Cross-Border Payments and Exchange Rates (Why It’s Important)28 min read

Reading Time: 10 minutesCross-border payments are a very sensitive issue. It’s crucial to ensure the transaction is conducted without being affected by any factors.

Exchange rates have an impact on cross-border payment. Whenever money crosses international borders, the fund must be converted from the local currency to the recipient country’s native currency.

Currency conversions expose cross-border payment to the effects of volatile exchange rates that influence the ultimate expense.

Brief Summary : We’ll look at how exchange rates affect cross-border payments, why fluctuations matter, and how to manage risk in this article.

Additionally, we’ll look at how currency conversion works and how banks like The Kingdom Bank determine their exchange rates. Understanding these variables will assist you in making better choices about how to handle your global payment solutions.

Exchange rates are an important factor in international trade and cross-border payment. When money is sent across borders, it needs to be converted from one currency into another. This currency conversion process is influenced by ever-changing exchange rates.

In this article, we will look at how exchange rates work and the factors that can impact the exchange rate applied to cross-border B2B payments, SWIFT cross border payments, digital cross border payments, etc.

How Do Exchange Rates Impact the Cost of Cross-Border Payments?

The cost of conversion from one currency to another is known as the exchange rate. The sender’s money, on the other hand, is converted from their local currency into the currency of the destination nation at the moment of payment at the current exchange rate.

The conversion amount will be impacted by any shifts in this rate that happen in between.

If the currency of the beneficiary country appreciates, they may receive less of their own currency than they expected. If it depreciates, they may end up with more than they anticipated.

A business bank account holder in the US, for instance, must pay a supplier in Europe 10,000 Euros. The firm would need to transfer $11,000 from its account at an exchange rate of 1.1 Dollars per Euro.

But if the Euro declined to 1.2 Dollars per Euro by the time the money was sent, the supplier would only be able to acquire €9167 worth of products because of the conversion price increase.

Exchange rate volatility may introduce uncertainty and danger to international payments. Firms must also consider these possibilities, which complicates operations and increases the cost of global finance administration.

These concerns can be mitigated by using a digital banking platform like The Kingdom Bank that provides monitoring and hedging exchange rate risks.

Why Do Exchange Rate Fluctuations Matter in Cross-Border Payments?

Exchange rates are frequently subject to daily changes as a result of economic and political factors that influence international banking and business banking accounts.

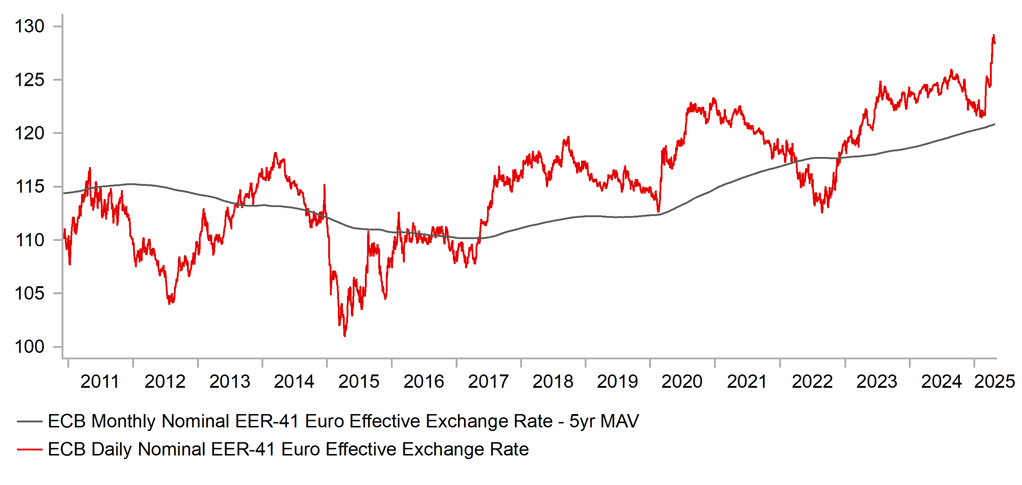

Graphic Source: MUFG Research

There are numerous justifications for why these fluctuations have such a significant impact on cross-border payments. Let’s look at these now.

