OTC Trading for Digital Assets: A Complete Beginner’s Guide21 min read

Reading Time: 8 minutesOTC trading allows you to manage your assets independently of centralized exchanges. Private transfers can take place between buyers and sellers.

This method reduces price volatility in large-volume crypto transactions and increases transaction privacy. It also offers the opportunity to provide instant liquidity.

Through brokerage firms, two parties can exchange assets securely and quickly. OTC trading is suitable for individual investors. It is also widely used by institutional investors. Online OTC trading allows traditional OTC transactions to be conducted digitally.

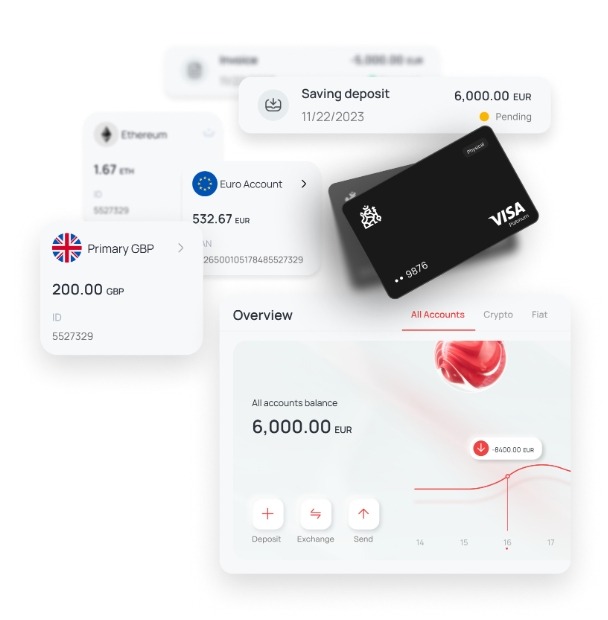

Pro Tip ↵ You can trade through digital platforms like The Kingdom Bank. In this method, buyers and sellers meet using matching algorithms. They provide pricing tailored to the volume of the transfer. You also trade anonymously and can monitor the transaction in real time.

OTC trading online is also compliant with regulations. With technical infrastructure support and rapid verification features, you can trade securely.

Transactions are completed without being recorded on the blockchain, allowing you to complete high-volume transfers without leaving a trace.

With digital asset banking, you can integrate your crypto investments with traditional banking. This type of banking allows you to store your investments digitally. You can also make transfers digitally.

You can open a digital asset bank account through crypto-friendly banks. This allows you to manage your portfolio without fiat money. Especially if you are a corporate investor, you can manage your stablecoin and token-based assets in these accounts.

OTC trading with digital assets is one of the most strategic transactions supported by this banking model. You can make high-volume purchases and sales with this banking system.

You can also make direct transfers outside of traditional exchanges. You can securely store your digital assets in your digital asset bank accounts.

You can buy and sell crypto through OTC banking. Thanks to digital asset banking, you can monitor your OTC transactions and conduct them in compliance with the law.

Those who want to open an over-the-counter trading account can visit The Kingdom Bank immediately.

What is OTC trading and how does it work for digital assets?

OTC trading allows you to sell your digital asset outside of a centralized exchange. This transaction takes place directly between two parties. Large asset transfers are made this way, eliminating price slippage and liquidity issues.

Transactions here occur outside the standard exchange order book. This can be more cost-effective. Privacy is also significantly higher.

You can also configure trading conditions to suit your needs. OTC trading account can be opened through platforms like The Kingdom Bank.

They offer users more comprehensive control than traditional exchanges. You can open an online OTC account and conduct OTC transactions digitally. Transfers are fast and secure. You have the option of user verification and volume management.

You can also receive special price quotes. You can communicate directly with the counterparty at any time. Attracts institutional investors with substantial funds otc trading for business.

Your business can conduct high-volume transfers at prices that are not publicly available and unknown to anyone. This saves you significant costs. You can track your transaction history and take advantage of reporting and risk management advantages.

How is OTC trading different from traditional crypto exchange trading?

OTC trading is a decentralized financial space. Transfers occur independently of exchanges. Transactions are conducted in crypto assets. Larger volumes are often completed directly between parties.

In OTC transactions, prices are not publicly available. This means less price slippage. Confidentiality is also significantly higher than in stock exchanges. OTC traders are institutional players, asset managers, and large portfolio holders.

These investors can avoid the liquidity problems and volatility of traditional stock exchanges. You can execute transactions through personalized offers and special agreements.

Forex trading is conducted in a decentralized foreign exchange market, which attracts more interest from individual investors.

For forex traders, the markets are constantly open. Currency pair transactions are based on current fluctuations. You buy and sell in the short term based on instant analysis.

