Prepaid Debit Card in 2026 (How to Choose the Best)22 min read

Reading Time: 9 minutesThe interest in prepaid debit cards increased in 2026. You can choose from popular brands on these cards. You can also select an option that suits your needs.

You can find special options for topics such as e-commerce, bill payments, and overseas expenses. You can top up via your private banking account.

Some cards provide budget control for young users. You can make contactless payments and create virtual cards with these cards. They also have advantages such as cashback opportunities and mobile application support.

The advantages of each card are different. Therefore, you should choose the one that suits your spending habits. Your card may have different security features. Balance loading options also vary. You should also look at the quality of customer service and transaction fees.

Quick Tip ↵ However, since the advantages offered by each card differ, users need to choose the one that best suits their spending habits. You can find high cashback with low transaction limits on basic cards. Additionally, you can receive instant notifications through the mobile application.

Spending Tracking and Card Locking

You can also use features such as spending tracking and card locking from your mobile device. Therefore, brand awareness does not determine the best card. For this, it is also necessary to focus on customised advantages tailored to individual needs.

There are many prepaid debit card options in 2026. Popular brands are not always advantageous. You can use these cards for e-commerce or bill payments. They may also be spending time abroad. In this case, you can choose according to your usage purpose.

You can also control your budget for young people. These cards may feature contactless payment and the ability to create a virtual card.

Also, evaluate options such as cashback opportunities and mobile application support. The advantages of each card are different. Therefore, consider your spending habits.

These cards may have private banking debit card features. Security features and balance loading options may be considered. Also, evaluate situations such as customer service quality and transaction fees.

You can get high cashback with low limits on the card you choose. Some cards may have a wider area of use. There may also be cards with international support. You can also get a debit card for business.

You can search for features such as instant notification, spending tracking and card locking via the mobile application. Therefore, do not only look at brand awareness to choose the best card. Choose according to your personal needs.

What Features Should I Look for in a Prepaid Debit Card in 2026?

You can make your basic payment transactions with a prepaid card. Apart from this, it has many other functions. It also features security, digital integration, and a user-friendly experience. Be meticulous here as you would when opening an investment account.

Don’t think of these cards only as a spending tool. They also contribute to budget management. They also provide financial education and online shopping security for young users.

The features offered by the card should be suitable for your purpose of use.

The main features to look for in a prepaid debit card in 2026:

- It should be compatible with NFC, QR and digital wallets.

- It should offer a virtual card for secure use in online shopping.

- Expenses should be tracked in real-time via mobile application.

- It should offer points, discounts or cash-back advantages according to expenses.

- It should be possible to load from ATMs, bank transfers, mobile applications and market chains.

- It should provide global validity with Visa and Mastercard infrastructure.

- It should offer the opportunity to close the card in case of loss/theft instantly.

- It should have features such as parental control and spending limits for young users.

- There should be no hidden costs when using the card.

How Does a Prepaid Debit Card Work Compared to Traditional Debit Cards?

Prepaid debit cards work differently than traditional debit cards. These cards operate without requiring a bank account connection.

You can only spend up to the amount of money loaded onto the card. You can control your spending with these cards because they do not offer borrowing options such as a Credit limit or additional account.

You load a certain amount after purchasing the card. You can use the card until the balance is depleted. You can make payments in physical stores and online shopping. You can also use it at ATMs.

Tip ↵ Traditional debit cards are directly connected to a bank account. You can use the existing balance in the account. You can give automatic payment instructions with these cards. You can pay bills. In some cases, there may be borrowing options such as additional accounts.

In contrast, prepaid cards do not require a Credit check. These cards work with lower transaction limits. In this respect, they are suitable for young users.

They are also preferred by those who want to keep their budgets under control. Ultimately, they serve as a practical alternative for individuals who do not have a bank account.

What are the Benefits of Using a Prepaid Debit Card in 2026?

Prepaid debit cards are not just an alternative payment tool. They also provide budget management and digital security. They also have advantages in terms of financial access.

