How to Open an Offshore Banking Account in the Isle of Man?39 min read

Reading Time: 14 minutesThe Isle of Man operates as a leading offshore financial center which combines strong regulation with an environment that supports business operations.

♦ TİP : Individuals and corporations can benefit from numerous advantages provided by the self-governing British Crown dependency when they open an offshore banking account in the Isle of Man.

Our article will detail the process of offshore banking in the Isle of Man and explain its main advantages while describing how to open an account and highlighting residency requirements.

Important ⇒ Once you finish this guide you will be equipped with the necessary knowledge to establish an offshore banking account in the Isle of Man that meets your specific financial requirements and objectives.

The process of opening an offshore banking account in the Isle of Man can appear daunting to individuals who have no prior experience with it.

When you partner with a trusted offshore digital bank such as The Kingdom Bank and have access to proper information you can easily establish an international account outside your home country.

What is Offshore Banking in the Isle of Man and How Does It Work?

Offshore banking involves financial entities located in foreign jurisdictions known as offshore financial centers providing banking services to customers outside their home countries.

The Isle of Man maintains its own distinct legal and tax system for its offshore banking sector which differs from that of the UK.

The Isle of Man functions as a self-governing British Crown dependency which remains outside the UK and European Union borders. The Isle of Man keeps strong political and economic connections with the United Kingdom.

The Isle of Man exercises its constitutional independence to create separate regulatory systems and tax regimes without UK or EU influence.

The Kingdom Bank alongside other Isle of Man-based offshore banks focuses on serving clients who do not reside in the jurisdiction.

Our banking and investment portfolio includes private banking and corporate banking along with wealth management trust services and digital banking.

Bank accounts are available in significant currencies such as GBP, EUR, USD and customers can open and manage them from any location.

The Isle of Man offshore bank accounts operate under local banking laws and international anti-money laundering standards instead of the banking regulations of the account holder’s home country.

The Isle of Man does not impose taxes on the interest from deposits and investment income which results in substantial tax savings for non-resident account holders.

What are the Benefits of Opening an Offshore Banking Account in the Isle of Man?

The Isle of Man offers multiple important benefits which make it an appealing destination for establishing offshore banking accounts.

Benefits of offshore banking in the Isle of Man

1 – Political and Economic Stability

The Isle of Man maintains a consistent political environment as a self-governing British Crown dependency with its own legislative body while benefiting from UK defense and international relations support.

A stable business environment exists because of the Isle of Man’s low tax rates and its deeply-rooted English common law legal system.

2 – Strong Regulatory Standards

The Isle of Man Financial Services Authority maintains independent supervision over all offshore financial institutions on the island and ensures compliance with the highest global standards.

The entity serves as a member of the EU Code of Conduct Group on Business Taxation which promotes transparency in regulation.

3 – Banking Secrecy

The Isle of Man maintains banking confidentiality for account holders although it follows international anti-money laundering standards. The territorial separation from one’s home country ensures that financial transactions and data remain private from domestic tax authorities.

4 – Tax Benefits

Non-resident individuals and corporations enjoy tax-free interest earnings and investment profits from Isle of Man offshore bank accounts. Account holders can build wealth in a highly tax-efficient manner without having to pay domestic taxes.

5 – Ease of Use

The remote management of an Isle of Man offshore bank account through online platforms such as The Kingdom Bank provides a high level of convenience. Account holders can make global deposits and withdrawals in major currencies without restrictions.

6 – Asset Protection

The Isle of Man ensures account holder fund security through asset protection trusts that create legal barriers against potential lawsuits and claims.

How Can Individuals and Businesses Open an Offshore Banking Account in the Isle of Man?

To open an offshore bank account with a licensed Isle of Man financial institution requires completion of several basic steps.

The steps are as follows

1 – Select a Bank

Evaluate different offshore banks operating on the island including The Kingdom Bank to identify one which suits your requirements. When selecting a bank analyze account minimum requirements together with fees and available services and digital capabilities.

2 – Complete the Application

You can get the bank application form either through the internet or directly from the bank branch and complete it with identification documents together with information on your source of wealth and planned account activities.

3 – Submit Required Documentation

The standard Know Your Customer (KYC) documents needed are a valid passport or ID card together with proof of your address and proof of the source of your funds deposit. Banks sometimes need companies and trusts to provide supplementary documentation.

