What’s the Role of SWIFT in Cross-Border Payments?25 min read

Reading Time: 10 minutesCross-border payments can sometimes be an intricate process. However, with the right global payment solutions, you can make your experience a lot less difficult and a lot more enjoyable.

When it comes to cross border money transfers, one of the most critical facilitators of the process in terms of international transactions is the Society for Worldwide Interbank Financial Telecommunication, better known as SWIFT.

SWIFT plays an important part in how The Kingdom Bank and other institutions work with cross border B2B payments and cross border currency exchange.

SWIFT stands for Society for Worldwide Interbank Financial Telecommunication. SWIFT is a global cooperative owned by financial institutions around the world that provides messaging services for secure cross-border financial communication.

SWIFT is a global member owned cooperative that is the world’s leading secure financial messaging network that links more than 11,000 banking, securities institutions, cross border payment providers, market infrastructures, and corporate customers across more than 200 countries and territories.

What is SWIFT and How Does It Facilitate Cross-Border Payments?

SWIFT, more formally known as the Society for Worldwide Interbank Financial Telecommunication, is a member-owned cooperative founded in 1973, providing secure financial messaging services to more than 11,000 banks, securities organizations, market infrastructures and corporate customers in over 200 countries and territories.

Essentially, SWIFT is a communication network that enables financial institutions to send and receive information about financial transactions in a secure, standardized and reliable environment.

When an international money transfer is initiated, the SWIFT network is used by your bank to transmit the payment details to the recipient bank as well as any other intermediary banks in the payment route.

Here are some important features to know about the role SWIFT plays in cross-border payments:

- Message format: SWIFT has developed common message formats and protocols for all of its member institutions to use, which ensures interoperability between them. This includes payment details such as the amount, date and transaction codes and more.

- Unique identifiers: Unique 8 or 11-character Bank Identifier Codes (BICs) are assigned to each financial institution and corporate customer in SWIFT. These codes serve as globally recognized identifiers for routing payments.

- Secure delivery: SWIFT’s messages travel over private financial networks and data centers which ensure confidentiality, integrity and availability of payment data during transit.

- Settlement later: SWIFT’s job is to transmit the payment instructions while the actual transfer of funds is done over other technical and financial systems. The two-tiered process separates message delivery from the movement of funds.

SWIFT provides the connectivity and standards needed for The Kingdom Bank and other financial institutions to securely communicate international payment orders and have funds move across borders in an efficient manner.

How Does SWIFT Ensure the Security of Payments?

As SWIFT handles trillions of dollars of cross border transfers each day, the security of cross border payments is of the utmost importance.

SWIFT has implemented strict security measures and protocols at each level of the process:

SWIFT Security Protocols

- Encryption: Encryption of all SWIFT messages during transmission between banks is done using public key cryptography techniques. This prevents messages from being intercepted or modified by a third party.

- Access controls: Access to each SWIFT member bank’s interface is controlled through credentials, certificates and permissions. This means only authorized bank staff can view or release payment orders.

- Monitoring: All network traffic flows and message patterns are constantly monitored by SWIFT to look for anomalies that could signal compromise or fraudulent activity.

- Authentication: Members are re-authenticated on a regular basis through security challenges. SWIFT also requires banks to undergo rigorous annual security audits.

- Infrastructure: SWIFT’s data centers and private networks are also based in secure facilities with advanced physical and environmental protections in place. Redundancy is also used to ensure uptime.

The result of its multi-layered defense has been that there has never been a security breach of SWIFT’s core infrastructure. Some high-profile hacks of individual banks have exposed SWIFT message details, but the underlying network has never been compromised.

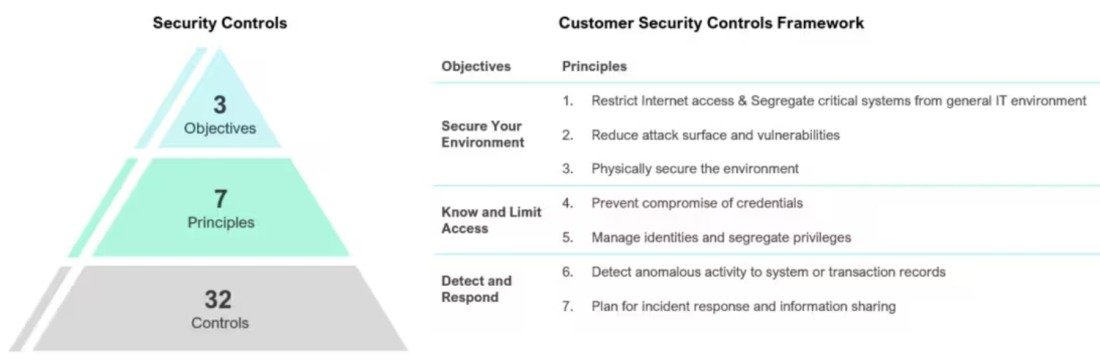

Image Source: SWIFT Website

SWIFT offers the gold standard when it comes to cross border payment security to financial institutions and their customers.

What are the Advantages of Using SWIFT for Cross-Border Payments?

