Best Cryptocurrencies Accepted for Crypto Payments in 202622 min read

Reading Time: 9 minutesThis article was created to inform you about the best cryptocurrencies accepted for crypto payments in 2026. In recent years, various cryptocurrencies have become more frequently used in payments managed through various platforms.

For example ↵ Bitcoin, Ethereum, and Litecoin are popular, while BCH and XRP are also accepted by many platforms. Stablecoins have also been increasingly used in crypto payments in recent years.

Unlike other cryptocurrencies, stablecoins carry the same value as fiat currencies like USD or EURO, with common examples such as USDT and USDC.

Just like credit cards, payments with cryptocurrencies will be possible on many platforms in the future.

Businesses across many sectors are using crypto banking services to update their financial infrastructure to be compatible with digital asset classes. To this end, businesses often open crypto accounts, just as they do with individual accounts.

Through these accounts, they can receive payments from their customers in cryptocurrencies. While there are numerous cryptocurrency exchanges, it is crucial to manage this conversion process through a reputable institution like The Kingdom Bank.

While an infrastructure transformation that can accept payments with cryptocurrencies can be confusing for businesses in terms of adaptation and cost, its impact on operational efficiency in the long run is huge.

Cryptocurrency Payments in 2026

Interest in payments with cryptocurrencies is increasing in 2026. Price increases in some cryptocurrencies and profitable positions in leveraged transactions have rekindled interest in these digital asset classes, just as they did during their peak period.

Businesses are preparing their infrastructure for a transformation to accept payments for their products or services in various cryptocurrencies through crypto payment systems.

Quick Note ↵ Among the benefits of crypto payments, the most critical advantage for businesses is the ability to manage payments quickly and with low transaction costs.

This feature makes it a suitable and accurate financial instrument not only for large global enterprises but also for small businesses.

When examining crypto payment transactions on online platforms today, in addition to popular cryptocurrencies like BTC, ETH, and LTC, stablecoins like USDT, which are considered stable and secure asset classes, are frequently used.

Businesses can accept payments in different cryptocurrencies depending on the compatibility services offered by their partner crypto payment gateway providers.

Accepting payments in a wide range of cryptocurrencies can be a significant advantage in reaching more customers.

Many businesses from different sectors and at different scales have started working on the how to set up crypto payments for your business process as of 2026.

What Are the Most Popular Cryptocurrencies in 2026?

As of the end of 2026, the cryptocurrencies most frequently used for payment transactions across various platforms can be listed as follows:

Most Popular Cryptocurrencies in 2026

- Bitcoin

- Ethereum

- Tether (also known as USDT)

- USD Coin

- Litecoin

These cryptocurrencies are common and highly liquid asset classes within the traditional financial ecosystem, such as EUR, GBP, and USD. While cryptocurrencies carry a higher volatility risk compared to fiat currencies, they are much less volatile.

Due to this structure, they are frequently used by both customers and businesses in crypto payments. In the best crypto payment gateways for small businesses section.

Important Reminder ↵ It should be noted that cryptocurrencies, as digital asset classes, can be suitable not only for large companies operating globally but also for SMEs, providing a variety of payment methods.

Changing and converting traditional payment methods to accept crypto payments for small businesses may seem costly at first glance.

However, one of the most significant benefits digital assets offer businesses is reducing transaction costs, which can alleviate cost concerns for small businesses in the medium term.

Therefore, even if you’re a small business, having the infrastructure to accept cryptocurrency payments in future markets may help you stay small no longer.

How Does Bitcoin Perform in Crypto Payments in 2026?

Bitcoin remains the most frequently used asset class for transactions such as cryptocurrency payments for a long time.

As the solutions and tools offered by crypto payments technology evolve daily, various cryptocurrencies, like Bitcoin, continue to evolve into secure investment models with strong backgrounds and investments that are both liquid and have low volatility risks.

However, when examining payment transactions on crypto payment platforms operating globally across various sectors, it becomes clear that Bitcoin is the most frequently used digital asset class.