4 – Conduct Due Diligence

The bank will perform identity verification and source of wealth assessments along with anti-money laundering checks on the applicant which might require video call confirmations.

5 – Fund the Account

The account becomes fundable through wire transfer after approval with a minimum deposit requirement of $1000 to $5000 based on bank policies.

6 – Start Using the Account

Customers will receive an online login to make transactions and view statements from secure digital banking platforms when they use their accounts remotely. Additional services can also be utilized.

Opening an account typically requires 2-4 weeks because banks follow different review procedures. The Kingdom Bank takes pride in its efficient digital system which allows full online account creation within days.

What Documents are Required to Open an Offshore Banking Account in the Isle of Man?

Opening an offshore bank account in the Isle of Man requires standard Know Your Customer (KYC) documents such as:

- Valid Passport or National ID – The document serves to authenticate the applicant identity and must be presented as an original with at least 6 months remaining validity.

- Proof of Address – The applicant must provide a utility bill or bank statement or government letter from the past three months that displays their current residential address.

- Source of Funds Documentation – Documentation that outlines the transaction history and source of the original deposit amount. Documents for proof of funds can consist of bank statements as well as pay slips and investment contracts.

- Signed Application Form – The bank requires the account opening form to be signed according to the specimen signature found on the applicant’s identification documents.

Banks might require additional documentation from non-person applicants such as companies and partnerships.

- Certificate of Incorporation

- Memorandum and Articles of Association

- Trust Deed in the case of trusts

- Partnership Agreement

Documents in foreign languages must be submitted with notarized translations. Most Isle of Man offshore banks require basic KYC documents to start the account opening review process.

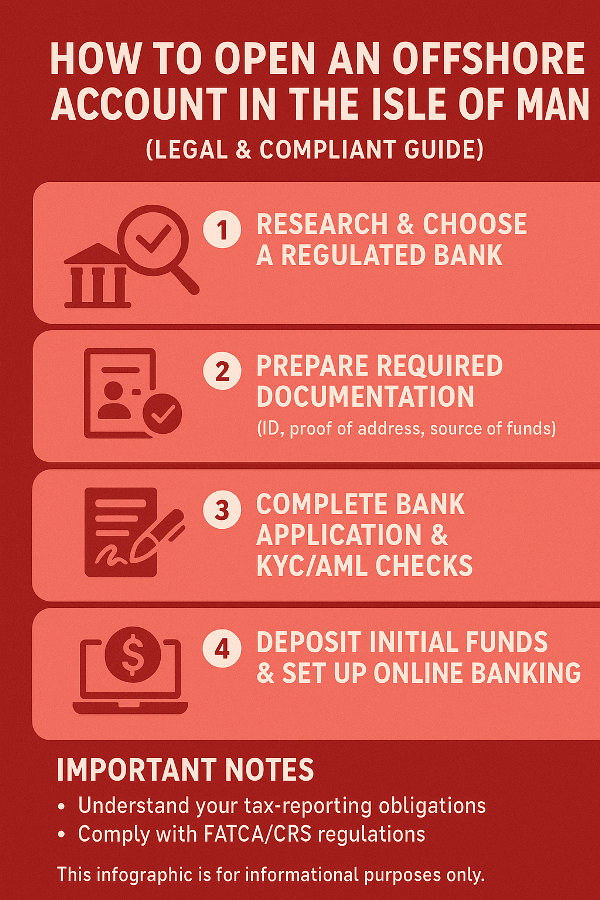

Let’s explain the whole process with an infographic ⇓

Can Non-Residents Open an Offshore Banking Account in the Isle of Man?

Opening an offshore bank account in the Isle of Man offers the significant benefit of remote account setup which allows account holders to bypass the need for physical presence or residency on the island.

The Kingdom Bank and other Isle of Man offshore banks allow non-resident individuals and entities from any location to open an account when they fulfill specific residency requirements.

- Tax residents of neither the Isle of Man nor the United Kingdom qualify for offshore banking accounts here. To meet residency criteria for opening an Isle of Man offshore bank account like one at The Kingdom Bank requires staying on the island for fewer than 183 days each tax year.

- FATCA regulations prevent US citizens or Green Card holders from opening accounts with this bank. US persons have additional reporting requirements.

- Present identification documents and KYC materials as previously discussed.

After approval, account holders can manage their accounts securely online via digital banking platforms without needing to travel to the Isle of Man. The account supports global transactions for depositing and withdrawing funds in major currencies.

