What are Exotic Currency Pairs in Forex Trading?26 min read

Reading Time: 10 minutesWhat are Exotic Currency Pairs in Forex Trading? If you’re wondering, we’ll cover that topic. During forex trading research you will have most likely encountered the terms “major,” “minor,” and “exotic” related to currency pairs.

EUR/USD and GBP/USD lead forex trading activity because major currency pairs benefit from both economic significance and high liquidity.

Minor currency pairs pair a major currency with a less frequently traded currency.

But what exactly are exotic currency pairs? Now we will give detailed information about this subject.

Short Description ↵ This article provides an in-depth analysis of exotic currency pairs. This discussion will show the distinctions between exotic and major/minor pairs through examples of popular exotic pairs and we’ll explore the elements affecting their value changes before we talk about trading options with The Kingdom Bank’s safe online forex trading platform.

The completion of this article will leave you with a strong grasp of exotic currency pairs while demonstrating how you can potentially gain from their increased risk and reward potential.

Forex trading enables traders to access currency markets from every corner of the globe.

The most traded currency pairs include those of the US dollar, euro, British pound, Japanese yen, Australian dollar, Swiss franc and Canadian dollar but traders also have access to a large number of less commonly traded “exotic currency pairs.”

This article provides an in-depth examination of exotic currency pairs and their benefits and drawbacks while explaining how brokers present them to traders and discussing effective trading strategies and analysis tips for these less popular currency pairs.

Reminding ↵ The online forex trading platform from The Kingdom Bank gives traders the ability to trade more than 50 exotic currency pairs in addition to major and minor pairs.

We’ll investigate important elements of trading currency combinations that traders don’t encounter as frequently.

How Do Exotic Currency Pairs Differ from Major and Minor Pairs?

Exotic currency pairs differ mainly in their levels of liquidity and volatility. The economic power and worldwide influence of their constituent currencies results in billions of daily trades for major currency pairs such as EUR/USD.

Major currency pairs demonstrate the highest levels of stability and predictability in the market. Minor currency pairs maintain adequate liquidity because they include one major currency component. Minor pairs demonstrate higher volatility because they include a currency that is not often traded.

Bonus Tip ↵ Exotic pairs take volatility to another level. Exotic currency pairs typically experience daily trading volumes of only millions of dollars instead of billions which are common with major pairs. The market experiences greater susceptibility to manipulation and frequent price gaps between sessions due to its insufficient liquidity.

Forex traders face narrower immediate profit potential because spreads remain wider in this market.

Another key difference is fundamental drivers. Major and minor currency pairs exhibit clear reactions to economic announcements and central bank decisions from nations such as the US, Europe and Japan.

The price movement of exotic currency pairs tends to be more influenced by political and economic events specific to the non-major currency nations they represent.

Price movements for these currency pairs become difficult to predict.

