How to Save Your Money in GBP? (2026 Guide)29 min read

Reading Time: 11 minutesGBP, or the Great British Pound (also known as Pound Sterling), is the official currency of the United Kingdom, symbolized by £, and it is one of the oldest currencies still in use as well as a major global reserve and trading currency.Today we will explain in detail How to Save Your Money in GBP? GBP savings account options today far exceed what traditional high-street banks can offer.

Today, depositors (be they locals, expats, or global customers) have access to high yield, flexible products that can be customized to their requirements.

With multi-currency capabilities, dedicated IBANs, and virtual cards, modern digital banks make it easier than ever to save in British pounds and earn competitive returns.

In fact, the right account can even help protect against currency risk, simplify cross-border transactions and deliver instant access to funds when you need them.

So, where you put your GBP isn’t only about the interest rate. Security, ease of use, and regulatory compliance play big roles, too. Whether you’re a UK resident looking for a UK savings account in GBP or a non-resident exploring an offshore GBP savings account, the best providers combine transparency with cutting-edge tools.

Many even allow you to open a GBP savings account online in minutes, without any need for paperwork or branch visits.

Quick Note ↵In this article, you will learn how GBP savings accounts work, their advantages, and how to select the best one for you; whether you’re looking for liquidity, fixed terms, or multi-currency options.

Options for GBP Savings Accounts

Options for GBP savings accounts have come a long way from the traditional high-street banks. Today, digital-first accounts provide convenient and secure options, which again can be higher-yielding, to grow the British pound balance whether you are a UK resident, an expat or an international investor.

With multi-currency features, dedicated IBANs, virtual cards and more, certain accounts also allow you to streamline the cross-border management of your finances, while enhancing your returns.

But not all GBP savings products are equal. Some are designed with non-residents in mind; others are ultra-competitive on the interest rates and a handful combine digital modern-day convenience with regulatory security.

Tip ↵ The trick is to find the right mix of features, fees, and protections for your needs. Here’s our guide to selecting, opening and managing a British pound savings account to use in 2026.

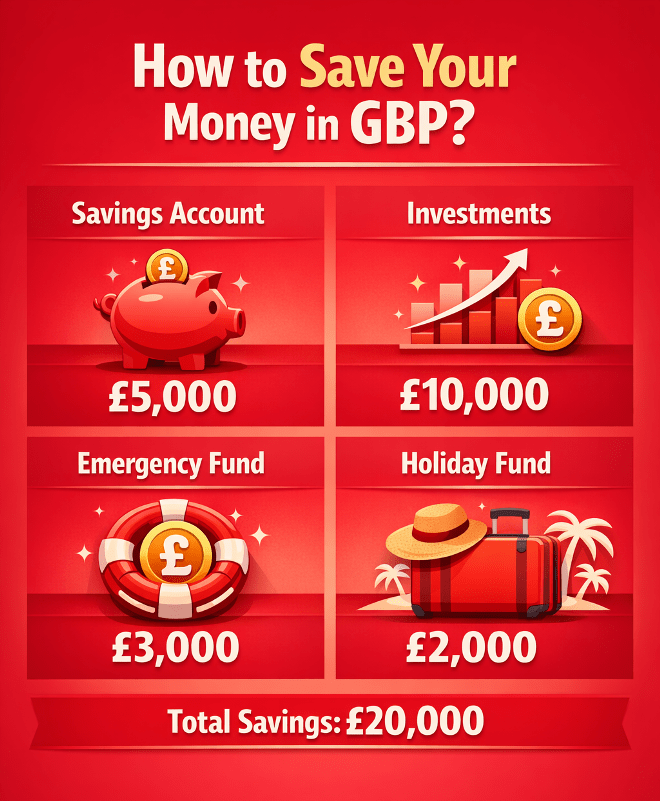

What Are the Best Ways to Save Money in GBP?

Saving in British pounds needs not imply accepting poor returns or inflexible terms. The best approaches vary with your objectives: short-term liquidity, long-term growth, or currency diversification.

