What are the Best Platforms for International Business Payments?21 min read

Reading Time: 8 minutesWe will discuss the best platforms for international business payments. Businesses operating globally have a greater need for international payment tools than those serving local regions.

Today, not only traditional banks but also digital finance platforms offer online international business payments suitable for these types of business models.

Pro Tip ↵ International banking requires a sophisticated digital infrastructure. Therefore, businesses should expect the infrastructure of the platform they choose to manage their financial needs to be compatible with the dynamics of international business banking.

In this banking model, cross-border transactions are managed with low transaction fees. Simultaneous transactions in different currencies are possible. Businesses should generally be able to view their transaction history through an easy-to-use dashboard.

These types of financial services significantly increase operational efficiency and can help them stand out in the highly competitive markets of the future.

Summary Information ↵ With the rise of digitalization, businesses in every sector, not just in e-commerce, need tools like international payments more. The corporate banking accounts offered by traditional banking providers are insufficient for cross-border transactions.

International banking services in traditional banking ecosystems are plagued by high transaction fees and limitations. Therefore, both SMEs and global businesses are turning to online banking platforms to meet their needs, such as international payments.

The primary reason for this is cost-efficiency. When choosing a platform for your business, you should prioritize options with a reliable ecosystem and advanced digital infrastructure.

Fintech companies are competing fiercely to offer the best products and services in international business banking.

Online business banking platforms that follow these innovative developments and integrate them into their services reach more customers.

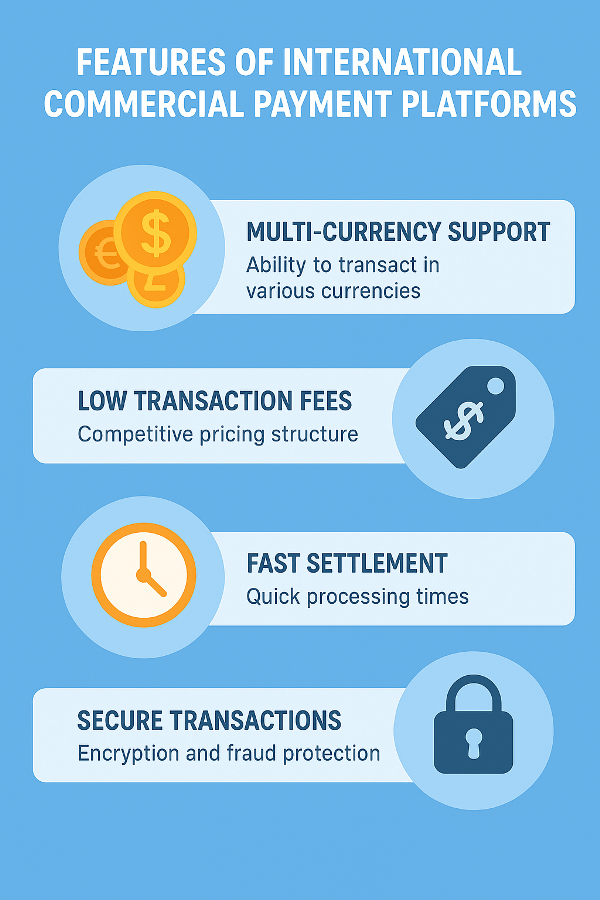

The features required for the platform on which we will manage international business payments can be summarized as follows:

Features of International Commercial Payment Platforms

- Advanced digital infrastructure

- Ecosystem compatible with security protocols

- Low transaction fees

- Transparent exchange rate policies

- 24/7 live customer support

Let’s show this as an infographic ⇓

Platforms that offer these features in a digital environment will be preferred by businesses and perhaps even take a step forward in competition with traditional banking actors.

What Makes a Platform Reliable for International Business Payments?

In today’s environment, businesses have certain expectations for a platform to be considered trustworthy and reputable. The most important of these are transaction speed, transaction fees, and regulatory compliance.

Furthermore, compliance with international security protocols is also a sought-after feature. When a global business opens an international business banking account, they expect strong connections to the SWIFT network.

This makes cross-border payments easier to manage. Furthermore, international payments managed through traditional banking accounts were subject to time and amount limitations.

However, thanks to the online business payment process offered by digital finance solutions, access to transparent pricing policies has become easier.

Let’s explain this title infographicly ⇓

Businesses can receive payments and transfer assets to suppliers from anywhere in the world with corporate banking services.