The Isle of Man offshore banking provides non-residents with easy access to tax efficient accounts beyond their domestic tax and banking systems.

The Isle of Man stands as a leading offshore financial hub which combines an advanced banking sector with a strong regulatory framework designed to support business operations.

Establishing an offshore bank account through a licensed institution on the island such as The Kingdom Bank enables individuals and businesses to access exclusive benefits.

You can visit The Kingdom Bank website for information about our digital procedure to open an offshore bank account which meets your specific requirements. The client relationship manager will gladly respond to your questions and provide step-by-step guidance.

What is Offshore Banking in the Isle of Man and How Does It Work?

Offshore banking involves financial entities located in foreign jurisdictions known as offshore financial centers providing banking services to customers outside their home countries.

The Isle of Man maintains its own distinct legal and tax system for its offshore banking sector which differs from that of the UK.

The Isle of Man functions as a self-governing British Crown dependency which remains outside the UK and European Union borders. The Isle of Man keeps strong political and economic connections with the United Kingdom.

The Isle of Man exercises its constitutional independence to create separate regulatory systems and tax regimes without UK or EU influence.

The Kingdom Bank alongside other Isle of Man-based offshore banks focuses on serving clients who do not reside in the jurisdiction. Our banking and investment portfolio includes private banking and corporate banking along with wealth management trust services and digital banking.

Bank accounts are available in significant currencies such as GBP, EUR, USD and customers can open and manage them from any location.

The Isle of Man offshore bank accounts operate under local banking laws and international anti-money laundering standards instead of the banking regulations of the account holder’s home country.

The Isle of Man does not impose taxes on the interest from deposits and investment income which results in substantial tax savings for non-resident account holders.

What are the Benefits of Opening an Offshore Banking Account in the Isle of Man?

The Isle of Man offers multiple important benefits which make it an appealing destination for establishing offshore banking accounts.

Benefits of Opening an Offshore Banking Account in the Isle of Man

1 – Political and Economic Stability

The Isle of Man maintains a consistent political environment as a self-governing British Crown dependency with its own legislative body while benefiting from UK defense and international relations support.

A stable business environment exists because of the Isle of Man’s low tax rates and its deeply-rooted English common law legal system.

2 – Strong Regulatory Standards

The Isle of Man Financial Services Authority maintains independent supervision over all offshore financial institutions on the island and ensures compliance with the highest global standards.

The entity serves as a member of the EU Code of Conduct Group on Business Taxation which promotes transparency in regulation.

3 – Banking Secrecy

The Isle of Man maintains banking confidentiality for account holders although it follows international anti-money laundering standards.

The territorial separation from one’s home country ensures that financial transactions and data remain private from domestic tax authorities.

4 – Tax Benefits

Non-resident individuals and corporations enjoy tax-free interest earnings and investment profits from Isle of Man offshore bank accounts. Account holders can build wealth in a highly tax-efficient manner without having to pay domestic taxes.

5 – Ease of Use

The remote management of an Isle of Man offshore bank account through online platforms such as The Kingdom Bank provides a high level of convenience. Account holders can make global deposits and withdrawals in major currencies without restrictions.

6 – Asset Protection

The Isle of Man ensures account holder fund security through asset protection trusts that create legal barriers against potential lawsuits and claims.

How Can Individuals and Businesses Open an Offshore Banking Account in the Isle of Man?

To open an offshore bank account with a licensed Isle of Man financial institution requires completion of several basic steps.

- Select a Bank

Evaluate different offshore banks operating on the island including The Kingdom Bank to identify one which suits your requirements. When selecting a bank, analyze account minimum requirements together with fees and available services and digital capabilities.

- Complete the Application

You can get the bank application form either through the internet or directly from the bank branch and complete it with identification documents together with information on your source of wealth and planned account activities.

- Submit Required Documentation

The standard Know Your Customer (KYC) documents needed are a valid passport or ID card together with proof of your address and proof of the source of your funds deposit. Banks sometimes need companies and trusts to provide supplementary documentation.

- Conduct Due Diligence

The bank will perform identity verification and source of wealth assessments along with anti-money laundering checks on the applicant which might require video call confirmations.

- Fund the Account

The account becomes fundable through wire transfer after approval with a minimum deposit requirement of $1000 to $5000 based on bank policies.