Fintech companies tend to have the best high interest GBP savings accounts. Many have tiered rates that increase with account balances.

Some also offer GBP fixed savings account with fixed rates for periods from three months to five years; perfect for those who do not require immediate access.

For non-residents, a GBP savings account for non-residents eliminates the need for a UK address or local credit history. Expats, meanwhile, benefit from accounts designed for cross-border living, such as GBP savings accounts for expats, which may include fee waivers on foreign transactions.

Expats and international clients should consider an international GBP savings account with multi-currency support.

You can hold GBP with USD, EUR and others in these accounts, so you won’t be paying exchange fees every time you transfer money.

To Remind ↵ Some, such as The Kingdom Bank, even provide dedicated IBANs for truly global transactions.

Virtual, of course, adds convenience. A GBP savings account with IBAN ensures smooth transfers, while linked virtual cards let you spend or withdraw funds without waiting for a physical card.

For firms, pooled accounts can aggregate GBP holdings across subsidiaries to ease cash flow management.

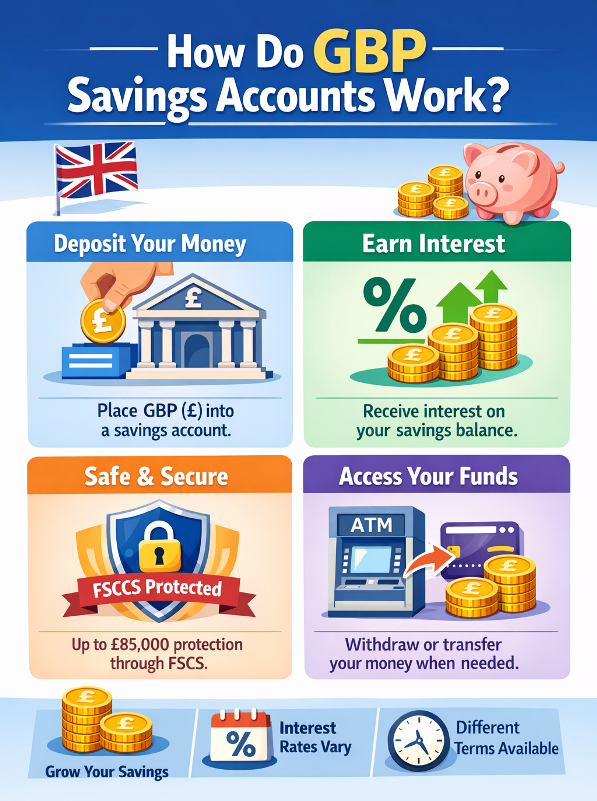

How Do GBP Savings Accounts Work?

A British pound savings account is similar to any other kind of savings account, but there are some differences that vary by provider. A digital banking app may accept non-residents, whereas your traditional UK banks probably won’t.

Most accounts fall into three categories:

- Instant-access savings: Rates are higher, you can withdraw at any time.

- Term deposits: Get higher interest rates for fixing your money for a period of time (such as 1 to 5 years).

- Holding multi-currency: You can hold GBP with other currencies in a single account.

Interest is calculated daily and paid monthly or yearly. A few accounts offer bonus rates for new customers or loyalty incentives. Digital banks tend to have real-time tracking, so you can see your earnings grow instead of waiting for statements.

For non-residents, an offshore GBP savings account is free from UK tax obligations (your local tax rules will still apply however). These accounts may have higher minimum deposit requirements, but they provide privacy and currency stability.

Important Tip ↵ Security is critical. Reputable providers, including The Kingdom Bank, use full-reserve banking, meaning 100% of deposits are held securely, not lent out. Regulatory supervision (e.g. Financial Services Unit) enhances protection on another level.

What Are the Benefits of Saving Money in GBP?

A GBP account with interest isn’t just for UK residents. The British pound is still one of the world’s most stable currencies making it a worthwhile option for saving some money.

For those wondering which bank offers the best GBP savings account, look for:

- Currency Stability: GBP is more stable than any of the South Asian currencies and hence it eliminates exchange rate risk.

