How Free Zone Overseas Banking Works in China in 202622 min read

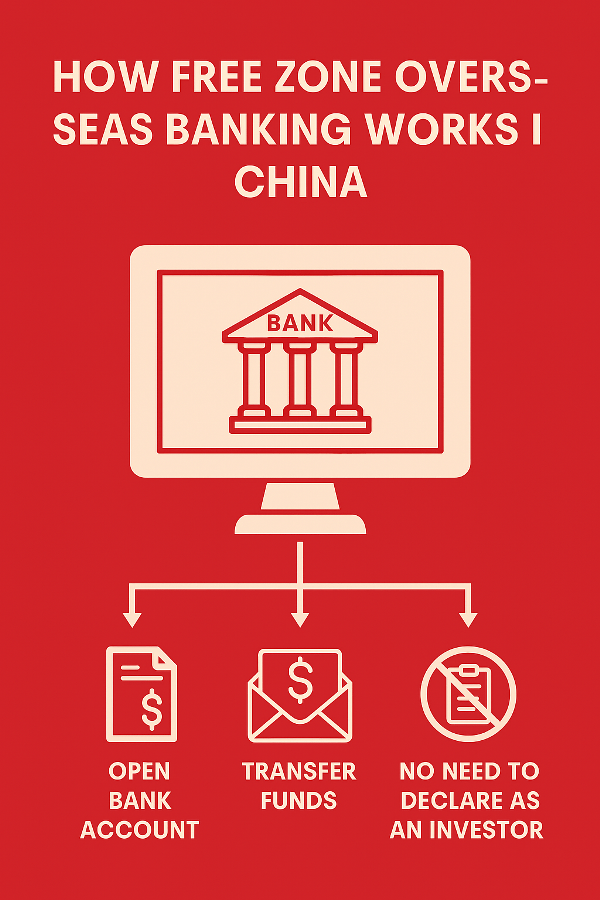

Reading Time: 9 minutesIn this article, we will discuss how Free Zone Overseas Banking Works in China.

Tip ↵ In China, free zone overseas banking offers efficient solutions to foreign investors in areas like the Shanghai Free Trade Zone.

Banks operating in designated free zones have more flexible rules regarding foreign currency transactions. Capital inflows and outflows are faster in these zones.

You can also easily open a bank account in foreign currencies. Once your business opens an account, it can begin managing all its financial accounts in China and globally from a single centre.

According to China’s local regulations, your account goes through fewer bureaucratic processes than the country’s traditional banking system.

Bonus Tip ↵ This makes overseas money transfers much easier. Singapore, Switzerland, Hong Kong, Luxembourg, and the United Arab Emirates are among the best countries for overseas banking.

You can benefit from financial privacy in these countries, as well as enjoy lower tax rates. The banking infrastructure is strong, and the country’s economy is relatively stable. Overseas online banking services allow you to open an account even if you’re not in China.

You can transfer money, make payments, and conduct investment transactions seamlessly through digital banking applications.

Do you have any questions? ↵ What is overseas banking? specifically for China. For questions, please get in touch with The Kingdom Bank.

Free zone overseas banking in China aims to increase foreign capital in this country. They aim to facilitate international trade for individuals, investors, and businesses. You can benefit from this system in free trade zones such as Shanghai, Shenzhen, and Tianjin.

This system allows you to open an account in any currency. Additionally, you’ll benefit from low-cost and fast foreign exchange transfers. Opening a free zone overseas account in China also provides access to the global financial network.

Important Note ↵ Free zone accounts offer flexible foreign exchange regulations. You won’t have to deal with bureaucratic procedures during these processes. Furthermore, investors can achieve operational efficiency within the international financial flow.

The best countries for overseas banking are those that provide financial stability. These countries have very low tax rates. Furthermore, they have a strong banking infrastructure. China is always eyeing you in the Asian market with its free trade zones.

China’s free zone overseas banking allows you to benefit from services that meet international standards if you operate in the Asia-Pacific region. You can find information on this at The Kingdom Bank.

What Is Overseas Banking in China’s Free Trade Zones?

As a foreign investor, overseas banking in China’s Free Trade Zones allows you to manage your foreign currency with flexible rules.

By adhering to this system, you can move more freely in your financial transactions. Overseas banking regulations in free zones do not impose restrictions on incoming funds.

In these zones, you can open accounts in foreign currencies with minimal effort. You won’t have to deal with bureaucratic hurdles when making quick transfers to different countries. China focuses on attracting foreign capital to its economy through these zones.

