversification.

When you diversify your trades across many currency pairs you reduce the risk of suffering significant losses from a single currency pair moving against your expectations. Position size limits that reflect account size serve to protect against excessive leverage.

Options provide longer-term strategic exposure by allowing gains through upside potential while limiting losses with premium payments as an alternative or supplement to spot trading.

Your ability to adjust to changing market conditions improves when you maintain several strategies in your trading arsenal.

How Can You Use Hedging for Risk Management in Foreign Exchange Transactions?

Hedging stands as one of the top dependable methods to manage risk within foreign exchange markets. Establishing offsetting positions helps eliminate risk from adverse currency fluctuations.

We’ll demonstrate the hedging process with a practical example from The Kingdom Bank’s online forex account services.

Our UK importer has a US supplier contract for $100,000 to be paid in three months without exchanging pounds to dollars.

The GBP/USD rate is currently 1.3000. The importer can avoid fixing the exchange rate now when the pound may weaken by implementing the following hedging strategy.

- Exchange $100,000 for £76,923 at the spot market rate of 1.3000

- Buy GBP/USD call options for $100,000 on a 1.3000 strike that will expire in 3 months while paying £2,000 in premium.

When the pound drops to 1.2500 against the dollar in three months the spot trade suffers a £5,000 loss but the call option generates £5,000 eliminating any financial risk.

The initial spot trade becomes profitable when GBP/USD rises but the option expires valueless. The transaction remains anchored at 1.3000 yet offers potential for gains above this level.

What Are the Psychological Aspects of Risk Management in Foreign Exchange?

Emotional control and discipline hold equal importance alongside technical risk factors during currency trading operations. Psychological elements such as overconfidence and herd mentality can destroy perfect strategies if traders do not control them.

Here are a few tips:

- Accept mistakes: All traders will make mistakes so expect errors in trading but focus on learning from them instead of fixating on losses.

- Avoid revenge trading: Increasing risk to recover losses will compound your financial problems. It often compounds the problem.

- Take breaks: Take a break following consecutive losses to achieve mental clarity before objectively analyzing the mistakes.

- Follow your plan: Stick to your strategic framework despite short-term outcomes or peer actions. Independently evaluate your thesis.

- Control fear and greed: These two emotions operate like two sides of a coin which lead to poor decision making. Remain dispassionate.

- Start small: When testing new strategies keep your positions small so that you remain psychologically resilient in the face of losses.

The mental aspect of financial performance requires continuous management throughout your life. Through discipline and experience you will develop an emotional advantage against market participants who lack self-awareness.

How Can You Adjust Your Risk Management Plan for Different Foreign Exchange Market Conditions?

Market environments differ from one another which requires risk management strategies that maintain adaptability to changing market conditions.

These suggested changes for your The Kingdom Bank online foreign exchange account should be considered based on the current condition of the fx market.

- Trending market: In strong trending markets with high volatility use smaller position sizes and set wider stops.

- Range-bound market: Narrow trade targets to range support/resistance areas and reduce stop distances for smaller market moves.

- High volatility: To protect against whipsaws during high volatility periods reduce trade size and determine target and stop-loss levels based on average true range. Use options to limit risk.

- Low volatility: You can expand your position size because the risk per pip decreases. You can position your stops a bit further away from the entry point.

- Before high-impact news: Exit positions or hedge exposure temporarily until the news release concludes and market direction becomes evident.

- At support/resistance: Trade scaling should be considered when support or resistance levels break with additional price movement.

Risk parameter agility enables traders to maintain their competitive edge during changing market conditions. The use of multiple instruments to measure market volatility and liquidity provides the necessary insights to make appropriate adjustments.

Successful trading in the ever-changing foreign exchange market depends on strong risk management to handle both potential gains and risks.

Through the knowledge of economic influences on currency values and application of tested hedging methods and emotional discipline combined with market-responsive strategies you achieve confidence in foreign exchange trading through The Kingdom Bank’s full-service fx account platform online.

Although historical performance does not predict future outcomes, strategic risk management improves your probability of achieving long-term success.

Visit The Kingdom Bank to learn about our offerings and application process if you want to open an online banking account for managing foreign exchange exposure and international portfolio diversification.

Contact an account representative to learn about our secure online currency transactions services which can help you meet your financial goals.

About The Author