- Global Acceptance: Since GBP is also extensively applied in trade, tourism, and investing, it enables you to make easy the payment on a global scale.

- Competitive Rates: The interest rates offered by digital banks on GBP savings accounts are usually higher than those offered by traditional high-street banks.

- Flexibility Multi Currency: Open a GBP multi-currency savings account with USD or EUR to protect yourself from fluctuations.

- Expat-Friendly: Most GBP savings accounts for expats are without UK residency requirements and come with fee-free International Bank Account Numbers (IBANs).

For businesses, holding GBP can streamline payroll, supplier payments, or invoicing in pounds. Some accounts are even designed to work with payment gateways, converting at good rates automatically.

For international clients, secure GBP savings accounts for international clients add layers of fraud protection and regulatory oversight, ensuring funds remain safe across borders.

Providers such as The Kingdom Bank employ sophisticated fraud detection and full-reserve banking, guaranteeing that funds are always accessible and protected.

How Can I Open a GBP Savings Account?

No more waiting in line or dealing with piles of paperwork. Today it’s possible to open a GBP savings account online in just 10 minutes; if you have the right documents.

GBP Savings Account Opening Procedures

Requirements for Residents vs. Non-Residents

- UK residents: Typically need a passport, proof of address (e.g., utility bill), and a National Insurance number.

- Non-residents: Maybe ask for more ID for example a visa or tax residency certificate and have a higher minimum deposit. A number of banks such as The Kingdom Bank offer GBP savings accounts to non-residents and provide expedited onboarding.

How to Open an Account

- Choose a Provider: Compare GBP savings account comparison UK tools to find the best rates and features. For the best GBP savings account, prioritize regulated institutions with multi-currency support.

- Provide Documentation: Submit ID, proof of address and (if relevant) company registration documents.

- Deposit: Send GBP through SWIFT, SEPA, or a connected debit card.

- Enable Features: Get a virtual card, set up standing orders or multi-currency.

Documents submitted via the digital banks were frequently verified the same instant, some of the traditional banks took days. For can foreigners open a GBP savings account, the answer is yes, but terms vary. Offshore providers usually have fewer restrictions.

For those asking how to open a GBP savings account online, the process is often streamlined: submit ID verification, fund the account, and start earning interest; all within minutes.

What Interest Rates Can I Expect on GBP Savings Accounts?

Interest rates on GBP savings accounts are subject to change dependent on the Bank of England base rate, type of account, and AER provider.

Important Tip ↵ As of 2026, these are a few things to consider:

- Instant-Access Accounts: 1.5%–3.5% AER (variable).

- Fixed-Term Deposits: 3.5%–5.5% AER (higher for longer terms).

- Offshore/International Accounts: 2%–4.5% AER (often tiered by balance).

Digital banks frequently offer best interest rates for GBP savings accounts, especially for new customers. Some offer promotional rates for the first year, others reward loyalty with bonuses.

For fixed-rate high interest GBP savings account, fixed-term is the general winner. But when it comes to cash you may be better off choosing an instant-access account offering a decent rate (say, 3%+).

For benefits of a GBP savings account in the UK, residents gain tax advantages (e.g., Personal Savings Allowance), while non-residents avoid local tax liabilities if structured correctly.

Always check for charges. A GBP savings account with no monthly fee maximizes returns, but some providers charge for withdrawals or currency conversions.

The Kingdom Bank is frequently highlighted for its competitive rates and seamless open GBP savings account process, catering to both residents and expats.

Are There Different Types of GBP Savings Accounts?

The range of GBP savings products is extensive and diverse, depending on the savings objectives and profiles of customers.

Different Types of GBP Savings Accounts

Standard Instant-Access Savings

- Best for: Flexibility and liquidity.

- Characteristics: No lock-in periods, instant withdrawals and variable interest rates are offered.

- Type of user: Expats who want to have quick access to their money or who are building up an emergency stash.

- Note: The rates may change, thus not suitable for growth in the long run.