It also aims to promote foreign trade in the country. This way, it manages your account in line with local and global financial systems.

You can open accounts in free zones within the country’s borders through overseas banking and offshore banking. Offshore accounts offer low tax rates.

You can also benefit from tax exemptions in some areas. China prioritises financial privacy in both these banking types.

Overseas banking in the China Free Trade Zone also allows you to take advantage of trade incentives in China. You can also capitalise on foreign exchange liberalisation and regional economic strategies. These accounts provide access to all the opportunities in the Chinese market.

“How to open an overseas bank account?” If you don’t want to wait too long, come to The Kingdom Bank.

How Does China Regulate Overseas Banking in Free Zones?

Overseas banking for individuals is becoming very popular in China’s free zones. This is because they offer flexibility in foreign exchange transactions.

Here, you can have an account in your preferred currency. As an investor, you can transfer money to different countries quickly and cost-effectively.

Secure overseas banking solutions ensure you are protected according to overseas standards. You can benefit from security measures such as multi-factor authentication and encryption technologies in all transactions.

Tip ↵ As a personal user, you won’t experience security issues with Chinese and global financial networks.

Overseas banking for businesses supports your import and export activities in free zones. Your business can have foreign currency-based commercial accounts. You can also make instant payments to your overseas suppliers and customers. Your collections are also very fast.

The Chinese government aims to pave the way for investment with its banking infrastructure in free zones. This focuses on increasing your competitiveness in the global market. Visit The Kingdom Bank now to open an account in the China free zone.

What Are the Main Benefits of Overseas Banking in Chinese Free Zones?

The benefits of overseas banking in China’s free trade zones bring you global access. Thanks to financial flexibility, you can process overseas money transfers and foreign exchange transactions quickly and cost-effectively.

If you live abroad, you can seamlessly conduct financial transactions in your home country and in China. You’ll also have the freedom to diversify your investments as you wish.

Free zone overseas banking in China allows you to benefit from a secure transaction infrastructure.

The benefits of overseas banking in China’s Free Zones are as follows:

- You can open foreign currency accounts and conduct transactions in multiple currencies.

- You experience speed and low transaction fees for overseas money transfers.

- You can diversify your investment portfolio across different countries.

- For those living abroad, overseas banking for expats to both local and global financial networks.

- Thanks to free zone overseas banking in China, you avoid bureaucracy and restrictions during commercial transactions.

- You can conduct overseas financial transactions protected by high security standards.

Which Cities in China Offer Free Zone Overseas Banking Services?

You can do China free zone overseas banking in select cities. These cities focus on strengthening foreign capital. The Shanghai Free Trade Zone, Shenzhen Qianhai, Zhuhai Hengqin, Tianjin, and Fujian are the most popular centres in the country.

Free zones established within these cities allow you to open accounts in foreign currencies. You can also open accounts in foreign currencies. Transaction costs for overseas transfers are also relatively low.

As an investor, you can access both the domestic and global markets by opening a free zone overseas account in China. You can open a China free zone overseas account at The Kingdom Bank immediately.

Opening an overseas account in China’s free zones will ensure you never experience any financial difficulties with your financial payments.

China offers special banking incentives for these accounts. Approval times are faster, and the digital banking infrastructure facilitates compatibility with overseas banks.

The cities where free zones are located also have strong logistics and trade infrastructure. This ensures that your physical commercial activities and financial processes are seamlessly handled.

Can Foreign Businesses Use Overseas Banking in China’s Free Trade Areas?

Opening a free zone overseas account in China allows you to enter the country’s market easily. Foreign currency transactions are completed in seconds through these accounts.

Furthermore, you’ll pay very low transaction costs for transfers. All your export and import payments are managed from a single panel.

Free zones implement special banking regulations. These regulations provide greater flexibility for capital inflows and outflows. You can also manage multi-currency accounts.

You won’t have any problems with payments to overseas suppliers. This gives you flexibility in financial transactions as a foreign business in China.

Thanks to online overseas banking in the China free zone, you can open an account without being in China. You can transfer money from these accounts and easily deposit funds into your account. Furthermore, multi-factor authentication and overseas security standards await you in the digital environment.

Because you don’t face financial difficulties, your operations are uninterrupted. This way, you can easily increase your business volume. You can also open a China free zone overseas banking account at The Kingdom Bank.

What Documents Are Needed to Open an Overseas Banking Account in China?

