Best Way to Open an Offshore Bank Account in Peru10 min read

Reading Time: 5 minutesOpening an offshore bank account in Peru can provide many benefits for both Peruvian residents and foreigners, but navigating the regulations and requirements can seem daunting at first.

In this guide, we’ll break down the steps to open an offshore account in Peru and choose the best online bank for your needs.

How to Open an Offshore Banking Account in Peru?

Opening an offshore banking account in Peru is straightforward as long as you understand the eligibility rules and documentation required. Here are the basic steps:

- Determine if you are eligible to open an offshore account. Peruvian citizens and legal residents can open accounts locally. Non-residents like expatriates and digital nomads may open offshore accounts with certain stipulations.

- Choose an offshore bank. Look for banks that are licensed and regulated by the Peruvian government like The Kingdom Bank. Offshore banks should be fully authorized to provide services to both local and international clients.

- Complete the application and KYC process. You’ll need to submit identification documents like a passport, proof of address, and information about the source and purpose of funds. Some banks allow applications to be completed fully online.

- Make a minimum initial deposit. Most offshore banks in Peru require a minimum deposit of $1000-5000 to open an account, though high net worth clients may have lower minimums. Deposits can usually be made via wire transfer.

- Wait for approval. Once your application is reviewed and approved, the bank will notify you that your offshore bank account is ready to use. The review process usually takes 1-2 weeks.

Following these basic steps should allow most individuals to open an offshore bank account in Peru suitable for both personal and business banking needs.

Let’s explore some of these requirements and options in more detail.

Can Foreigners Open an Offshore Banking Account in Peru?

Yes, foreigners can open offshore bank accounts in Peru, provided they meet a few key requirements:

- You must not be a Peruvian citizen or tax resident. Offshore accounts are intended for non-residents.

- You need a valid passport for identification. Some banks also accept national ID cards.

- Proof of address from your home country (e.g. a utility bill mailed to your foreign address dated within 3 months).

- Information on the source and intended use of funds going into the account. Banks want to comply with anti-money laundering regulations.

As long as you can provide the proper identification and residency documents, most reputable offshore banks will allow foreigners to open accounts remotely without needing to be physically present in Peru.

This makes offshore banking a convenient option for digital nomads and business people working internationally.

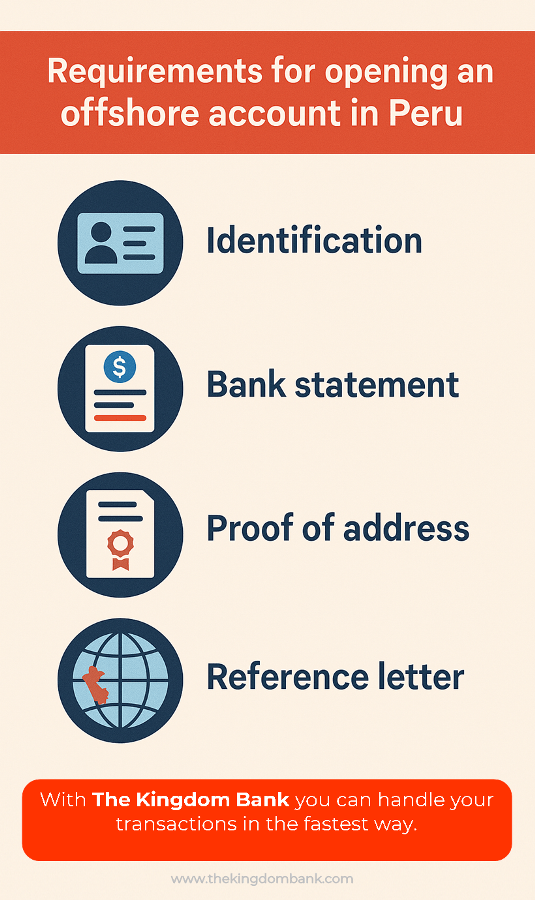

What is Required for Non-Residents to Open an Offshore Banking Account in Peru

In addition to valid identification documents, offshore banks in Peru may require additional documentation from non-resident clients opening offshore accounts:

- Business registration documents if opening a business account. This could include articles of incorporation, business license, etc.

- Income source verification like pay stubs, tax returns, or investment portfolio statements.

- Proof of address as mentioned above, e.g. a recent utility bill. Digital nomads can provide addresses from their home country.

- Bank reference letter from a major bank you currently hold an account with.

- Personal net worth statement detailing your assets and liabilities. High net worth clients have lower account minimums.

While these extra requirements add some paperwork, reputable offshore banks like The Kingdom Bank streamline the process through fully digital applications and document uploads.

Non-residents need not visit Peru in-person if all requested information can be provided upfront online. With the right bank, opening an offshore account remotely is very feasible.

How to Open an Online Offshore Banking Account in Peru?

The best way for non-residents to open an offshore bank account in Peru is through an online offshore bank that offers fully digital account opening.

Here are the basic steps:

Choose an online bank like The Kingdom Bank that is licensed in Peru and allows digital on boarding.

- Visit the bank’s website and select “Open Account” or similar.

- Complete the online application form, entering all personal details accurately.

- Upload clear copies of your valid passport or ID, proof of address, and any additional required documents.

- Fund the minimum initial deposit amount, usually $1000-$5000, via international wire transfer.

- The bank will review your application and documents online. With a digital bank, this review typically takes 1-2 business days.

- Once approved, you’ll receive login credentials for the bank’s online portal to manage your new offshore account from anywhere globally.

Going through the digital account opening process avoids the need to visit Peru.

An online offshore bank makes it simple to set up an offshore account remotely as a non-resident.

The Best Online Bank to Open an Offshore Banking Account in Peru

When choosing an online offshore bank licensed in Peru, The Kingdom Bank stands out as one of the top options for both individuals and businesses worldwide:

- Fully digital account opening, management, and wire transfers via online portal. No need to visit Peru.

- Licensed and regulated by the Financial Services Unit of Dominica as an offshore bank. Prudentially supervised.

- Provides personal and business banking services globally with multi-currency accounts.

- Requires only $1000 minimum deposit to open an account. No monthly or transaction fees.

- Offers private banking services for high net worth clients with personalized account managers.

- Secure online banking platform with bank-level encryption to protect accounts and funds.

- 24/7 client support via phone, email, and live chat on the website.

For a truly digital offshore banking experience, The Kingdom Bank makes it effortless to set up an account remotely in Peru or from anywhere in the world.

Our competitive fees and services make us a top choice for both individuals and businesses in need of an offshore bank account.

Opening an offshore bank account in Peru provides benefits like diversifying assets, tax advantages, and access to global payment and investment options.

With an online offshore bank like The Kingdom Bank, going through the simple application process remotely avoids the need to visit Peru in person. Non-residents can easily set up a secure offshore account and take advantage of the banking services provided.

If you’re looking for a digital offshore bank licensed in Peru, The Kingdom Bank is highly recommended to handle all your international banking needs securely online from anywhere in the world.

About The Author