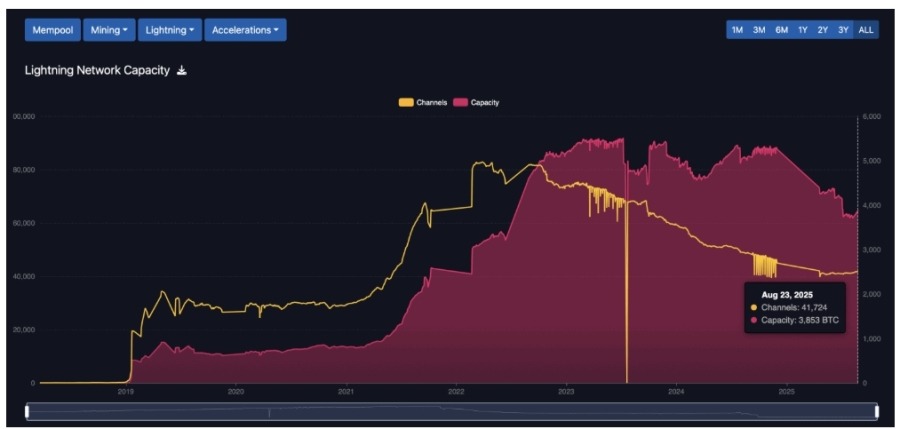

The Bitcoin Lightning Network — a second layer for fast, very low-fee payments — has seen real growth in usage and infrastructure through 2024–2025 and is expected to keep growing into 2026.

It supports near-instant settlement and “scan-to-pay” apps, making BTC usable in retail and everyday spending scenarios. We can see this clearly in the image below.

Image reference ↑ Bitcoin.com News and coinlaw

In 2025, Bitcoin continued to claim around ~40%+ of all crypto merchant payment volume globally, according to payments industry data — stronger than other crypto — though stablecoins (e.g., USDT/USDC) are commonly used for payments because of price stability.

If you need guidance on how to accept crypto payments for business, you can take your first steps toward digital asset classes now through The Kingdom Bank.

Is Ethereum Widely Accepted for Crypto Payments in 2026?

Ethereum, or ETH for short, listed on crypto exchanges, is one of the most popular cryptocurrencies in recent years. While Bitcoin experiences periodic economic cycles of ups and downs, Ethereum may be a safer investment model.

Due to the reputable and established investment projects behind Ethereum, it has become one of the safest investment models of recent years.

ETH continues to be one of the best solutions for investors and businesses seeking a good and secure alternative to Bitcoin.

Research Result ↵ In recent years, we have seen examples of crypto payments for online stores in many different sectors, such as e-commerce. An examination of these transactions reveals that 20% of transactions are made using ETH. Research results on cryptocurrency payments in 2025 clearly demonstrate this.

It is foreseeable that investments and payments managed through ETH will become even more common in the near future.

Quick Reminder ↵ If you want to have the necessary infrastructure to receive payments with Ethereum for your business, choose The Kingdom Bank, one of the most secure platforms in the 2026 markets.

With a digital wallet you can open in minutes, you can receive cross-border payments from customers around the world in seconds.

What Role Does Litecoin Play in Crypto Payments?

Litecoin should definitely be included among the crypto payments trends 2026. Due to investment efforts in recent years, the LTC project has gained significant recognition and liquidity within the market.

Therefore, businesses are managing the digital transformation process to securely accept payments in LTC. The biggest advantage of this cryptocurrency compared to others is its low transaction costs in terms of crypto payments fees.

Litecoin is also widely used on many crypto banking platforms and crypto payment gateway providers today.

During the crypto payments integration process, it’s important to collaborate with a platform that can accept payments not only in BTC but also in other cryptocurrencies like Litecoin.

This allows you to reach potential customers with different digital wallets. Including LTC among payment methods can also be considered a positive element for your corporate identity. 1 LTC is worth approximately $100 on current crypto exchanges.

Because this value is much lower than BTC, it can also be considered for long-term investments. In addition, it can be a good financial instrument choice for secure crypto payments processes due to its low volatility risk.

Are Stablecoins Commonly Used for Crypto Payments in 2026?

Stablecoins are one of the most advantageous digital asset classes in the step-by-step guide to accepting crypto payments. These digital asset classes are cryptocurrencies with a fixed price. Their prices are held at the same value as common fiat currencies like USD or EURO.

They are highly suitable financial instruments for long-term investments or business payments. The most common are Tether (USDT) and USD Coin (USDC). These stablecoins have the same value as 1 USD.

This cryptocurrency allows investors to make long-term plans, while businesses can manage their crypto payments for businesses without any risk of volatility.

If you desire to integrate with these innovative payment tools, regardless of the size of your business or the sector you operate in, you can securely access the best crypto payments solution digitally by contacting The Kingdom Bank now.