For banks and corporations there are major advantages to using SWIFT rather than trying to develop proprietary international payment systems:

Advantages of Using SWIFT

- Reach: SWIFT’s network with its more than 11,000 members in over 200 countries means nearly every bank in the world can be reached through SWIFT. This extensive reach negates the need to partner with many other providers.

- Standardization: The common formats and identifiers ensure payments can be initiated and tracked in the same way no matter who the counterparties are. This simplifies reconciliation and exception processing.

- Speed: Well established payment rails and optimized routing mean same day or next day delivery is available to most countries. This improves liquidity management versus slower alternatives.

- Compliance: Tools and data provided by SWIFT also make it easier for its members to comply with various global regulations like sanctions, anti-money laundering and know-your-customer norms.

- Resilience: Geographic distribution and failover capabilities make SWIFT highly resistant to outages. This is critical for time sensitive payments.

- Cost: SWIFT’s transaction fees are reasonable and for many mid-sized and smaller firms are more cost effective than building custom integrations bank-to-bank.

Leveraging the pre-existing SWIFT plumbing allows companies and banks like The Kingdom Bank to focus on their core services rather than duplicating global payment rail infrastructure.

How Does SWIFT Connect Financial Institutions for Payments?

Behind the scenes, SWIFT has designed various robust technical and operational components to seamlessly connect its global membership base:

- Messaging interface: SWIFT certified software is installed by each member bank to securely send and receive payment messages at their premises. Standardized file formats and protocols are employed.

- Validation nodes: Messages first have to pass through SWIFT managed validating nodes before being able to enter the main network. Syntax, formatting and security are checked here.

- Private FIN network: Member to member communication only takes place over SWIFT’s private FIN network, which consists of redundant high-speed lines leased from telecom providers.

- Addressing routing database: SWIFT centrally manages an authoritative database which maps BICs and other details to routes for addressing and delivering messages to the right recipients.

- Data centers: Geographically distributed data processing centers house SWIFT’s servers and private network equipment. Advanced physical security and environmental controls are also employed.

- An optional service called Alliance Lite2 provides a standardized interface for banks’ core banking systems to integrate with SWIFT. It helps simplify development and ongoing message management.

Collectively, these components form a highly robust and resilient fabric which The Kingdom Bank and all SWIFT members can seamlessly plug into for their international payment requirements. Customization is also possible through optional connectivity services.

What Role Does SWIFT Play in Reducing Delays in Cross-Border Payments?

While real-time cross border payments are generally reliable and efficient, delays can occur due to intermediary bank failures, liquidity shortfalls, or incorrect information.

SWIFT is also working on initiatives to further streamline the end-to-end cross-border payment experience:

What SWIFT Is Doing to Reduce Delays

- Message delivery tracking: Real time status of messages within the SWIFT network can be tracked by members to help identify and resolve bottlenecks early.

- Same-day settlement: For most currency pairs between major economic zones, SWIFT now enables banks to commit to secure international transactions with same day value and availability of funds.

- Instant payments: Rich payment status updates and support for instant cross border payments between partner banks in selected corridors is provided by the SWIFT gpi service.

- Automation: Standards like SWIFT’s Network for the Automated Exchange of Information enable straight through processing and exception handling between banks without manual intervention.

- Transparency: Payment tracking and gpi initiatives also enhance transparency into fees and foreign exchange spreads applied across all intermediaries in a transaction chain.

All these developments being engineered by SWIFT aim to minimize delays and exceptions for international payments being initiated through the network.

These benefits can then be localized by financial institutions like The Kingdom Bank for their corporate and retail payment clients.

For those who regularly send and receive funds from outside the country, it is important to choose a financial partner like The Kingdom Bank which fully leverages SWIFT capabilities.

Not only will your cross-border payment experience be seamless but you will also gain access to SWIFT’s extensive global network, security safeguards and future innovations in the pipeline.

If you are looking for a digital banking platform to help you handle all of your corporate banking, international money transfer and cross border payment needs in a secure and efficient manner, look no further than The Kingdom Bank.

Contact one of our representatives today to learn more about our SWIFT-enabled solutions.

How Do Cross-Border Payments Differ When Processed via SWIFT Compared to Other Systems?

Cross-border payments are processed through SWIFT differently than domestic or regional payments due to several factors.

What SWIFT Is Doing to Reduce Delays

- Reachability – SWIFT messages can be sent to banks and financial institutions in virtually any country in the world because it is a global network. Domestic payment systems only work for financial institutions and banks operating in a particular country or region.

- Standardization – SWIFT requires the use of standardized message formats and protocols. This provides interoperability so payments can be processed consistently across institutions using their own internal systems.

- Processing Times – It often takes SWIFT transactions 1-4 business days to complete. Domestic transactions clear faster, often instantaneously or within 1 business day. SWIFT transactions involve coordination between multiple banks across time zones.

- Security & Compliance – SWIFT provides security standards like encryption and access controls, as well as screening against sanctions lists. It helps banks meet regulatory compliance obligations for anti-money laundering (AML), sanctions screening, and transaction reporting for cross-border payments.