- Start Using the Account

Customers will receive an online login to make transactions and view statements from secure digital banking platforms when they use their accounts remotely. Additional services can also be utilized.

Opening an account typically requires 2-4 weeks because banks follow different review procedures.

The Kingdom Bank takes pride in its efficient digital system which allows full online account creation within days.

What Documents are Required to Open an Offshore Banking Account in the Isle of Man?

Opening an offshore bank account in the Isle of Man requires standard Know Your Customer (KYC) documents such as:

- Valid Passport or National ID – The document serves to authenticate the applicant identity and must be presented as an original with at least 6 months remaining validity.

- Proof of Address – The applicant must provide a utility bill or bank statement or government letter from the past three months that displays their current residential address.

- Source of Funds Documentation – Documentation that outlines the transaction history and source of the original deposit amount. Documents for proof of funds can consist of bank statements as well as pay slips and investment contracts.

- Signed Application Form – The bank requires the account opening form to be signed according to the specimen signature found on the applicant’s identification documents.

Banks might require additional documentation from non-person applicants such as companies and partnerships.

- Certificate of Incorporation

- Memorandum and Articles of Association

- Trust Deed in the case of trusts

- Partnership Agreement

Documents in foreign languages must be submitted with notarized translations.

Most Isle of Man offshore banks require basic KYC documents to start the account opening review process.

Can Non-Residents Open an Offshore Banking Account in the Isle of Man?

Opening an offshore bank account in the Isle of Man offers the significant benefit of remote account setup which allows account holders to bypass the need for physical presence or residency on the island.

The Kingdom Bank and other Isle of Man offshore banks allow non-resident individuals and entities from any location to open an account when they fulfill specific residency requirements.

- Tax residents of neither the Isle of Man nor the United Kingdom qualify for offshore banking accounts here. To meet residency criteria for opening an Isle of Man offshore bank account like one at The Kingdom Bank requires staying on the island for fewer than 183 days each tax year.

- FATCA regulations prevent US citizens or Green Card holders from opening accounts with this bank. US persons have additional reporting requirements.

- Present identification documents and KYC materials as previously discussed.

After approval, account holders can manage their accounts securely online via digital banking platforms without needing to travel to the Isle of Man. The account supports global transactions for depositing and withdrawing funds in major currencies.

The Isle of Man offshore banking provides non-residents with easy access to tax efficient accounts beyond their domestic tax and banking systems.

The Isle of Man stands as a leading offshore financial hub which combines an advanced banking sector with a strong regulatory framework designed to support business operations.

Establishing an offshore bank account through a licensed institution on the island such as The Kingdom Bank enables individuals and businesses to access exclusive benefits.

You can visit The Kingdom Bank website for information about our digital procedure to open an offshore bank account which meets your specific requirements.

The client relationship manager will gladly respond to your questions and provide step-by-step guidance.

What Types of Offshore Banking Accounts are Available in the Isle of Man?

Several types of offshore banking accounts exist in the Isle of Man which you can choose based on your individual requirements.

The following list includes the most popular account options available to customers.

Personal Banking Accounts

Individuals can choose from multiple personal banking account types which serve single account holders. Standard savings accounts provide the flexibility to add and remove money whenever necessary along with interest earning potential. Checking accounts operate like standard accounts but they provide additional functionality for writing checks and processing direct debits. Certain offshore banks provide premium personal accounts that offer higher interest rates alongside reduced fees.

Joint Banking Accounts

Two or more parties can access and control a single account together through joint accounts. Joint banking accounts provide a convenient solution for family members or business partners to manage their finances together. Both savings and checking options exist for joint accounts just as they do for personal accounts. Ensure every party comprehends the account terms along with ownership structures.

Business Banking Accounts

Business banking accounts in the Isle of Man serve commercial clients regardless of their company size from sole proprietorships to international corporations. Business banking accounts feature business checking and savings options as well as cash management tools and payment processing features. The verification of your business identity requires proper documentation of incorporation.

The account choices provided by established digital banks such as The Kingdom Bank enable you to locate an offshore banking structure which meets your particular requirements.

Personal service representatives have the expertise to guide you through selecting the account that will best meet your specific requirements.

How Do Offshore Banking Regulations in the Isle of Man Ensure Security and Privacy?

The Isle of Man functions as an independent jurisdiction that has implemented a financial regulatory framework which establishes rules and standards ensuring offshore banking clients experience strong privacy and security protections. These main methods show how Isle of Man regulations protect your account security.

