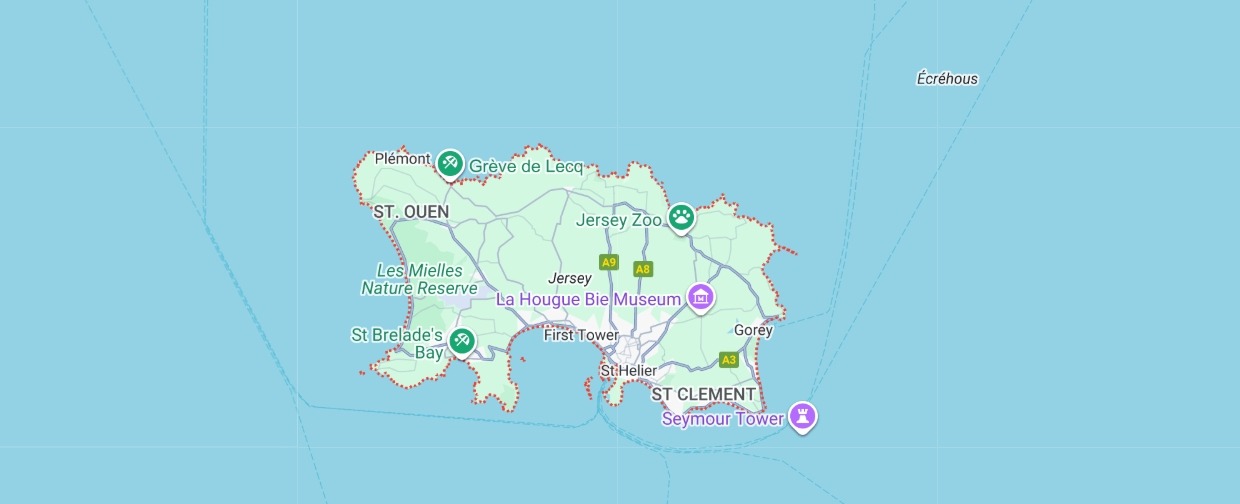

Opening an Offshore Bank Account in Jersey11 min read

Reading Time: 5 minutesJersey has long been popular as premier offshore bank account advantages. Online banks that operate in Jersey provide extensive banking services including offshore banking accounts.

TİP : Non-citizens living abroad also often find these accounts effective as a means to reduce taxes and currency conversion rates.

Jersey offshore bank accounts provide non-residents seeking to decrease taxes and profitable solutions, while also saving assets from political and economic events in their home country, and assisting avoid certain taxes such as wealth tax.

How to Do Offshore Banking in Jersey?

Jersey banks have a great track record when it comes to serving global investors, providing everything from multi-currency accounts and offshore accounts, to low-cost globally money transfers.

An invaluable service for both businesses and investors finding to save their assets from taxation.

When opening an offshore bank account, it’s key to consider both your jurisdiction’s requirements and those of the bank you choose.

Consider fees, services offered, minimum deposit requirements and digital access before opening one. Furthermore, meeting with tax obligations by reporting these accounts could result in serious fines and high costs.

Offshore banking accounts have become a great popular center among high-net-worth individuals, business owners, and non-citizens.

By keeping savings outside their country of origin and with higher interest rates than local accounts can provide, offshore accounts offer also better financial protection from local crises while making payments online from customers around the world.

How to Open an Offshore Bank Account in Jersey?

If you desire to open an offshore bank account in Jersey, there are countless options available to you.

Offshore accounts in Jersey tend to cater more towards high-net-worth individuals and come equipped with many advantages to assist handling wealth more productively as well as tax-efficient features, involving lower capital gains and legacy taxes.

Opening an offshore bank account in Jersey is relatively simple. Initially, you will need your passport, residence visa and identity paperwork.

The next stage should be submitting an application form and depositing funds. When approved you’ll be able to access your account remotely and make sure all tax laws are being adhered to.