GBP Fixed Savings Account

- Best for: Predictable income for a fixed period of time; e.g., 6 months to 5 years.

- Feature: Returns more than instant-access savings accounts, but early withdrawals attract penalties.

- Perfect For: Those investors who are sure they do not need the money for the duration of the term.

Offshore GBP Savings Account

- Best for: Non-residents and international companies or those wanting to optimize their tax situation.

- Feature: Based in jurisdictions such as Dominica or the Channel Islands, Multi-currency account facility in some cases.

- Perfect for: Expats, digital nomads, and businesses that need to juggle cash flow across borders.

- Warning: There are regulatory and tax consequences around the world, check with an advisor before you set one up.

High Interest GBP Savings Accounts

- Best for: Earning the highest yields without locking money away.

- Feature: Attractive APYs (often 3-5%+) with tiered rates on balances.

- Key takeaway: Savers looking to grow over time and not necessarily in extreme liquidity.

- Tip: When checking best interest rates for GBP savings accounts compare on a quarterly basis; digital banks tend to change their offers frequently.

Multi-Currency Savings with GBP

- A UK savings account in GBP that also supports EUR, USD, or other currencies lets you diversify without opening multiple accounts.

- Feature: One account, multiple currencies with dedicated IBANs for each currency, live FX transactions.

- Provider note: The Kingdom Bank stands out for its GBP multi-currency savings account with real-time exchange rates.

Business GBP Savings

- Ideal for firms: Businesses that have surplus cash or working capital that they want to earn something on.

- Features: Higher balance tiers, API access for automation and corporate debit cards.

- Ideal users: SMEs, startups, or e-commerce businesses with revenue in GBP.

How Safe Is Saving Money in GBP?

Security is a top concern, especially for foreigners asking, “Can foreigners open a GBP savings account?”. Three things contribute to your security: your bank’s licensing, the protection of your money, and fraud prevention.

Here’s what to check:

Regulatory Licensing

- Minimum requirement: The bank must be fully licensed as a bank (e.g. under the UK’s FCA or the Financial Services Unit of Dominica).

- Red flags: Avoid entities which have only EMI (e-money) license as these are not able to provide protection for deposits.

- For example: The Kingdom Bank is a holder of Class A banking license which complies with AML and capital adequacy regulations.

Deposit Protection Schemes

- Covered by FSCS for UK banks up to £85,000 per person.

- Offshore banks: These banks may provide private insurance or segregate accounts (i.e., 100% reserves).

- Fact: Verify whether client funds are kept in tier-1 banks or in any way separated from company assets.

Fraud and Cybersecurity

- Essentials: Two-factor authentication (2FA), alerts for transactions, SWIFT payment verification.

- Advanced: AI-based fraud monitoring (e.g. real time anomaly detection by The Kingdom Bank).

- User tip: Don’t share your login information; not even with “bank representatives” calling you out of the blue.

Currency Risk (For Non-Residents)

- GBP volatility: The pound can depreciate against other currencies. If you are saving in GBP and spending in EUR / USD, get hedging.

- Solution: A few international GBP savings accounts provide forward contracts to fix exchange rates.

Can I Save Money in GBP Through Online Banks?

Digital banking has revolutionized how people open GBP savings accounts online, offering speed, lower fees, and global accessibility.

Online banks streamline the process of opening and managing a GBP savings account for expats or non-residents.

Here’s why online banks are often the best GBP savings account providers:

| Feature | Digital Banks (such as The Kingdom Bank) | Traditional UK Banks |

| Opening account | 100% online, 10–30 minutes | In-branch visits, weeks |

| Verification of ID | Video call or AI document scan | In-person or by mail |

| Minimum deposit | Often £0–£1,000 | £5,000 + is common |

| Fees | Low/no monthly fees | More maintenance fees |

| Interest rates | Competitive (3–5%+ for fixed terms) | Lower (0.5–2%) |

| Multi-currency | Built-in (GBP + EUR/USD/others) | Limited or expensive |

| Customer support | Chat/phone 24/7 | 9–5, Branch dependent |

| Monthly maintenance | £5–£15 | Often GBP savings account with no monthly fee |

How to Open a GBP Savings Account Online

- Select a provider: Compare GBP savings account comparison UK tools or check reviews for which bank offers the best GBP savings account.