The Importance of Exchange Rate Fluctuations

- Budgeting and forecasting – It’s difficult for importers and exporters to anticipate the price of future payments and profits in foreign money because of erratic exchange rate movements. This makes financial planning difficult.

- Management of cash flow – Conversion rate swings might induce last-minute shortfalls or windfalls when paying international invoices. This has an impact on working capital and cash flows.

- Competitiveness – Currency price changes in reality increase or lower the price of products and services worldwide. A company’s competitiveness and pricing in international markets may be affected as a result.

- Risk of non-compliance – Tax rules, import/export laws, and other regulatory variances in various nations are all expressed in local currencies. Non-compliance may occur as a result of changing exchange rates.

- Opportunity cost – Waiting or making up time to benefit from transient currency swings requires capital and resources to time the market just right. In the meantime, you’re missing out on savings.

Proactively managing exchange rates with the help of these problems through various instruments and services, digital banking platforms may make global trade easier for companies.

This enables them to make better financial decisions by providing more consistent and reliable payments.

How Can Businesses Manage Exchange Rate Risks in Cross-Border Payments?

Firms may use a variety of strategies to lessen exchange rate dangers when making cross-border payments.

Strategies to Mitigate Exchange Rate Risks

- Forward contracts to hedge – Locking in today’s conversion rate for a certain future date by signing a forward contract fixes costs. It may aid in establishing a certain budget but does not adapt to change. Banks provide services like forward contracts.

- Payments in the currency of invoicing – Paying invoices in the local currency of the supplier or service provider eliminates the danger of currency conversion entirely. However, the payer must hold multi-currency balances, which adds operational intricacy.

- Notification of trigger rate – Setting off rate threshold warnings on your banking partner’s payments platform can alert you when rates leave your acceptable range, allowing you to hedge in a timely manner.

- Balances in several currencies – Maintaining funds in various currencies may mitigate the need to constantly make huge conversions at inopportune times. Digital banks provide multi-currency accounts.

- Payment on receipt – Some banks have the ability to release international payments on a specific date in the future after they’ve been received and let you lock in the exchange rate at the moment of authorization to allow you to budget for costs correctly.

The active monitoring tools and hedging tactics should be used in a combination.

By providing cross-border payers with optimal exchange rate risk management solutions, a single integrated banking platform like The Kingdom Bank streamlines transactions.

What Role Does Currency Conversion Play in Cross-Border Payments?

Money transmission between payment service providers, banks, and recipients is the primary purpose of currency conversion, which enables cross-border money flows.

Conversion entails the following:

- The sending bank, on the other hand, converts the deal from the sender’s native currency into a few of the major currencies used for international settlement, including the US Dollar, Euro, and Pound, at its current rates.

- Then, the fund is transferred between banks in the appropriate settlement currency via the payment rails, such as SWIFT or payment gateways.

- Upon receipt, the funds are reconverted by the beneficiary’s bank into the recipient’s native currency before being credited to the account at its own rates.

- The money must go through several currency conversions if the receiving country’s currency is different from the settlement currency, with each conversion levying its own margin.

Digital banking platforms like The Kingdom Bank, which centralizes conversion requirements and has access to wholesale currency markets, may provide more competitive exchange rates than high street banks.

Furthermore, they speed up the process by automating the conversions rather than requiring people to do them manually.

How Do Banks Set Exchange Rates for Cross-Border Payments?

Commercial banks apply a little markup to the interbank rates when they convert currencies. Banks use a variety of considerations when determining their exchange rates.

Factors Applied in Determining Exchange Rates

- Rates at wholesale level – The bank obtains the currency through the interbank markets, where it can buy/sell to and from other financial institutions in bulk at wholesale interbank pricing.

- Cost of operation – Maintaining currency inventories, trading platforms, and 24-hour liquidity networks accessible all over the world entails a high infrastructure cost for banks. Operating margins assist in this.