You can use these cards if you do not have a bank account. Young people and online shoppers also frequently use them. These cards provide control.

They also have a practical use. They have advanced mobile applications. They also have fintech infrastructures. Prepaid cards are a time-saving and financial awareness tool.

The main benefits of using an online prepaid debit card (2026):

- It does not carry the risk of debt like a Credit card. Only the amount of the loaded balance can be spent.

- It provides access to the financial system for individuals who are not bank customers.

- Card information is protected thanks to the virtual card feature. The risk of fraud is reduced.

- Instant balance and transaction tracking can be done via mobile applications.

- Families can offer controlled pocket money management to their children.

- It offers global validity with infrastructures such as Visa and Mastercard.

- Basic transactions such as withdrawing money from ATMs and paying bills are supported.

- Some cards offer special discounts and cashback for spending.

How Do I Compare Fees When Choosing a Prepaid Debit Card?

When choosing a prepaid debit card, look at the initial acquisition costs. Additionally, be mindful of all costs incurred during the usage process.

The card’s annual fee and balance loading commissions should be taken into account. Additionally, be aware of ATM withdrawal fees and virtual card creation fees.

There may also be penalty fees charged in the event of inactive use. Some cards are offered free of charge. However, they can charge up to 2% commissions for loading balance with a Credit card.

Others may offer more advantageous campaigns with low fees. Check the fees before applying for an online debit card.

Check whether the fees are balanced with the advantages offered by the card. Cashback rates and campaign variety are also important.

Additionally, prioritise overseas usage support and customer service quality. Online debit cards for business banking may vary in their features.

Can I Use a Prepaid Debit Card for Online Shopping in 2026?

Prepaid debit cards can be used for online shopping. These cards are very similar to credit cards. Like a private banking debit card, it has a 16-digit card number, expiration date and CVV code. You can use it as a payment tool on e-commerce sites.

You can also use the virtual card creation feature. In this way, you can shop without sharing your physical card information. This method can serve as an additional security measure against the risk of fraud.

Prepaid cards are not connected to your bank account. They are not connected to your bank like an online debit card. You load a certain balance onto the card. Your balance is limited to the amount you load onto this card. Therefore, you can easily control your budget.

Debit card deposits are not valid here. You can use the mobile application of the prepaid card. From here, you can use features such as instant balance tracking, spending notifications and card locking. Your online shopping can be safe and controlled.

You can use a debit card banking account according to your shopping habits. You can also use a prepaid card.

What is the Best Prepaid Debit Card for Travellers in 2026?

Travelers love prepaid debit cards. They use them for budget control and easy international spending. Online debit cards have stringent rules. Prepaid cards can be flexible and secure.

They also have exchange rate advantages and low transaction fees. They also offer mobile app support. Costs are transparent for home ATM transactions when shopping abroad. In this way, they offer travellers more comfortable and economical solutions.

How Secure is a Prepaid Debit Card in 2026?

Business debit cards are safe. Prepaid debit cards also use advanced security technologies. Regulations also support them. Therefore, they are a secure payment tool.

EMV chip technology is used in these cards. You can also perform contactless transactions and two-factor authentication. There are also instant transaction notifications. In this way, online prepaid cards are a secure option.

There is also a feature for creating virtual cards. Thus, you do not share your physical card information.

At the same time, official institutions also conduct the necessary inspections for these cards. They can also be used as online debit cards for business.

Tip ↵ Institutions that offer prepaid cards also offer mobile application support. From here, you can use features such as card locking and setting spending limits. You can also track transaction history.

Young users can make secure financial transactions. It is also used by people who do not have a private banking account. When choosing a card, the provider must be licensed and regulated. You should also pay attention to security features.

What’s the Difference Between a Prepaid Debit Card and a Credit Card?

There are differences between prepaid cards and Credit cards. The primary difference lies in the source of spending. You load a balance onto prepaid cards.

You only spend as much as the balance you load. There is a limit on Credit cards. Therefore, you spend by borrowing.

This difference diversifies the purpose of use and the level of risk associated with it. It also has significant consequences in terms of financial control. You can control your budget with prepaid cards. You can also avoid getting into debt.

