The Ultimate Guide to Overseas Banking in the Czech Republic22 min read

Reading Time: 8 minutesIf you want to achieve financial stability in the European Union, you can obtain overseas banking services in the Czech Republic. The country’s financial stability and strong banking infrastructure attract foreign investors.

Tip ↵ Individual and corporate customers can access banks operating in the country. You can open a foreign currency account, access investment products, and take advantage of online services. Opening an overseas bank account can be completed quickly once the necessary documentation has been submitted.

Banks such as The Kingdom Bank in the country provide high-quality service to foreign customers with their English-language services.

Important ↵ The Czech banking system operates under the supervision of the European Central Bank and the Czech National Bank. Therefore, the country enjoys a high level of transparency and security.

If you are looking for secure overseas banking, you can open an account in the Czech Republic immediately. As an account holder, your account is protected by regulatory insurance up to a specific limit. Its digital banking infrastructure allows you to manage your assets from anywhere in the world.

The Czech Republic offers individuals and businesses the opportunity to open accounts in Europe. To open an account in the Czech Republic, you can do so at The Kingdom Bank.

The country’s banks serve both individual and corporate clients. In addition to opening foreign currency accounts, you can also access investment products. Loan services also make international financial transactions very convenient.

Mandatory Document ↵ Foreigners must provide their address and identification documents when opening an account in the country.

If you’re looking to access the European market, the Czech Republic serves as a strategic financial centre. The country’s banks operate with modern infrastructure for overseas banking solutions.

You can access your account via the mobile app or online banking. Foreigners living abroad can open an account in the Czech Republic through overseas banking accounts.

These accounts can meet both individual and corporate needs. As an investor, you can open a high-quality overseas bank account in the Czech Republic at The Kingdom Bank.

What Is Overseas Banking in the Czech Republic?

Foreign investors, entrepreneurs, and individuals can open an overseas banking account in the Czech Republic, thanks to the reliable financial infrastructure of the European Union. This account allows you to open a foreign currency account. Investment products and online services are also available.

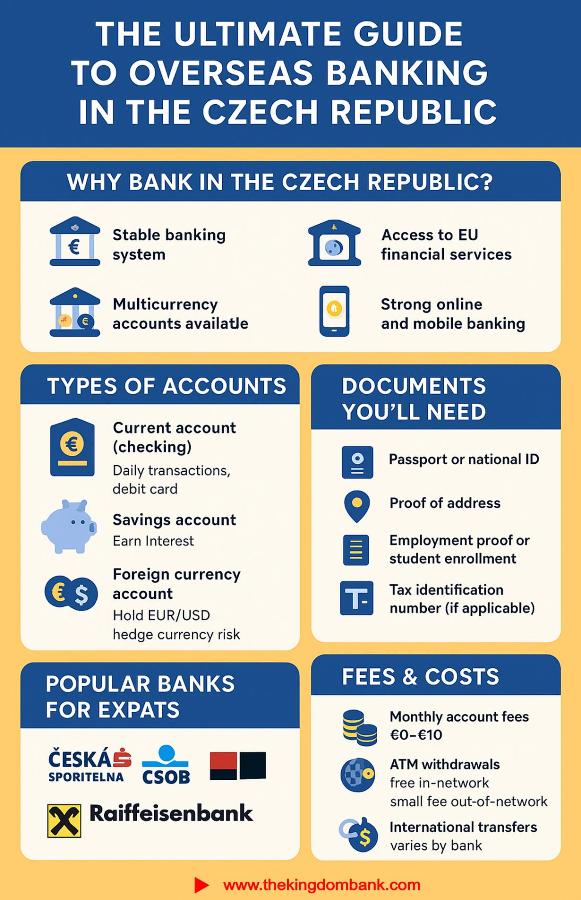

For foreigners, when opening an overseas bank account, you must provide basic documents, such as a passport, proof of address, and proof of income. Banks in the country offer foreign customers the opportunity to conduct financial transactions in a secure environment.

The European Central Bank and the Czech National Bank regulate the Czech banking system. Therefore, a high level of confidentiality and transparency awaits you. If you are seeking the best overseas banking services, this country is a suitable choice.