- Check eligibility: Certain banks limit services for non-resident; others also accept international clients (such as The Kingdom Bank).

- Send in documents: Usually passport, proof of address and (for companies) articles of incorporation.

- Deposit to the account: Via SWIFT, SEPA, or domestic payment rails.

- Enable functionality: Apply for a GBP savings account with IBAN, virtual cards, or API access if you require them.

Who Can Open an Account?

- UK residents: Access to the ever-popular same day funds holdings in all products, including ISAs. UK residents can shelter up to £20,000 annually in a GBP account with interest that’s tax-free.

- Non-residents: You can apply for a GBP savings account for non-residents or an offshore account.

- Expats: Search for GBP savings accounts for expats that do not ask for a UK address.

- Business: Corporate account holders may be subject to additional KYC requirements (e.g. beneficial owner details).

What Are the Fees Associated with GBP Savings Accounts?

Fees can eat into returns, so read the small print.

Typical charges include:

Different Types of GBP Savings Accounts

Account maintenance

- Normal range: £0 – £20 / month.

- Avoid: Choose a GBP savings account that does not require a monthly fee.

Fees related to transactions

- Domestic transfers (UK): Usually free.

- International transfers: £5–£30 for each SWIFT payment, SEPA may be cheaper.

- Overseas markups: 0.5 to 2% on top of interbank rates when exchanging currencies.

Penalties on withdrawal

- Term accounts: Withdrawal penalty (e.g., interest for 90–180 days).

- Excess withdrawals: A few instant-access accounts restrict free withdrawals in excess of 3 to 6 per year.

Inactivity charges

- Risk: £5–£15/month if no transactions for 6–12 months.

- Solution: Execute a tiny recurring deposit to keep the account active.

Card fees (If applicable)

- Virtual/debit cards: £0–£10 issuance fee; 1–3% foreign transaction fees.

- ATM withdrawals: Free for up to a certain amount (e.g., £200 per month) and then 1 to 2% for each withdrawal.

Request a fully bespoke pricing offer at all times; these fees can vary with deposit size or transaction volume from some banks.

Can I Hold Multiple Currencies Alongside My GBP Savings?

Yes, a GBP multi-currency savings account is ideal for managing funds in pounds, euros, dollars, and more without juggling multiple banks.

Key benefits:

Unified Dashboard

- One interface to all your GBP, EUR, USD, etc. accounts view and transfer.

- Example: The Kingdom Bank’s platform shows real-time balances and FX rates.

Cost-Effective FX

- Exchange at wholesale exchange rates (usually 0.2-0.5% over interbank).

- Exclude: High-street banks applying a 2–5% fee for conversions.

Dedicated IBANs

- Each currency has its own IBAN (e.g., a GB sort code for GBP, a DE IBAN for EUR).

- Why it matters: Makes it easier to get paid by clients or platforms in other countries.

Hedging Tools

- So, you can lock in exchange rates with forward contracts or limit orders.

- Use case: Hedge the GBP savings from volatility if you will need EUR/USD in future.

Interest on All Balances

- Get competitive rates on GBP and other currencies (such as 4% on USD, 2.5% on EUR).

- The state of play: Non-GBP balances typically don’t earn interest at traditional banks.

Who Is Multi-Currency For?

- Freelance/remote workers paid in several currencies.

- Importers and exporters who need to manage supplier payments.

- British expat with income in GBP but outgoings in another currency.

- Investors who want to diversify across assets denominated in different currencies.

By choosing a regulated, digital-first provider like The Kingdom Bank, you gain the benefits of a GBP savings account in the UK without the limitations of traditional banking.

The Kingdom Bank has redefined what’s possible, offering secure GBP savings accounts for international clients, multi-currency convenience, and competitive returns; all without the bureaucracy of traditional banking.

About The Author