- Supply & demand – When one currency is in high demand, its price will rise. Banks also frequently adjust buy/sell prices to reflect supply/demand imbalances in order to both keep their inventory under control and make the most of the imbalance.

- Intensity of rivalry – The Kingdom Bank, a digital bank with direct access to the currency markets and a significant amount of capital to start with, may offer its clients a better retail exchange rate.

- Transaction’s size – Higher rates are available for large payment volumes due to the banks’ ability to do bulk currency conversion.

Although the exchange rate market is only semi-competitive, it is necessary for banks to earn appropriate margins in order to maintain a strong worldwide payments infrastructure and service. Transparency in pricing also assists clients in developing confidence.

Exchange rates affect both the amount and delivery of cross-border payment. The rates change on a constant basis, making it necessary to actively watch and manage the danger for companies that regularly do international transactions.

Digital banking remedies like The Kingdom Bank’s multi-asset and multi-currency wallets can address these problems through integrated payment solutions, more competitive exchange rates, and hedging instruments.

These solutions help optimize international money transfer processes, ensuring secure international transactions and cost efficiency.

Please visit our website to learn more about The Kingdom Bank’s safe and convenient solutions for your international business payments and money transfers.

Keeping track of the impact of changes in exchange rates is beneficial in the long run since it will help to optimize your global payment process and cash flows.

Are Mid-Market Rates Used in All Cross-Border Payments?

Not necessarily. When exchanging one currency for another, banks typically apply either a mid-market rate or an adjusted rate based on transaction size and timing.

The mid-market rate is the midpoint between the buy and sell rates being quoted by banks and foreign exchange traders at that instant. It is the fairest exchange rate possible since it is the midpoint of what someone is willing to buy or sell a currency.

Large commercial cross-border payment transactions may have exchange rates that have been adjusted by a few percentage points higher or lower than the mid-market rate.

A transaction worth millions of dollars would affect the currency markets, at least temporarily, even if it is normal commercial activity. To address currency exchange risk on their end, banks must manage it.

The mid-market rate is frequently used for individual or small business transfers totaling less than $10,000.

However, international money transfers, for example, those completed via The Kingdom Bank, may also get a specially negotiated rate for corporate clients who make large transfers on a regular basis between countries.

This makes it easier for big multinational firms to manage currency risks and lower their exchange costs over time.

How Can I Get the Best Exchange Rate for Cross-Border Payments?

Businesses can do several things to ensure they receive the best exchange rate for their cross-border payment requirements:

- Time international payments strategically: Exchange rates are dynamic and change all the time depending on economic and geopolitical factors. Sending money when a favorable rate is available will save money compared to rushing a payment during less optimal times. Live tracking of exchange rates is possible with platforms like The Kingdom Bank.

- Aggregate recurring payments: Many small transfers add up over time. Consolidate regular international supplier payments or payroll into a single larger transfer each month to qualify for better negotiated rates.

- Use a specialized cross-border payment provider: Banks charge exorbitant markups on currency conversion. Specialist providers, like The Kingdom Bank, maintain significant currency reserves and are better positioned to offer highly competitive rates customized for businesses.

- Pay in the currency of the recipient country: Where possible, ask suppliers if they are willing to accept payment in their currency rather than having to convert the payment into your home currency first. This reduces one unnecessary conversion.

- Negotiate advanced foreign exchange contracts: For significant predictable international expenses, you can also negotiate and pre-agree exchange rates weeks or months in advance with foreign exchange providers like The Kingdom Bank to lock in advantageous exchange rates.

By taking these steps, it is possible to optimize every international dollar, euro or other currency transferred across borders.

The research and effort are well worth it to find the provider and payment strategies that save the most on exchange rates over time.

What Fees are Added to Exchange Rates in Cross-Border Payments?

Additional fees are applied on top of the exchange rate when currency is exchanged during a cross-border payment, affecting the total cost.

Fees Added to Exchange Rates

- Currency conversion markup: Spread above the mid-market rate retained by the payment provider as profit. Banks and traditional banks’ markups can exceed 3-5% whereas specialist platforms like The Kingdom Bank aim to keep this at 1% or less.

