International Bank Account for Yacht Owners: How to Open12 min read

Reading Time: 5 minutesMany people see yacht ownership as a dream but this comes with substantial financial obligations, this is exactly where the international bank account comes into play.

Yacht ownership demands substantial financial resources for maintenance and repairs as well as crew wages, insurance and docking fees. International cruising enthusiasts and those with global business interests face increased financial challenges when managing yacht finances.

International bank accounts offer a solution to streamline financial operations for yacht owners.

What Is an International Bank Account for Yacht Owners?

Yacht owners can manage worldwide financial transactions through an international bank account which is also referred to as an offshore bank account.

Yacht owners benefit from their international bank account because they can access it online from any location to manage financial responsibilities such as bill payments and fund transfers in various currencies and jurisdictions.

International accounts grant all everyday banking capabilities but extend their reach to global operations unlike domestic-restricted regular bank accounts.

Owners can dock their yacht at international ports and manage payments for local vendors, crew salaries and fuel bills effortlessly. The account supports operations that include buying replacement parts from foreign vendors.

Yacht enterprises or charter operations that operate internationally benefit from a streamlined financial administration through their international bank account.

The account provides centralized payment collection and expense management irrespective of where customers and suppliers are located. Owners benefit from a single source that enables them to collect rental income worldwide while managing different international expenses.

Why Do Yacht Owners Need an International Bank Account?

Multiple important factors demonstrate why yacht owners require an international bank account.

- Convenience of global banking: The concept of physical borders no longer applies when yacht owners use internet and mobile banking to handle their yacht finances from any location in the world.

- Easy currency exchanges: Managing payments across multiple countries becomes challenging due to changing currency values. International accounts enable customers to perform currency exchanges at the best possible rates.

- Secure global money transfers: Wires and money orders enable fast payment transactions with vendors, crews and docking stations across different countries. Stop depending on slow checks and dangerous cash transfer methods.

- International tax planning: Certain account jurisdictions offer tax benefits. Some countries offer yacht charter businesses lower or zero taxation rates for their profits.

- Regulatory compliance: Establishing a bank account at offshore financial centers enables yacht owners to meet international anti-money laundering requirements while buying or selling yachts or conducting global operations.

- Data privacy: Private banking jurisdictions maintain the confidentiality of sensitive financial data belonging to wealthy clients.

The ownership of a yacht requires various banking operations across borders which an international bank account consolidates into one solution.

What Documents Are Required to Open an International Bank Account for Yacht Expenses?

The documentation needed to open an international bank account is similar across providers regardless of their specific requirements.

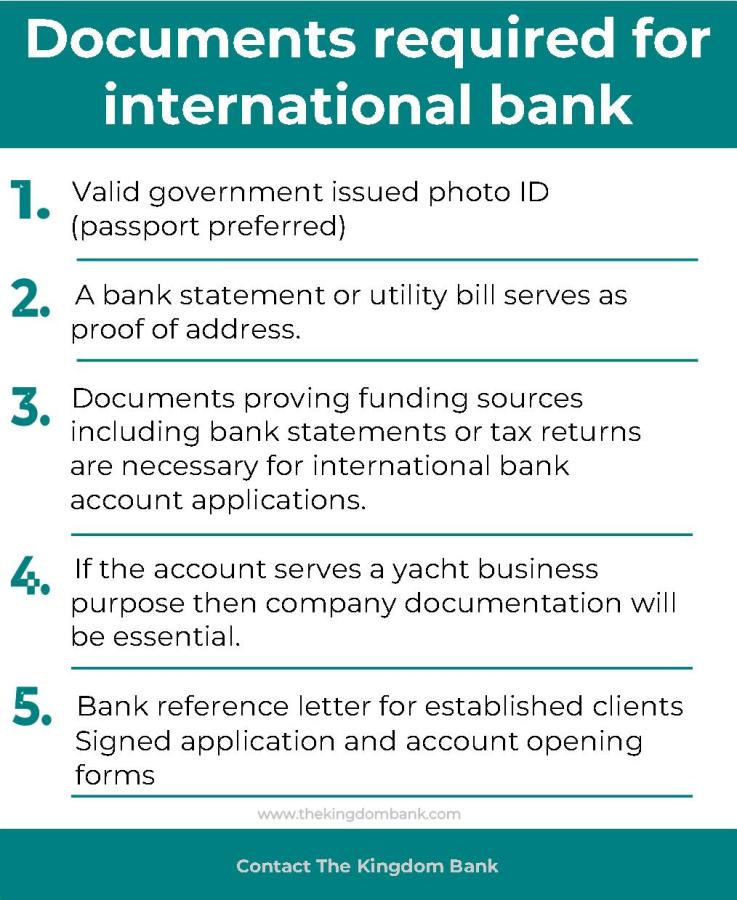

Documents required for international bank account ;