Deposit insurance, low transaction fees, and a strong banking infrastructure offer you the opportunity to diversify your foreign currency holdings.

If you are looking for a reliable financial centre in Europe, the Czech Republic can provide what you are looking for in the long term. Open your account with The Kingdom Bank today.

Why Consider the Czech Republic for Overseas Banking?

Located at the heart of the European Union, the Czech Republic has a strong economy. The country’s financial system is also stable. With its modern digital infrastructure, foreign investors can benefit from overseas banking services.

Individual and corporate clients have access to secure and long-term solutions. These opportunities enable you to open an account in another country and manage your finances with the security of the European Union.

Here are some reasons to consider the Czech Republic for overseas banking:

- For international clients, you can find foreign currency accounts, investment products, and commercial solutions within the scope of overseas banking. These solutions provide access to the European financial system.

- You can take advantage of an advanced digital infrastructure for online overseas banking transactions. You can transfer money and invest from anywhere in the world through mobile applications and internet banking.

- Strict oversight complies with overseas banking regulations. This ensures your accounts are secure and you receive transparent services. Your assets are also protected by deposit insurance.

How Do I Start the Overseas Banking Process in the Czech Republic?

If you want to receive overseas banking services in the Czech Republic, you start by choosing a bank. Then, you apply through the official channels of your chosen bank. During this process, you must upload the required documents to the bank’s online portal.

The primary benefit of overseas banking is the ability to open an account quickly. You can open your account quickly and find banking solutions that comply with European Union standards. This gives you access to international investment opportunities.

Located in the heart of Europe, the Czech Republic offers banking solutions to both individual and corporate clients. Once your application is approved, you can begin using your account. To do this, you should also research the fees associated with overseas banking.

Before opening your account, you can make detailed comparisons. You can also research the differences between offshore and overseas banking. You can easily apply with The Kingdom Bank and obtain an overseas bank account in the Czech Republic.

Is Overseas Banking in the Czech Republic Legal for Foreigners?

In the Czech Republic, foreign nationals are legally entitled to access overseas banking services. You can receive services in the country that comply with European Union standards. Foreign individuals and companies can legally open accounts by providing the required documentation.

Overseas banking transactions are efficient for businesses in the country. Opening an account allows you to make international trade payments. You can also easily access investment opportunities in Europe through this account. A secure financial environment awaits you as you integrate into the EU internal market.

Quick Note ↵ The Czech banking system will also experience the highest level of digitalisation. You can access international digital banking services in the country. You can manage your account with a mobile app, online banking, and English-speaking customer service.

It also ranks among the best countries for overseas banking in 2025. The country’s strong deposit insurance and low transaction costs attract investors. Transparent EU-regulated regulations also attract individuals.

The Czech Republic is a legal and reliable banking environment for foreign investors. You can open an account with The Kingdom Bank today.

What Are the Key Benefits of Overseas Banking in the Czech Republic?

Located at the centre of the European Union, the Czech Republic has a strong economy. It also has a stable financial system. Its modern digital infrastructure makes it a hub for overseas banking for foreign investors.

Individual and corporate clients can choose the Czech Republic as a gateway to expand into the European market.

The key benefits of overseas banking in the Czech Republic are as follows:

- Opening an account in the Czech Republic provides access to the reliable banking infrastructure in the EU. This makes international trade transactions more convenient.

- You can open accounts in Euro, USD, and your preferred currency. Investors can diversify their assets and mitigate currency risk.

- Mobile apps and online banking allow you to manage your account from anywhere in the world. Money transfers and investment transactions are also convenient.

- Non-resident individuals and businesses can manage their investments by opening an account.

- Privacy laws in the Czech Republic are stringent, and the EU deposit insurance system maximises the security of account holders.

- You can open commercial accounts for businesses. International payments and credit products are also available.

For information on overseas banking account requirements for foreigners, please visit our website at The Kingdom Bank.

What Types of Accounts Are Offered Through Overseas Banking in the Czech Republic?

You can access the European Union’s reliable and advanced financial system from the Czech Republic. Opening an overseas bank account is convenient for individuals and businesses. You can conduct international money transfers through these accounts.