Both small businesses and large global enterprises should adapt and update their financial processes to integrate with digital business banking tools.

This will increase operational efficiency in all international payments, regardless of the frequency or size of your transactions.

For a platform where international business payment services can be received to be considered reliable, it must offer the following factors:

Factors are as follows

- Compatibility with international security protocols

- Advanced encryption tools

- Multi-factor authentication methods

- Commission and exchange rate charges should be transparent

- Payment times should be short

- Offering global transaction accessibility

- Implementing anti-money laundering protocols such as AML

- Ability to conduct transactions with multiple currencies simultaneously

- Integrated or be compatible with ERPs or popular e-commerce platforms

- Offering 24/7 accessible customer support

How Secure are Leading Platforms for International Business Payments?

One of the areas that online business banking platforms like The Kingdom Bank strive to maintain is ecosystem security.

Reliable international banking platforms that operate in compliance with international security protocols such as KYC and AML maintain the security of both users and the ecosystem through numerous methods.

Tip ↵ Numerous fintech applications, especially in recent years, have been working in this area. Common methods include advanced encryption tools, multi-factor authentication, biometric verification, and security software.

Additionally, it’s important to choose platforms with a positive reputation in the market. If you want to experience the most secure online business banking account for your business, you should consider these factors.

Although digital financial tools have accelerated international payment processes, we must not overlook the existence of cybersecurity threats.

To address these potential security risks, businesses should seek services from reputable and reliable platforms and consider advanced encryption tools and multi-factor authentication methods.

Do Fintech Platforms Outperform Banks in International Business Payments?

Fintech companies aim to transform financial technologies into innovative products or services. In recent years, many fintech applications have been launched that provide various efficiencies in international payments.

One of the most critical advantages of these applications is that they offer much faster and more flexible payment processes compared to traditional corporate bank accounts.

In the corporate payments process, businesses demand low transaction fees, fast processing times, and a flexible working ecosystem.

Furthermore, transparent exchange rate policies are important for businesses that make frequent payments. Therefore, both SMEs and global businesses are pursuing fintech solutions to manage their financial needs most efficiently.

Digital banking platforms, such as The Kingdom Bank, offer integrated fintech application tools, with advanced security networks and infrastructure. International business payments processes can create significant costs for businesses if not managed through a digital banking platform with advanced digital infrastructure.

Therefore, participants from every sector have been interested in digital financial services providers that keep up with developments in fintech and continuously update their tools in recent years.

When managing these payments using traditional methods, there’s a high probability of encountering issues like only being able to process transactions during business hours, facing transaction fees, and being subject to payment amount limitations.

Therefore, businesses are seeking faster and more affordable ways to meet these needs through a mobile app.

Can Multi-Currency Accounts Improve International Business Payments?

Businesses offering global services or products can achieve greater flexibility thanks to a multi-currency business banking account, which allows them to transact in different currencies simultaneously.

Utilizing these accounts, they gain the opportunity to manage fast payment processes with both customers and suppliers.

The multi-currency banking offered by digital banking, especially in addition to solutions like B2B banking or B2B payments, also eliminates exchange rate conversion costs.

Tip ↵ Having a bank account that allows a business to conduct financial transactions in different currencies, such as USD, EURO, and GBP, not only makes it easier to explore global investment opportunities but also ensures sustainable commercial interactions with customers or suppliers around the world.

Thanks to a multi-currency business banking account, your customers have the flexibility to pay in local currencies, and with this flexibility, you can reach potential customers from different parts of the world and increase your financial profitability more easily.

No matter your sector, you can explore the “best business banking payment method” options by visiting The Kingdom Bank now.

How Do Payoneer and Wise Compare for International Business Payments?

Today, many different financial institutions and fintech companies offer various international business payment tools. Payoneer and Wise are the most popular. However, the tools these popular platforms offer for businesses can be limited.

Individuals working on digital platforms as freelancers typically receive their payments through these platforms. However, The Kingdom Bank, which offers a more professional approach for businesses, may also be a good choice.

If you’d like to manage your business’s corporate payments processes flexibly and quickly, without any restrictions or high transaction fees or commissions, don’t hesitate to contact us now.

What Role Does Blockchain Play in International Business Payments Today?