OTC investors generally trade strategically and confidentially. Special verification processes and high-volume transactions are required.

If you’re interested in OTC trading, you can start trading immediately at The Kingdom Bank.

Who typically uses OTC trading for digital assets?

OTC trading allows you to sell your digital assets through customized transactions. You can trade securely and flexibly here. Off-exchange financial transactions are conducted within the OTC market, allowing transactions to be conducted directly between parties.

If you want to avoid price volatility, you can choose OTC trading. This method also allows you to maintain privacy and provide rapid liquidity. You can conduct these transactions digitally through online trading platforms.

Individuals and institutions that can use OTC trading for digital assets include:

- Institutional investors: Funds, holding companies, and digital asset portfolio managers prefer OTC services for large-volume transactions.

- Miners and liquidity providers: They turn to over-the-counter exchanges for large amounts of crypto assets they want to sell or exchange.

- High-net-worth individuals: Individual investors managing large portfolios use OTC for personalized price quotes and privacy.

- Financial technology companies: Businesses that provide crypto services to their customers achieve operational efficiency and regulatory compliance through OTC transactions.

- Professionals who engage in off-exchange arbitrage: They evaluate price differences and take strategic positions in the OTC market.

What are the main benefits of OTC trading in the crypto market?

Opening an over the counter trading account allows you to bypass the limitations of centralized exchanges. OTC trading offers customized solutions. Here, you can execute high-volume transactions and remain unaffected by price fluctuations.

They allow you to complete your transactions quickly. The best OTC markets offer reliable trading. They also operate with a regulated infrastructure. They focus on providing user-friendly digital platforms.

Let’s explain the advantages of OTC trading:

- Large-volume transactions can cause sudden price fluctuations on the exchange. However, the OTC structure mitigates these effects.

- Because transactions are not visible on public order books, they provide a higher level of confidentiality.

- Buy and sell orders can be set between parties through special price quotes.

- OTC platforms offer investors a large volume of liquidity not available on exchanges.

- In addition to standard order types, structured transfers can be made tailored to the investor’s needs.

- They are particularly advantageous for businesses in terms of accounting, reporting, and regulatory management.

If you’re looking for answers to questions like “ how to do otc trading?”, you can contact The Kingdom Bank. Those looking to open a digital asset bank account meet here.

Is OTC trading safe for buying and selling digital assets?

OTC trading allows you to buy and sell your digital assets off-exchange. Investors prefer this method, especially for high-volume transactions. You can trade securely here.

Verified parties can communicate with you in this trading process. You also find liquidity and regulatory compliance based on trading volume.

If you have an over the counter trading account, you can benefit from special pricing, identity verification, and transaction tracking. By making OTC payments through the right institutions, you can avoid fraud risks. These systems are highly audited and monitored.

Online OTC trading is supported by advanced security infrastructures. Corporate platforms feature multi-signature protocols and encrypted communication options. You can also use anti-manipulation algorithms.

You can use transaction history and reporting modules on the platforms. As a corporate and individual customer, you can trade transparently and with control. Your risk is minimized and you can trade securely.

Tip ↵ If you would like to trade digital assets OTC, contact The Kingdom Bank now.

Meta Decs. Looking to start trading digital assets OTC? Learn how to open an account, reliable platforms, and trading costs with this guide. Trade high volumes with confidence.

How do I get started with OTC trading as a beginner?

If you’re looking for answers to the question of how to trade OTC, you’re in the right place. First, you need to start by choosing the right platform. If you’re a beginner, you should open a reliable OTC trading account.

Platforms allow you to open different types of OTC accounts, tailored to your corporate or individual needs. At this point, you should create your account according to your needs.

After selecting the account type, you must apply and complete the identity verification process. Then, you can start OTC trading.

The best OTC markets are those that offer transaction security and technical support. As a beginner, you should choose options with a simple interface. Also, choose platforms that explain the transaction steps step by step.

Don’t forget to review your chosen bank’s payment methods and asset transfer procedures. Also, learn about transaction prices. Also, don’t start OTC trading without first consulting The Kingdom Bank.