Bank Licensing and Oversight

The Isle of Man Financial Services Authority (IOMFSA) requires all operating banks on the Isle of Man including digital offshore banks like The Kingdom Bank to obtain proper licensing. Periodic audits and other prudential oversight measures as well as capital requirements apply to these institutions. Only reputable, law-abiding institutions are granted licenses.

Data Privacy Laws

The Isle of Man has implemented powerful data protection laws that align with European norms. Financial institutions cannot disclose personal information or account data without your permission unless they suspect illegal activity. Robust cybersecurity practices are also mandated.

Bank Secrecy Act

The Isle of Man Bank Secrecy Act of 1982 which was developed from Swiss banking practices requires banks to maintain client confidentiality and forbids them from sharing private financial details with foreign governments unless a court has issued an order. Bank customers receive exceptional protection for their financial information.

Lack of Automatic Information Exchange

The Isle of Man stands apart from other offshore financial centers as it has not committed to multilateral agreements for automatic data sharing with foreign tax authorities. The exchange of information happens exclusively in cases where tax evasion is suspected following a thorough review process which maintains your privacy.

When you select a licensed and well-established offshore bank such as The Kingdom Bank which follows Isle of Man’s robust regulatory standards you secure your assets and personal information from unauthorized access and disclosure.

What are the Costs Associated with Maintaining an Offshore Banking Account in the Isle of Man?

Offshore banking accounts offer substantial advantages but require consideration of ongoing financial costs.

The Kingdom Bank and similar reputable digital offshore banks maintain low and transparent costs for their customers. Evaluating the fee structures in advance helps identify the best total value option. To minimize or eliminate specific service fees you can maintain higher account balances or increase account activity.

How Does Currency Exchange Work with Offshore Banking Accounts in the Isle of Man?

Your international offshore account will probably require currency exchanges throughout your deposit and withdrawal activities or during money transfers.

The Kingdom Bank among other reputable Isle of Man banks provides convenient currency exchange services which avoid imposing heavy fees.

Here’s a typical currency exchange process:

- Banks provide daily “spot” exchange rates which reflect their connection to worldwide monetary markets. Rates fluctuate constantly based on supply/demand.

- The bank uses its own exchange rate to convert deposits in non-account currencies when received before crediting the equivalent domestic amount.

- Banks execute fund conversions at current rates during withdrawal or transfer processes to mitigate exchange rate risk.

- Banks typically provide exchange rates that match competitive market rates for direct transactions. Banks usually add a margin ranging from 0.5% to 2.5% to interbank rates when processing currency exchanges.

- Preferential rates might be available for big transactions when negotiated beforehand. Banks provide expedited payment solutions including same-day and multi-currency transactions.

Your offshore bank provides seamless currency conversion services that enable effective management of international assets minus third-party charges.

The value of your investments can be affected by fluctuations in exchange rates.

Are There Tax Advantages to Opening an Offshore Banking Account in the Isle of Man?

Opening an offshore banking account in the Isle of Man may offer some tax advantages when compared to domestic onshore accounts although individual tax circumstances differ.

- The Isle of Man provides tax-free growth opportunities for traded assets like stocks because it does not levy capital gains tax on investment profits.

- Companies enjoy a low corporate tax rate in which they pay no tax on the initial £300,000 of yearly profits and between 10-20% on surplus profits based on their business activities.

- The Isle of Man does not levy inheritance, estate, or wealth taxes which would decrease the value of assets transferred between generations.

- The Isle of Man remains a non-EU jurisdiction and therefore does not supply foreign account details to the majority of countries under existing regulations.

- Investors can use Isle of Man accounts and trust or holding company structures to spread asset ownership across multiple tax jurisdictions.

Residents are required to pay taxes in their home country on income earned globally. Through collaboration with a tax advisor offshore structures demonstrate their potential to reduce tax liabilities on specific incomes and assets throughout time. Always follow relevant laws and disclosure requirements.

The Isle of Man attracts businesses to establish offshore accounts through its solid regulatory system together with its appealing banking environment.

With knowledge of available account types and costs at a reputable digital offshore bank such as The Kingdom Bank individuals and businesses can access financial privacy and flexibility through international banking options.

Please reach out to an account representative whenever you need further assistance. Professional representatives provide seamless support from application to funding enabling you to fully utilize the Isle of Man’s offshore financial center benefits.

About The Author