These cards are a good solution for individuals who do not have a bank account with a bank card.

There is greater spending flexibility with Credit cards. They also offer advantageous campaigns. However, if you do not use them carefully, you will be burdened with debt.

Are There Any Prepaid Debit Card Options with Rewards in 2026?

Prepaid debit cards are not just an alternative payment tool. They also provide user experience and digital security.

They also have a foreign exchange advantage. Thus, they offer strong financial solutions. Examine the options before applying for a prepaid debit card.

Frequent travellers and young people use these cards. Those who do not have a debit card can also choose them for business banking.

How Do I Reload Money onto a Prepaid Debit Card?

There are various ways to load money onto a prepaid debit card. You can load money via an investment account. You can use debit card deposits. You can load money even if you don’t have a bank account.

You can make transactions via mobile applications or physical channels. However, the loading options offered by each card provider may differ. Therefore, please check the current instructions on the official card platform.

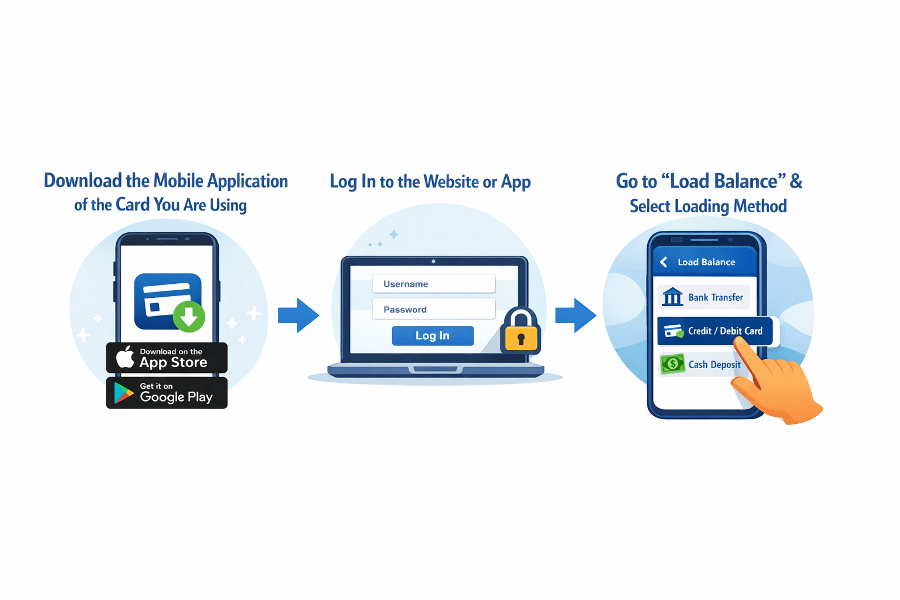

The process of loading money onto a prepaid card is as follows;

1 – Download the mobile application of the card you are using. You can log in to the website instead of the application.

2 – Enter a menu such as “Load Balance” in the application.

3 – Select the loading method.

- Bank Transfer/EFT/FAST: Transfer from your bank account to the card’s account number.

- Loading with Credit Card: Transfer balance by entering Credit card information through the application. You can load money using your debit card banking account.

- Loading Cash from an ATM: Insert the card into a contracted ATM, select the “Deposit Money” option and deposit cash.

- Market or Store Points: Loading can be done at contracted points.

- Mobile Wallets: Some cards also accept top-ups via Apple Pay or Google Pay.

You can also load balance via debit card for business banking.

4 – Enter the amount you want to top up and confirm the transaction.

5 – When the top-up is complete, you will receive an instant notification via the app.

The Kingdom Bank For Prepaid Debit Card

User satisfaction, innovation and accessibility are essential here. Some cards that consider these issues also win awards.

The Kingdom Bank is waiting for you to apply for a prepaid online bank card. Apply for a debit card. Come to The Kingdom Bank now. If you want to get a debit card for business, check out advantages.

Update Information: This article was updated in 2026.

About The Author