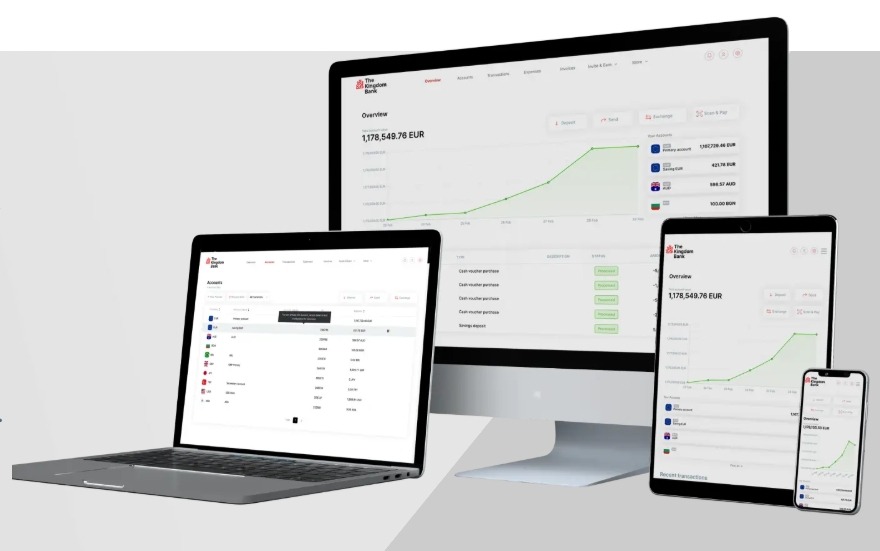

What platforms or providers offer trusted OTC trading services?

OTC trading allows you to buy and sell your digital assets outside of a centralized exchange. This trading method allows you to avoid price volatility, especially if you have a high volume of transactions.

It also allows you to maintain the confidentiality of your transactions. This trading method also offers you transaction flexibility.

With online OTC trading, you can trade securely and quickly on digital platforms. Numerous platforms in the UK offer OTC services as a financial infrastructure.

Among the platforms that offer reliable online OTC trading is The Kingdom Bank. This platform makes OTC transactions convenient for both individual and institutional investors.

You can trade with its advanced mobile infrastructure and fast transaction options. You can also take advantage of its high security and high-volume transaction advantages.

What fees are involved in OTC trading for digital assets?

With an OTC trading account, you can easily sell your digital assets off-exchange. Moreover, you can do this directly. You also have the opportunity to execute high-volume transactions seamlessly.

This trading method is suitable for both institutional and individual investors. Furthermore, it offers advantages such as privacy, liquidity, and price stability. An online OTC account brings these advantages to the digital world, making them faster and more accessible.

Also, keep in mind that OTC trading has some transaction costs.

Let’s list the most common fees for OTC trading:

- Transaction commission: OTC desks or providers may charge a percentage-based or flat fee for each trade. You typically pay between 0.1% and 1%, but this amount varies depending on your trading volume.

- Spread: In OTC transactions, there is a certain margin between the buy and sell prices. This difference forms the liquidity provider’s revenue model and can vary depending on the transaction type.

- Custody or wallet service fee: OTC providers may offer additional services to store digital assets securely. If you utilize these additional services, you may be charged a monthly or annual fee. • Verification and integration costs: Platform integration and compliance services may incur additional costs, especially for OTC trading for businesses involved.

- Investor service fees: If you utilize additional services such as dedicated representative support, transaction analysis, or corporate reporting, you must pay for them.

Take advantage of The Kingdom Bank‘s affordable pricing for OTC payments and trading now.

How is pricing determined in OTC trading for cryptocurrencies?

OTC investors execute high-volume digital asset transactions. One of the most important reasons for choosing this method is that pricing in OTC trading is determined independently of the central exchange order book. Here, the parties determine the prices jointly.

The set price is generally close to the market price. However, the price fluctuates based on volume, counterparty liquidity, and transaction timing. OTC desks can also offer price quotes tailored to the size of the transaction if the buyer and seller request it.

Pricing during this process is not publicly available. Confidentiality is paramount. Forex trading is conducted via buy and sell orders in decentralized foreign exchange markets. Transaction prices are determined by the supply and demand within the liquidity pool.

As forex traders, you can act based on short-term technical analysis. If you are a low-volume trader or a frequent trader, you can also use this method. If you are developing long-term strategies and have a large portfolio, becoming an OTC investor is a more suitable option.

How does OTC trading help with large-volume digital asset transactions?

OTC trading is the most suitable digital banking platform for large-volume transactions. Transactions are conducted independently of the exchange order book.

High-volume transactions on centralized exchanges affect prices. The OTC market offers the opportunity for transactions at customized prices between buyers and sellers, thus not negatively impacting the market.

OTC trading ensures transaction security, and pricing is tailored to the volume of your transaction. Furthermore, parties can communicate directly. Individual and institutional investors frequently perform these transactions.

Online trading platforms allow you to conduct OTC trading digitally. As an investor, you can manage your large-volume transactions. They utilize verification processes and transaction matching algorithms, giving you full control before and after the transaction.

Over-the-counter trading and banking allow you to track transaction history and access dedicated customer representatives. You can also handle large transfers independently of market volatility and liquidity issues.

If you are interested in online OTC trading, The Kingdom Bank is always at your service.

About The Author