- International wire/payment processing fee: A flat fee ranging from $15-35 per transfer levied by most providers, including banks and The Kingdom Bank. May be waived for high-volume customers.

- Foreign correspondent/receiving bank fees: A payment made to the bank in the recipient’s country to receive and localize the funds. Usually a small flat fee.

- Regulatory compliance charges: Processing additional payments for transfers involving sanctioned countries or currencies subject to tariffs.

Determining all applicable fees is one method of learning the real total cost of transferring money globally. Cross border payment providers that show exchange rates and a fee structure like The Kingdom Bank allow companies to accurately predict their international payment budgets.

Comparing various vendors can also save money on otherwise unavoidable currency conversion fees.

Do Real-Time Exchange Rates Improve Cross-Border Payments?

The ability to view real-time exchange rates and make cross-border payment instantly has several advantages for businesses.

Advantages include:

- Optimized payment timing: Live rates are accessible 24 hours a day, 7 days a week through online platforms. By allowing businesses to track currency fluctuations and time transfers to capture maximum value, this optimizes when payments are sent. This lessens the danger of being affected by a poor overnight rate change.

- Faster working capital availability: International invoices can be settled right away, which means that money that would otherwise be trapped in overseas accounts can be recovered quickly. It is possible to reuse the money from exports to back new import orders as soon as they are available.

- Improved cash flow forecasting: Real-time exchange rates also provide an accurate predictive view of future international payment expenses. This allows for better budgeting and financial planning across various currencies on a worldwide scale.

- Decreased transaction fees: Processing numerous small recurring payments at once in real time can also allow businesses to negotiate preferential exchange rates from providers. This decreases the need for costly individual wire transfer fees.

Real-time functionality does, of course, need to be supported by strong connections between ERP/accounting systems and online cross-border payment experts like The Kingdom Bank. But for companies that trade frequently, it is possible to maximize working capital.

And for businesses engaged in international trade, the future of global commerce will be characterized by quicker financial settlements across borders.

How Do Fintech Platforms Affect Exchange Rates in Cross-Border Payments?

Cross-border payment platforms and fintech companies’ emergence are reshaping traditional ways and driving down costs in a variety of ways:

- Operational efficiency: Digital-first platforms keep overheads lower by having less brick-and-mortar infrastructure and more streamlined internal procedures. They pass on these savings to their customers.

- Access to global liquidity pools: Large currency reserves are centrally held by these platforms and managed for maximum economies of scale that are out of reach of individual banks. This enables them to keep exchange rate spreads tighter.

- Tech-enabled negotiation power: Advanced data analytics allows these platforms to have negotiation leverage that allows them to source preferential rates from top global money brokers in a way that is unachievable by smaller banks.

- Automated multi-bank connectivity: Money can be routed automatically across networks of partner banks worldwide, and the platform ensures that it will always discover the least expensive settlement alternative. They are not bound by restricted correspondent banking networks.

- Real-time exchange rate tools: As discussed earlier, these online cross-border payment platforms give businesses access to better information and tracking of live rates to optimize timing. Obsolete phone-based enquires are no longer available.

Innovators like The Kingdom Bank are completely reimagining cross-border payments by stripping out layers of legacy costs and inefficiencies.

With our internationally compliant license and 24/7 multilingual support, we have become a compelling alternative to international banks of all sizes for businesses.

Currency conversion spreads will continue to shrink over time as fintech solutions continue to provide more specialized cross-border services.

Platforms such as The Kingdom Bank have a number of cost-saving advantages, including very competitive exchange rates, real-time payment instruments, and expert services that have been customized for cross-border trade.

This service streamlines worldwide treasury operations to enhance cash flow.

To find out how The Kingdom Bank can help your business manage international payments more effectively and reduce currency risk, please contact our representatives.

We would be delighted to review your specific payment needs and demonstrate how our services may provide the best rates available to maximize the amount of money you transfer across borders every day.

About The Author