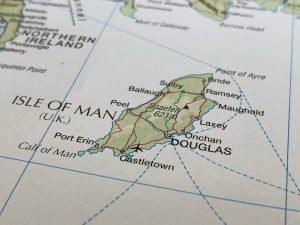

Opening an Isle of Man Offshore Bank Account as a UK Resident11 min read

Reading Time: 5 minutesThe demand for opening an account that is not in the Isle of Man bank account non resident is very high these days.

The Isle of Man has established itself as a premier offshore financial centre, providing numerous benefits for individuals and businesses who want to open an offshore bank account away from their home country.

For UK residents in particular, the Isle of Man offers a convenient location with cultural familiarity as well as incentives for ‘overseas’ banking.

In this article, we’ll explore how UK residents can establish an Isle of Man bank account and take advantage of everything this offshore jurisdiction has to offer.

How to Open a Bank Account in the Isle of Man?

Opening an account in the Isle of Man generally follows a straightforward process for UK residents:

- Choose a licensed Isle of Man bank.

- Submit your application and documentation. Have your valid passport, proof of address, source of funds statement ready. You’ll need to fill out an online or physical application form providing basic KYC details.

- Undergo verification. The bank will vet your credentials and source of wealth through background checks which may take up to two weeks.

- Get your account activated. Once approved, you can begin using online banking services and moving funds to your new Isle of Man account from an existing account.

- Keep records updated. Comply with annual AML obligations like submitting latest financial statements as required by your bank and Isle of Man regulations.

Make sure to check specific eligibility rules, document requirements and account options with the bank of your choice before starting your application.

An expedited option is The Kingdom Bank, a regulated digital bank known for its simplified online account opening procedure without minimum deposits.

How to Do Overseas Banking in the Isle of Man as a UK Resident?

As a UK citizen, offshore banking through an Isle of Man account brings certain benefits over UK-based accounts:

- Financial confidentiality: The Isle of Man has strict privacy laws and does not enter automatic exchange of information agreements, offering more anonymity than UK banks.

- Tax advantages: While interest income is still taxable, capital gains and inheritance taxes are usually waived on offshore assets held via an Isle of Man account.

- International exposure: You gain access to global investment opportunities and can hold balances in multiple currencies including USD, EUR and GBP.

- Asset protection: The Isle of Man’s legal framework is designed to safeguard account holders’ wealth through asset protection trusts if needed in the future.

- Connectivity: Manage your account seamlessly online or through a mobile app while enjoying fast international payments both inbound and outbound.

To use your Isle of Man account for overseas banking effectively, follow best practices like maintaining sufficient records for tax compliance, only transferring declared income offshore and consulting a tax advisor about any unique non-resident obligations.

A digital bank like The Kingdom Bank makes it very straightforward.

Can Foreigners Open Banking Accounts in the Isle of Man?

In principle, yes – the Isle of Man welcomes qualified non-residents to establish offshore bank accounts on the island.

Eligibility rules among different banks vary but some general criteria that foreigners must meet include:

- Holding a current valid passport of an accepted nationality (European, British Commonwealth etc.).

- Having a minimum initial deposit, usually around $1000-5000 depending on the account type. The Kingdom Bank does not impose deposits.

- Providing documented proof of address from their home country and source of wealth/funds statements.

- Undergoing more rigorous anti-fraud screening than locals or UK residents since the person has no physical Isle of Man ties.

Subject to the above process, foreigners involved in international business or property investments in the Isle of Man find an account quite useful.

The Kingdom Bank is best for foreigners as its fully digital process minimises hassles for non-residents versus local banks. Just be prepared to answer detailed verification questions during sign-up.

Why Choose the Isle of Man to Open an Online Bank Account?

Some clear advantages that make the Isle of Man an enticing online banking destination include:

- Established jurisdiction: The island has a long history as an offshore centre with a robust legislative and economic framework respected globally.

- Political stability: As a British Crown dependency, the Isle of Man offers far greater governmental certainty than smaller nations.

- Stringent regulation: The Isle of Man Financial Services Authority ensures all local banks follow strict know-your-customer and anti-money laundering compliance standards.

- Digital capabilities: Technologically advanced online/mobile banking platforms provide seamless access to accounts from anywhere worldwide.

- Multicurrency support: Most Isle of Man banks support multiple transactional currencies beyond just GBP for international commerce needs.

- Tax friendliness: While interest earned is taxable as unearned income, capital gains, inheritance, gifts and other investments enjoy more favourable tax treatment.

Given these advantages, The Kingdom Bank has emerged as the leading digital-only bank in the Isle of Man for simple and secure international online banking needs. Let’s explore this unique proposition in more detail.

Best Digital Bank to Do Overseas Banking in Isle of Man

The Kingdom Bank stands out as the optimal choice amongst Isle of Man banks for several compelling reasons:

- Fully online account opening: No need to visit the island. Simply apply via our user-friendly global website from anywhere.

- Fast approval: Once verified, accounts are instantly activated within 2-3 business days for immediate access versus 4-6 weeks at local banks.

- No hidden fees: Unlike rivals, The Kingdom Bank does impose no monthly maintenance charges or currency conversion premiums on transactions.

- Unique offerings: Choose from personal, business and crypto banking solutions tailored to your particular requirements through one integrated platform.

- Robust security: Military-grade encryption, two-factor authentication and BIS banking standards ensure complete protection of all customer assets and data online.

- 24/7 service: chat, phone or email support is available round the clock from our multi-lingual global customer team.

- Convenience: Manage your finances on a fully-responsive website, or through our intuitive mobile banking app from anywhere in the world with just an internet connection.

Given these differentiating factors, The Kingdom Bank makes overseas banking in the Isle of Man uniquely simple, affordable and secure even for international clients compared to local competitors.

You can easily open your account within days from the comfort of home.

The Isle of Man presents a compelling overall value proposition for UK residents and international customers seeking premier online banking services.

And among Isle of Man banks, The Kingdom Bank stands out as the optimal choice for its innovative digital capabilities and streamlined account opening. To get started on your own offshore banking journey, simply visit The Kingdom Bank online and submit an application today.

About The Author