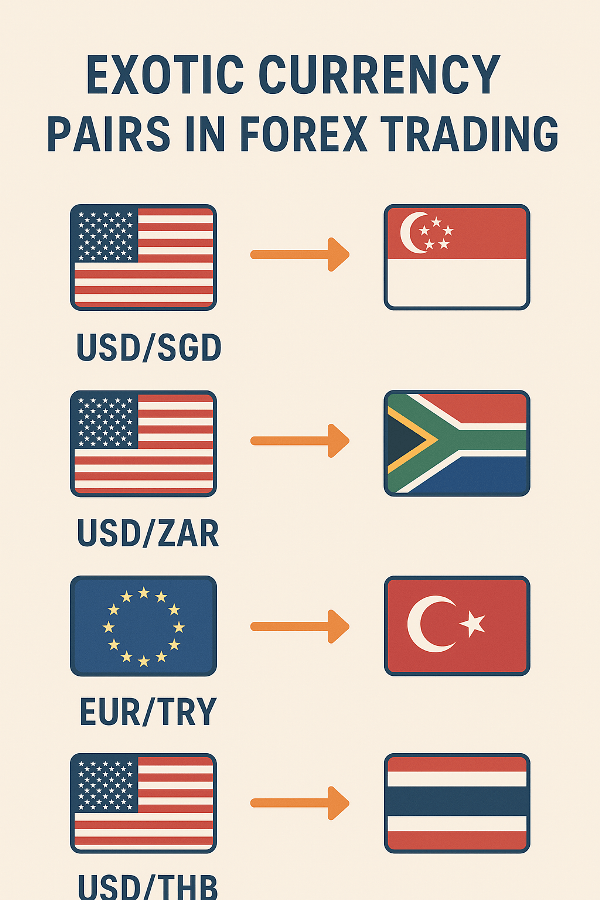

What Are Some Examples of Exotic Currency Pairs in Forex?

These widely traded exotic currency pairs feature prominently on major forex platforms:

Examples of Exotic Currency Pairs in Forex

- USD/ZAR (US dollar vs. South African rand)

- USD/TRY (US dollar vs. Turkish lira)

- AUD/NZD (Australian dollar vs. New Zealand dollar)

- EUR/PLN (euro vs. Polish zloty)

- GBP/HKD (British pound vs. Hong Kong dollar)

- USD/MXN (US dollar vs. Mexican peso)

- USD/SGD (US dollar vs. Singapore dollar)

- EUR/CZK (euro vs. Czech koruna)

- GBP/SEK (British pound vs. Swedish krona)

- USD/RUB (US dollar vs. Russian ruble)

The examination of numerous exotic pairs reveals their composition from emerging market currencies across South Africa, Turkey, Poland, Hong Kong, Mexico, and Russia.

Emerging market economies demonstrate greater volatility in their economic performance when compared to developed nations.

What Factors Affect the Value of Exotic Currency Pairs?

The value movements of exotic currency pairs are more reliant on localized political and economic circumstances in the non-major currency countries because major global economies exert less direct influence on them.

The value of exotic currency pairs can be influenced by several primary factors.

Factors Affecting Exotic Currency Pairs

- Demand fluctuations in exotic currency pairs can occur when central banks in non-major currency nations make policy changes to interest rates.

- Market prices fluctuate based on unexpected figures in inflation rates, GDP growth results, employment figures and trade balances from emerging markets.

- Political instability manifests as additional risk premiums from occurrences such as civil unrest, elections, and geopolitical tensions.

- Export-dependent economies experience upward and downward movements in conjunction with resources such as oil, metals and agricultural products.

- International investor demand for capital flows adapts to shifts in yields and risk preferences.

- Several emerging nations actively intervene in their currency markets by managing their exchange rates in relation to the USD.

Forex traders need to closely watch local political and economic developments to successfully capitalize on price fluctuations in unconventional currency pairs.

How Can You Trade Exotic Currency Pairs in Forex?

You can trade exotic currency pairs without needing direct access to interbank markets or hard-to-find liquidity.

The Kingdom Bank among other top online forex brokers offers traders access to multiple exotic currency pairs through widely-used platforms such as MetaTrader 4 and MetaTrader 5.

Begin trading exotic currency pairs through your The Kingdom Bank forex account by selecting your desired currency pair from the symbol selector.

Utilizing standard forex trade sizes you can execute market or limit orders to buy (go long) or sell (go short) the base currency.

Brokers usually provide adjustable leverage rates for exotic pairs which can increase both potential profits and losses because of their inherent volatility.

Practice careful risk management when determining position sizes. Because of their liquidity challenges exotics should be handled as short-term swing or day trades instead of long-term holdings.

Through The Kingdom Bank’s secure online forex trading platform users gain access to advanced charting options and technical studies along with news feeds which support their analysis of exotic currency pairs.

You have the ability to test strategies using historical price data before risking actual money.

How Can Economic Events Impact Exotic Currency Pairs?

Exotic currency pairs show strong reactions to significant economic announcements from emerging market nations because they involve at least one emerging market currency.

Markets participants pay close attention to events that might shift sentiment and affect supply and demand factors.

Emerging market news that affects exotic currency pairs manifests through several key examples.

- The value of exotic currency pairs tends to move quickly when central banks from emerging markets deliver unexpected rate changes.