By opening a China-free zone overseas banking account, you can efficiently conduct financial transactions in China. You can also make international money transfers through these accounts, offering several advantages.

A China free zone overseas account also offers flexibility in foreign currency transactions. Low transfer costs await you here, and you can also take advantage of fast transactions. When opening your account, Chinese banking regulations require you to provide complete documentation.

The required documents for opening an overseas bank account in China are as follows:

- Passport and Visa Information – Proof of identity and authorisation to enter the country.

- Company Establishment Documents – For companies opening a commercial account, a trade registry record, articles of association, and authorisation documents are required.

- Proof of Address – Official documents, such as electricity/water bills or proof of residence, obtained within the last three months.

- Tax Identification Number – Required for international tax compliance (FATCA/CRS).

- Bank Reference Letter – A positive reference from another bank, supporting your financial history.

If you are looking for secure overseas banking solutions, the bank you choose should be licensed. If your digital security infrastructure is strong, you will not have any problems using a China-free zone overseas banking.

Is Overseas Banking in China Safe and Compliant?

Your business can conduct transactions with high security in overseas banking operations in China. You can also operate your account in compliance with international standards.

Individuals can benefit from a variety of currencies for their overseas banking transactions.

You can protect your assets while easily accessing international investment opportunities. Accounts opened in free trade zones in China offer low fees for international transfers. Transactions are also processed much faster.

The country’s robust digital security infrastructure allows you to comply with global security practices. This allows for secure and legal transactions. Liquidity management in

Overseas banking for businesses is also facilitated.

You can also open multi-currency accounts and make secure payments for international trade. Among the benefits of overseas banking are tax optimisations. You also gain flexibility in your operations and easy access to different markets.

The overseas banking infrastructure of the China Free Zone provides businesses and individuals with the opportunity to compete in Asia-Pacific-based financial networks.

How Do Currency Controls Affect Overseas Banking in China?

Capital movements in China are regulated thanks to exchange rate controls. This makes overseas banking transactions faster. You also expect lower costs and flexibility. Opening an overseas account in the Chinese free zones offers limited autonomy within these zones.

This eliminates unnecessary workloads for international money transfers. The exchange rate advantage also gives you a competitive advantage.

Free trade zones apply specific quotas more flexibly. The Chinese government is also speeding up the approval process for your transactions.

You can transfer foreign currency from the mobile app using online overseas banking in the Chinese free zones. You can also easily manage multi-currency accounts and overseas payment orders. Large transfers can be made subject to the country’s exchange rate control regulations.

When making large transfers, additional reporting may be required for certain currencies. Therefore, you must comply with local and international regulations.

Secure online banking in free trade zones will prevent you from being affected by these problems.

What Role Do Overseas Yuan Accounts Play in Overseas Banking in China?

For those living abroad, overseas banking allows you to manage your financial assets in a different currency. This protects you from exchange rate fluctuations. Your investment portfolio can also be diversified as desired.

You can open a Yuan account in free zones in China. This allows you to integrate into both the Chinese domestic and global markets efficiently. This will enable you to access China-based investment opportunities even if you live abroad. Consequently, you can minimize your currency conversion costs.

Opening Yuan-denominated accounts within China’s free zone overseas banking system will speed up your money transfers. Exchange rate freedoms, multi-currency account usage, and low transfer costs await you in the free trade zone.

If you’re an investor trading in Asia, you can trade safely in regional markets with these accounts. Furthermore, you’ll never encounter any problems with financial payments. Learn “How to open an overseas bank account?” at The Kingdom Bank. You can open your Yuan-denominated account in just a few minutes.

Are There Tax Advantages to Using Overseas Banking in Chinese Free Zones?

Online overseas banking in the China Free Zone allows you to conduct transactions with tax advantages. International investors can benefit from tax deductions. Some taxes are deferred, and you can also take advantage of numerous tax exemptions.

Overseas banking regulations apply to banks in these zones. All regulations ensure compliance with local tax laws and international financial standards. As an investor, you operate legally.

This way, you can reduce your tax burden. You can also begin managing your international capital as you wish. The key difference between overseas banking and offshore banking lies in their distinct tax practices.

Free trade zones in China generally have a hybrid system. Furthermore, the conditions for taxation in the country are easier. Overseas online banking services allow you to manage your account easily.

You can also transfer foreign currency and transact in multiple currencies. You can securely manage your tax reporting from anywhere in the world. All the advantages of free zones make your tax planning more effective.

To open an overseas bank account in China, follow the steps at The Kingdom Bank.

About The Author