Blockchain, one of the technologies that has brought about the most significant changes in the financial world in recent years, has radically revolutionized the way data is recorded and processed. The advantages of this technology are also being utilized by traditional financial institutions.

It has become possible to achieve maximum speed and security in international payments managed with blockchain technology. International asset transfers using traditional business banking tools must be conducted within business hours and in limited quantities.

However, payments made with blockchain technologies and digital asset classes can be completed in seconds. Moreover, this fast transaction infrastructure does not create problems for businesses in terms of commissions and transaction fees.

Thanks to blockchain networks, which are an example of decentralized finance, all transactions are recorded transparently. By their nature, all transactions are transparently viewable by other participants, creating a much more secure ecosystem compared to traditional banking.

Businesses seeking to make both fast and secure international business payments should explore platforms like The Kingdom Bank that integrate with blockchain tools. These platforms can meet your business’s financial needs through cryptocurrencies like Bitcoin, in addition to fiat currencies.

Which Platforms Simplify Compliance for International Business Payments?

In today’s markets, combating cybersecurity threats at a high level and complying with international security protocols are very important areas of work. Many platforms offer international business payment services that reduce compliance issues for businesses.

These platforms adhere to security protocols and standards, minimizing security risks within the ecosystem and thus simplify compliance for corporate payments.

Thanks to procedures such as AML and KYC, a business must digitally submit official documents, such as income statements, to an online banking platform before registering. Before opening an online business account, the platform conducts security checks on these documents to ensure compliance with various security protocols and regulations.

Following this security check, companies now have access to solutions like online corporate payment systems.

Are There Platforms Tailored for Freelancers’ International Business Payments?

Today, digital app markets offer thousands of mobile apps offering international business payment tools. Some are specifically designed for freelancers. Freelancers typically handle job postings from around the world through a platform.

If the gig is successfully delivered, the employer sends the progress payment through the platform’s payment infrastructure. Many platforms are developing digital payment tools to optimize these processes. One of the most reliable among them is The Kingdom Bank.

Thanks to our advanced digital banking infrastructure, you can manage your payments digitally and conveniently, whether as an employer or a freelancer. This allows you to access significantly lower transaction fees, transparent currency conversion fees, and faster transaction options compared to traditional banking.

Since many business models will be managed entirely digitally in the future, applications developed specifically for freelancers may be preferred by individuals or businesses from every profession.

Additionally, you may be able to explore various international business banking solutions such as B2C payments.

How Do Traditional Banks Compete with Digital Platforms in International Business Payments?

Although we live in an era where digital banking is widespread, traditional banks still account for a significant portion of transaction volume. However, the services they offer in international business banking can be inadequate.

If a business manages its business operations with customers or suppliers using traditional banking solutions or corporate payments processes, it faces limitations such as time and volume. Businesses in sectors like e-commerce frequently engage in cross-border transactions, leading them to search for the most efficient online business payments solutions.

However, due to their perceived reliability, large global businesses still manage a significant portion of their financial needs through traditional banking accounts. In recent years, due to the operational efficiency advantages offered by digital banking, many businesses have implemented a hybrid model by opening online business accounts.

Unfortunately, traditional banking institutions are no longer able to compete with digital banking platforms in international payments.

The main reasons why traditional banks lag behind in the competition with online banking solutions can be listed as follows:

- Time restrictions, such as being able to perform transactions during business hours

- High transaction fees

- Insufficient multi-currency support

- Insufficient infrastructure for integrations

- Lack of scalability tools

- Delay in introducing current innovations and innovative tools

What are the Most Scalable Platforms for Growing International Business Payments?

Businesses often prefer scalable financial platforms to analyze their performance and general accounting. The Kingdom Bank, one of these scalable platforms, offers the opportunity to periodically monitor and analyze business performance through its dashboards.

In today’s environment, businesses are managed by a structure that constantly questions their market power by creating analyses and strategies based entirely on data. In addition, they also choose the most financially efficient methods and tools.

Financial instruments that combine these two approaches are generally scalable digital banking applications.

Tracking and recording business transactions is crucial, especially for businesses in the growth phase. If businesses use traditional solutions instead of online corporate payment systems, transaction analysis and performance testing are managed manually.

This isn’t good for operational efficiency. If you’d like to access scalable international business payment solutions for your business and best business banking payment methods, visit our website The Kingdom Bank now and gain the flexibility, speed, and digital financial power of your business.

About The Author