- Consumer price data from Mexico, Poland, or South Africa that deviates unexpectedly from forecasts can lead to immediate currency market responses.

- Economic growth rates revealed each quarter can alter the currency forecasts of countries trading as exotic pairs based on their strength or weakness.

- Price movements occur when voting results potentially affect foreign investment and fiscal/monetary policies during elections.

- The occurrence of civil unrest, wars or international power tensions raises risk premiums in the currencies of emerging markets.

Forex traders who monitor The Kingdom Bank’s forex news feeds for economic events and data releases can better exploit the major price movements triggered by such events in exotic currency pairs. A fast response time enables traders to capture profits during brief periods of market volatility.

Exotic currency trading on secure platforms such as The Kingdom Bank offers rewarding opportunities for traders who apply wise risk management while studying pair-specific fundamentals and price action patterns to complement their existing major and minor pair strategies.

Engage in trading that fits your financial capacity while maintaining attention on all possible risks.

Are you curious about exotic currency pair trading as an opportunity to gain profits from global macro events and short-term market fluctuations?

Begin your exploration of high-reward exotic currency pairs by opening a live or demo account with The Kingdom Bank today.

What Are the Advantages of Trading Exotic Currency Pairs?

Exotic currency pairs offer traders the possibility of experiencing higher volatility and executing larger profit-making moves than those available with major currency pairs.

The reduced economic news updates and central bank activities affecting exotic currency pairs leads to their price movements becoming more unpredictable and volatile on a daily basis. The increased volatility presents more significant profit possibilities in both long and short positions.

Exotic currency pair traders gain advantages through reduced trading volumes and minimal influence from big institutional participants. Relatively smaller trading capital has more influence over market movement due to its reduced size.

Relatively small trade values of several million dollars can make exotic currency pairs experience drastic price movements either up or down. Reduced liquidity leads to broader average spreads when compared to liquid majors which creates potential trading opportunities for market participants.

Another advantage is diversification. You introduce less correlated assets to your forex portfolio when you trade exotic pairs alongside major currency pairs.

True diversification helps mitigate overall portfolio risk. Exotic pairs provide trading access to emerging market economies which traders cannot reach through traditional major currency pairs.

Trading less popular currencies gives you the chance to enter the market before other traders.

By trading an exotic currency pair that develops a strong trending pattern and attracts more attention you will gain an early advantage which allows you to capitalize on increased liquidity and trading volume.

Are Exotic Currency Pairs More Volatile Than Major and Minor Pairs?

Exotic currency pairs experience significantly greater price movements both throughout the day and between trading sessions compared to major currency pairs.

The primary reason exotic currency pairs show greater price swings is their lower daily trading volumes combined with minimal involvement from central banks and major financial institutions.

The absence of large market player involvement makes exotic currency pairs more sensitive to news events affecting only their two underlying economies.

Traders experience higher realized volatility because exotic pairs exhibit wider bid/ask spreads as a result of reduced liquidity levels.

Research shows that exotic pairs experience annualized historic volatility levels that are 2-4 times greater than major currency pairs such as EUR/USD. Increased volatility creates opportunities for substantial gains but simultaneously introduces significant risks of sudden market reversals.

Different exotic currency pairs experience varying levels of volatility which depend on the economic and political stability of the currencies involved.

Currency pairs that consist of two emerging market currencies from turbulent regions usually show much higher volatility compared to pairs between two stable currencies from developed economies. Entering exotic pairs trading requires traders to anticipate substantial daily price fluctuations.

How Do Brokers Offer Exotic Currency Pairs for Trading?

Top forex brokers provide access to leading exotic currency pairs together with major and minor currency pairs through their online trading platforms today.

The Kingdom Bank provides traders access to over 50 forex pairs which they can trade through the web-based MetaTrader 5 platform as well as its mobile application.

The trading of exotic currency pairs occurs through brokers who secure liquidity by connecting with multiple wholesale forex market makers because these pairs lack centralized exchange trading platforms

Most brokers manage to offer competitive spreads for popular exotic pairs even though their liquidity doesn’t match levels found in USD/JPY or EUR/GBP trades.