You can also conduct transactions in a different currency. Once you open an account, you can easily access the European financial network.

The account types available in the Czech Republic are as follows:

- You can open an individual account for your salary, daily expenses, and bill payments.

- Access a savings account to earn interest and save.

- If you want to trade in different currencies such as EUR, USD, or GBP, you need foreign currency accounts.

- For high-net-worth individuals, you can take advantage of specialised banking solutions such as investment and portfolio management.

The main advantage of overseas banking in the Czech Republic is low transaction costs. To open an account, you must be covered by EU deposit insurance. For low-cost overseas banking services, you can choose The Kingdom Bank.

What Documents Are Required for Overseas Banking in the Czech Republic?

The Czech Republic’s banking system offers advanced digitalisation opportunities. Therefore, the best overseas banking services in the country await you. This allows you to take advantage of remote access opportunities.

Foreigners don’t have to visit a branch to open an account faster. Banks generally manage the preliminary application and identity verification processes online. Individual and corporate customers can expedite the account opening process by submitting an online application.

Tip ↵ Once you complete the overseas bank account opening process, you can manage it via mobile apps and online banking. You can transfer money from your account or conduct foreign currency transactions. You can perform all your transactions, such as investment management and bill payments, within the scope of online overseas banking.

You can use any currency you choose for your banking transactions. You can even use multiple currencies in a single account if you wish. Currency conversion costs are also minimized across your accounts. You can also set up automatic instructions when receiving payments or paying bills from these accounts.

Thanks to protocols that comply with European Union standards, you can access remote access. This provides you with a high level of practical protection with The Kingdom Bank.

Can I Access Overseas Banking Services Remotely in the Czech Republic?

The Czech Republic’s banking system offers advanced digitalisation opportunities. Therefore, the best overseas banking services in the country await you. This allows you to take advantage of remote access opportunities.

Foreigners don’t have to visit a branch to open an account faster. Banks generally manage the preliminary application and identity verification processes online. Individual and corporate customers can expedite the account opening process by submitting an online application.

Once you complete the overseas bank account opening process, you can manage it via mobile apps and online banking. You can transfer money from your account or conduct foreign currency transactions. You can perform all your transactions, such as investment management and bill payments, within the scope of online overseas banking.

Thanks to protocols that comply with European Union standards, you can access remote access. This provides you with a high level of practical protection with The Kingdom Bank.

Are There Minimum Deposit Requirements for Overseas Banking in the Czech Republic?

There are minimum deposit requirements for bank accounts in the Czech Republic. These requirements may vary from bank to bank. Banks may require a low initial balance when opening an individual account.

If you’re opening an overseas business banking account, there may be a high deposit requirement. The size of your business, the type of account, and the additional services offered vary. You can receive transparent and secure service in a country which is affiliated with the European Union.

You can quickly complete all your financial transactions in European Union countries. You can receive payments and automatically process your taxes while conducting business in any country. Your transactions in the Czech Republic and EU countries are very secure and seamless.

International digital banking services offer relaxed minimum deposit requirements. This allows you to apply online. The Czech Republic is expected to be among the best countries for overseas banking in 2025. Transaction costs are low in this country, and you can open an account through The Kingdom Bank, which has EU guarantees.

How Secure Is Overseas Banking in the Czech Republic?

The Czech Republic’s banking system operates in accordance with European Union standards. The country maintains a high level of security measures. Overseas banking services for international customers are conducted in accordance with EU regulations.

EU regulatory insurance protects your government assets up to a specific limit. Your bank implements strict procedures for anti-money laundering and customer identity verification. This ensures secure account management.

Overseas banking regulations are based on EU principles of financial transparency and security. For foreigners, the primary requirements for an overseas banking account are a passport and proof of residence. You must also submit documents demonstrating your income and employment status.

You must submit all the requested documents. If any problems arise during the review, your account will not be approved. To ensure a smooth account opening, your documents will be reviewed within 2-3 days. If the review is positive, you can start using your account immediately.

The documents required by the bank ensure customer security. These regulations ensure the security of all your banking services. You can open your account at any time through the website The Kingdom Bank.

About The Author