- Valid government issued photo ID (passport preferred)

- A bank statement or utility bill serves as proof of address.

- Documents proving funding sources including bank statements or tax returns are necessary for international bank account applications.

- If the account serves a yacht business purpose then company documentation will be essential.

- Bank reference letter for established clients

- Signed application and account opening forms

Some providers may also ask for:

- Background checks and due diligence on owners

- Asset management requires yacht details such as its name, flag state registration and overall value.

- The volume of expected transactions and the type of financial operations

- Banks request endorsements from maritime lawyers as well as yacht captains and owners who are already in the business.

The bank’s thorough verification process requires the onboarding to last between 2 and 4 weeks. Bank verification procedures may require scheduling video call appointments to continue discussions.

Opening an international account requires the same level of careful review that banks perform for domestic high-value accounts.

How Secure Are International Bank Accounts for Yacht Owners?

Many people who use international bank accounts worry about how secure they are and how well they are regulated.

Established banking institutions such as The Kingdom Bank implement rigorous due diligence processes while meeting international anti-money laundering requirements.

Some key aspects that ensure security:

- Legal protection and prudential supervision come from top-tier financial regulators through licenses such as those provided by the Financial Services Authority and Central Bank of Dominica.

- Online and mobile banking systems use advanced encryption together with multi-factor authentication to shield themselves from digital threats.

- Regular transaction monitoring alongside occasional owner verification helps prevent financial crimes.

- International deposit protection schemes secure segregated client accounts with an insurance limit of one million dollars.

- Local branch networks along with physical assets strengthen security infrastructure which provides owners with reassurance.

Yacht owners benefit from strong security measures equivalent to domestic banks when they select reputable offshore private banking institutions.

The purpose of international regulations includes safeguarding against unexpected fund blockages or confiscations.

Which Countries Are Best for International Banking for Yacht Owners?

The chosen jurisdiction for opening an international bank account needs to meet specific requirements related to taxation options, privacy laws and the availability of financial services.

Yacht owners should consider these leading options for banking.

- Switzerland: Renowned for banking secrecy and political stability. Bank accounts deliver both high liquidity capabilities and essential financial tools for asset management as well as estate planning services. Tax implications need evaluation.

- Caribbean nations: Dominica and Saint Vincent and Grenadines among other Caribbean nations draw yacht owners due to their appealing regulatory environment and the possibility of sailing year-round. The Kingdom Bank in Dominica provides its clients with the highest possible data protection standards.

- Middle East: Dubai centers provide tax exempt accounts which include luxury marina residence options. The location makes it perfect for exploring both the Red Sea and the African coastline.

- Seychelles and Mauritius: Seychelles and Mauritius provide both tropical island living and developed financial hubs which offer owner residency programs for those who choose to live on board.

- Hong Kong: Business accounts in this Special Administrative Region of China operate efficiently for Asian operations and international transactions. Minimal tax and open economy.

Specialized advisors conduct profile analysis to identify the best international jurisdiction that fulfills banking requirements and lifestyle preferences. Maintaining compliance demands close collaboration with licensed service providers.

Yacht owners can benefit from immense financial flexibility while conducting business and sailing globally by obtaining the appropriate international bank account. The Kingdom Bank enables customers to open accounts through an expedited digital process that requires no paper documents.

Owners can access their funds unrestrictedly across borders via secure digital banking solutions available on both web and mobile platforms from anywhere.

Yacht owners preparing for worldwide sailing trips should establish an international bank account for financial stability.

Contact a The Kingdom Bank advisor today to get personalized information about creating an offshore account that fits your distinct yachting lifestyle and needs. Keep track of international waters using your needed banking services wherever your travels take you.

About The Author