How Is Ripple (XRP) Used in Crypto Payments?

Ripple is one of the most traded cryptocurrencies on various cryptocurrency exchanges today. Listed on exchanges as XRP, this cryptocurrency was once quite popular, and its low price made it a popular choice for portfolios for crypto investors of all skill levels.

With the support of research and investment projects in recent years, XRP has become a digital asset class used by businesses to meet their financial needs. Today, by using crypto banking services, many businesses aim to gain the financial infrastructure to accept crypto payments with XRP.

Cryptocurrencies are on a major trend, having regained their popularity in 2026. The vast majority of businesses of all sizes have embarked on a digital transformation for their payment infrastructure, and the number of investments in this area is increasing daily.

Due to its tailored-price during its launch, many people used XRP in their portfolios or digital wallets as a long-term investment model, anticipating an upward trend.

Can DeFi Tokens Be Used for Crypto Payments?

In theory, DeFi (Decentralized Finance) tokens can also be accepted in crypto payments. However, it’s important to remember that they are not a widely used financial instrument.

In the near future, businesses across various sectors will also accept payments with this asset class.

Uniswap (UNI), Aave (AAVE), and Chainlink (LINK), some of the most popular tokens in recent years, are frequently used in crypto banking ecosystems for payment processes.

However, online platforms or businesses have not yet completed the integration process that allows them to accept payments directly with these tokens.

If you want to keep up with modern financial trends for your business and accept payments with these DeFi tokens, you can contact The Kingdom Bank.

Because DeFi tokens are a rapidly evolving field, they will be considered a viable and popular asset type in the future.

Businesses that integrate with these innovative asset classes today and successfully manage the adoption process with these new payment methods can gain a competitive advantage.

Using common examples like Bitcoin or Ethereum as an initial step in the crypto payments integration process is recommended.

Focusing on cryptocurrencies that customers already own and are familiar with can be a good indicator of business profitability.

What Advantages Do Privacy Coins Offer in Crypto Payments?

Privacy coins, one of the lesser-known cryptocurrencies, are essentially an asset model that allows both senders and receivers to benefit from anonymity.

When you transact with these cryptocurrencies, you can take advantage of the privacy opportunity, also known as crypto payments benefits.

Common examples include XMR and ZEC. In these types of transactions, businesses and investors maintain a high level of privacy.

In recent years, it has become considered the right cryptocurrency for those seeking secure crypto payments.

The opportunities offered by Privacy Coins can be listed as follows:

- Anonymity opportunity

- Highly secure ecosystem

- Privacy transactions

- Tax advantages

If you want to open a crypto account in compliance with global financial regulations, you can manage the process under high privacy conditions through The Kingdom Bank right now.

To become a member of an ecosystem like Privacy Coins, where your privacy and data are protected with high privacy conditions, an online application may be sufficient.

How Fast Are Crypto Payments with Popular Cryptocurrencies?

Popular cryptocurrencies offer the advantage of higher liquidity because they have more advanced infrastructure and financial backgrounds. This allows transactions managed with popular cryptocurrencies to proceed faster.

In recent years, it has been known that transactions made with cryptocurrencies like LTC or XRP on online platforms that use crypto payments are confirmed within seconds.

However, payments managed with lesser-known cryptocurrencies that lack high liquidity require a certain waiting period for the transaction to be confirmed.

While many businesses from different sectors are interested in these digital payment solutions, they will be most frequently used in e-commerce in 2026, as part of the advantages of using crypto payments in e-commerce.

The support behind a cryptocurrency, such as public relations and investment, is one of the fundamental factors that contribute to its market strength.

Are New Cryptocurrencies Emerging for Crypto Payments in 2026?

Yes, new cryptocurrency projects are launched every day. Launched digital asset classes achieve an average value based on the supply-demand balance among market participants.

Cryptocurrencies that can be considered relatively new in recent years include SOL and AVAX.

One example of emerging cryptocurrencies is the digital asset classes offered by central banks. Many countries around the world have accepted cryptocurrencies, updated their regulations, and launched their own digital currencies.

These new cryptocurrency models are called CBDCs (Central Bank Digital Currencies). We shouldn’t expect every crypto payment platform to offer transactions with these new cryptocurrencies.

Some cryptocurrency projects may require time to be practically used in the market and achieve liquidity.

To meet your business’s financial needs with cryptocurrencies offering liquidity advantages, you can start your digital transformation process by contacting The Kingdom Bank now.

About The Author