When market volatility increases brokers often use their internal liquidity pools to enhance available liquidity. These practices protect traders from forced trade closures and widening spreads during major news releases and times of reduced market activity.

The contract sizes for trading exotic currency pairs typically vary from micro to standard lots based on the specific pair and account type.

The margin requirements for exotic currency pairs exceed those of major pairs due to their greater volatility levels. Reputable brokers provide clients with dependable and efficient trading experiences when dealing with exotic currency pairs.

What Are the Best Strategies for Trading Exotic Currency Pairs?

Higher volatility and potential big price movements in exotic pairs make short-term price swing exploitation one of the best trading strategies.

Best Strategies for Trading Exotic Currency Pairs in 2025

- Scalping: Traders achieve numerous small profits during the day or week by repeatedly opening and closing positions within 1-5 pips intervals. The strategy requires constant monitoring yet delivers constant returns when risk management is properly applied.

- Breakouts: Traders should look for currency pairs that maintain a tight trading range before breaking out with expected targets located between 10-30 pips from the breakout point. Traders execute their positions immediately when price action verifies the breakout.

- Pullbacks: After the market pulls back between 50-200 pips from recent highs or lows traders place transactions along the primary trend direction. The goal is to capture the reestablishment of the existing trend.

- News trading: Profiting from large initial market responses to economic announcements or unexpected central bank decisions. Positions get closed quickly before market volatility subsides.

- Swing trading: Winning positions are maintained for one to five days while seeking continuous trends of 100+ pips in more active market conditions. Requires patience and use of protective stops.

To achieve success in exotic markets traders should maintain position sizes between 0.1-0.5 standard lots due to their unpredictable behavior.

Investors should spread their trades across multiple currency pairs instead of focusing on only one or two.

How Can You Analyze Exotic Currency Pairs in Forex Trading?

When analyzing exotic currency pairs, you need to implement a different methodology than you would use for major currency pairs.

Here are some tips:

- Focus on pair-specific fundamentals: You need to study economic information and central bank policies while understanding political and regulatory risks that affect the two currencies in the pair. General market influences matter less.

- Study pair’s historical charts in depth: To effectively analyze exotic currency pairs study seasonal trends along with typical consolidation and breakout ranges and how these pairs respond to unexpected economic events. Look for repeating scenarios.

- Watch for cross rates involving the currencies: The performance of a currency against a third currency can reveal insights about its power relative to its primary counterpart.

- Monitor high impact news carefully: The market experiences strong responses from economic reports about inflation, GDP, or interest rates even though there are fewer such reports.

- Use higher time frame charts: Daily charts along with those of 4-hour intervals are better at identifying trends compared to hourly or 30-minute charts which tend to produce noise. Identify intersections of trading signals from multiple time frame analyses.

- Employ technical analysis tools: The relative strength index (RSI), moving averages and Fibonacci retracements serve as technical analysis tools to detect overbought or oversold conditions and signal trend continuations.

- Backtest strategies rigorously: Manual backtesting through demo accounts proves necessary because major accounts yield less historical data. Refine methods that prove historically viable.

Traders who analyze and develop strategies based on each exotic pair’s specific nature can discover profitable opportunities in these underpopulated currency markets through The Kingdom Bank’s adaptable online forex platforms. Managing risk calls for maintaining small position sizes.

Exotic currency pairs offer traders opportunities for profit through market volatility and inefficiencies while enabling portfolio diversification which requires diligent risk management due to their higher risk levels.

The Kingdom Bank facilitates access to the exotic currency market for all traders by offering fully-online forex trading accounts designed for beginners and professionals.

The Kingdom Bank delivers deep market liquidity across more than 50 exotic currency pairs by providing tight spreads and flexible trading conditions. Competitive funding and withdrawal rates alongside advanced security features and educational tools help traders improve their strategies.

Open an account and begin trading exotic currency pairs with tight spreads and low commissions by visiting The Kingdom Bank online or using our mobile app.

You can reach customer support at any time for help because we offer 24/7 service. It is essential to implement correct risk management techniques for these unstable market conditions.

About The Author