You can reach a financial advisor or online banking service such as The Kingdom Bank as well to make sure everything runs properly. All processes are so practical from applying to manage transactions offered by The Kingdom Bank.

Offshore banking in Jersey is greatly popular among wealthy investors, businesses and investment funds. This account type offers personalized asset management opportunities at high minimum deposit requirements based on income levels or investment projects.

Opening an Offshore Bank Account in Jersey Requirements

Jersey accelerates its own financial sector and provides offshore banking alternatives for high-net-worth individuals who wish to manage assets across various currencies. Opening an offshore account in Jersey is a practical process and these accounts provide access to a full range of financial services.

Custodial and depositary banks in Jersey play a major role in safeguarding large financial assets for both individuals and companies.

Unlike traditional banks, custodian and depositary banks specialize in holding, protecting, and safeguarding these assets and providing competitive taxation rates while streamlining management procedures.

Offshore banks in Jersey have seen a popular interest among non-residents, expats, and foreign companies looking for stable third country offshore banking options.

To evaluate this special banking type, It is enough to submit your asked documentation related to identification paperwork.

Opening an Offshore Bank Account in Jersey Online

An offshore bank account in Jersey allows investors to keep and manage savings outside their nation of citizenship, which may be especially advantageous for non-citizens who do not live in Jersey and don’t desire the hassle of transactions physically.

Offshore banking also offers businesses with services not typically found within local banks, including multi-currency accounts and fast and secure foreign exchange services.

These features allow companies to manage global transactions more productively while simultaneously managing money internationally.

Jersey is home to countless top-tier banking institutions that provide offshore banking services for high net worth individuals and business, including offshore banks, wealth management firms, and investment projects.

Jersey’s free economic environment and advantageous tax rates make it a sought-after wealth management and offshore hub among investors around the world. Further strengthening Jersey’s standing as a global finance center.

Jersey provides businesses of all sectors the chance to open offshore accounts that offer low-cost SEPA transfers and deposit guarantees, as well as offering advantages like tax shelter.

Custodian banks generally offer these accounts, making them suitable for businesses that operate internationally or trade by using multiple currencies.

Can a Non Resident Open Offshore Bank Account in Jersey?

Jersey is an appropriate hub for non-residents seeking offshore banking solutions, as banks here have done away with any bad reputation figures to focus on offshore banking in Jersey.

Furthermore, they have adopted ESG investing and sustainable linked lending (SLL), assisting them become more competitive within the international finance arena.

⌈ TAX RATES : One benefit of offshore banking in Jersey is its efficient tax rates. No capital gains, transfer fees, VAT withholding tax or legacy tax applied on this island nation, enables Jersey an attractive center for high net-worth investors seeking specialized asset management accounts complete with direct communication with managers.

Non-residents, expats and people living an international lifestyle often find Jersey the ideal locations for conducting offshore banking accounts.

These jurisdictions master their needs for solid third-country banking that matches local bank providing as well as reasonable transfer costs thanks to SEPA membership which are two selling points that appeal particularly to businesses that rely on global payments.

Easiest Offshore Bank Account to Open in Jersey

Jersey’s economy thrives thanks to a number of elements.

First and foremost, it benefits from having a stable finance industry encompassing offshore banking, fund administration, asset management and trusts and companies and industries which make up a substantial proportion of Jersey’s workforce.

Jersey enjoys very low inflation levels, and the Jersey government takes measures to maintain this. It accelerates profitable tax rates which has attracted global business.

Being part of Britain offers some degree of political strength. Jersey’s ability to fastly adapt to changing ecosystems and regulations over time has contributed dramatically to its popularity as an international offshore banking hub.

If you desire to take advantage of offshore banking in Jersey, you can contact The Kingdom Bank now. We offer fast and secure offshore banking services for investors who wish to launch accounts in Jersey.

Thanks to online services offered by The Kingdom Bank, you can benefit from Jersey’s advantageous ecosystem remotely and online.

About The Author