- Fees – Banks typically pay a message fee to SWIFT for every message. Sending and receiving banks also charge their own fees. Currency conversion fees also apply when payment currencies differ. In total cross-border SWIFT transfers are more expensive than domestic options.

SWIFT provides global reach, standardization, security, and compliance oversight, but the process is slower and more expensive for cross-border payments compared to domestic equivalents.

What Fees are Involved When Using SWIFT for Cross-Border Payments?

A few key fees are typically involved when sending a cross-border payment using SWIFT:

- SWIFT Message Fees – SWIFT charges banks a small fee (usually a few cents) for each payment message sent across its network. This covers their operational costs.

- Bank Fees – Sending and receiving banks also charge fees. The sending bank usually charges a wire transfer fee of $15-25 to process the payment. The receiving bank may charge additional fees to credit the funds.

- Currency Conversion Fees – If the payment currency is different than the origin currency a bank charges currency conversion fees (1-3% of the transaction).

- Correspondent Bank Fees – For cross-border payments involving banks in multiple countries intermediary correspondent banks are used, which also charge their own fees for facilitating the transfers.

So in total you can expect to pay at least $30-50 in fees for an average international wire transfer sent through SWIFT. Fees can be reduced by using a digital cross border payment platform like The Kingdom Bank where possible.

How Does SWIFT Handle the Communication of Cross-Border Payments Between Banks?

SWIFT is a communication network for banks. It does not settle accounts. When cross-border payments need to be made SWIFT helps transmit payment instructions between banks.

Here are the basic steps involved.

- The sending bank originates a payment order using a standardized SWIFT message format, debiting the payer’s account for the transfer.

- SWIFT then securely sends this message to the receiving bank and any intermediary correspondent banks in the transfer route.

- Upon receiving the SWIFT message each bank in turn validates and processes the payment. Correspondent banks laterally pass the message from one to another.

- The receiving bank credits funds to the beneficiary’s account and sends a confirmation message back to the sending bank through SWIFT.

- Simultaneously SWIFT monitors all messages for error checking and security checks like sanctions screening.

- Finally actual funds are transferred between banks later over settlement systems like CHIPS (in the US) or TARGET2 (in Europe) to debit and credit accounts.

SWIFT is the critical communications layer that allows banks globally to securely coordinate cross-border payments while adhering to global messaging standards.

Is SWIFT the Most Widely Used Network for Cross-Border Payments?

SWIFT is by far the dominant cross-border payments network, but its position is being challenged by various competitors and alternative technologies:

- SWIFT facilitates around 40 million messages per day. The vast majority of cross-border bank transfers still run on SWIFT.

- Newer digital platforms like The Kingdom Bank have emerged and are gaining traction for consumer international money transfers due to their better user experience and lower fees compared to banks wires.

- Blockchain-based networks have the potential to completely replace SWIFT, as they will enable peer-to-peer cross-border transactions, but regulatory issues remain an obstacle.

- China, India, Russia, and other countries are developing their own domestic and cross-border payment systems to become less reliant on SWIFT, gain more control, and capture financial data flows.

- SWIFT itself is also not standing still, but improving its platform with initiatives like Global Payments Innovation (GPI) that provides richer payment information to enhance speed and tracking.

So while SWIFT remains the leader today, a wide range of challenges and new technologies are coming to compete with SWIFT in the cross-border space. It must continue innovating to stay relevant.

How Does SWIFT Help Ensure Compliance in Cross-Border Payments?

Compliance and oversight are critical roles for SWIFT, which has implemented various safeguards and features to help maintain legal and compliant business payments and international banking flows:

How SWIFT Ensures Compatibility

- Sanctions Screening – SWIFT payment messages are screened against international sanctions lists to prevent money from being transferred to prohibited individuals or entities.

- Suspicious Activity Monitoring – SWIFT actively monitors payment flows and message data for anomalous patterns or transactions that could indicate money laundering or other financial crimes, and shares this with authorities.

- Secure Authentication – Strict authentication is enforced using digital certificates and access controls to prevent unauthorized or fraudulent network access.

- Audit Trails – SWIFT maintains comprehensive audit trails of all message traffic which aids traceability and investigations by authorities.

- Compliance Training – It also hosts training workshops for its members to help them stay updated on latest anti-money laundering (AML) and counter-terrorism financing regulations.

- Collaborations – SWIFT also proactively engages with policymakers and law enforcement agencies in public-private partnerships to help further strengthen the financial system.

SWIFT plays an important gatekeeper role in ensuring cross-border payments are in compliance with global banking rules and international law. It is working to counter money laundering, terrorism financing, and other financial crimes.

SWIFT is the central nervous system for cross-border payments worldwide. While SWIFT’s position is being challenged by new players and technologies, SWIFT continues to enhance its own capabilities to remain relevant.

In most regions of the world for banks and corporations, SWIFT remains the central nervous system to enable the secure, traceable transmission of funds across borders, in compliance with global standards.

Platforms such as The Kingdom Bank complement SWIFT’s role, by offering the end users a better experience when doing digital cross border payments.

About The Author