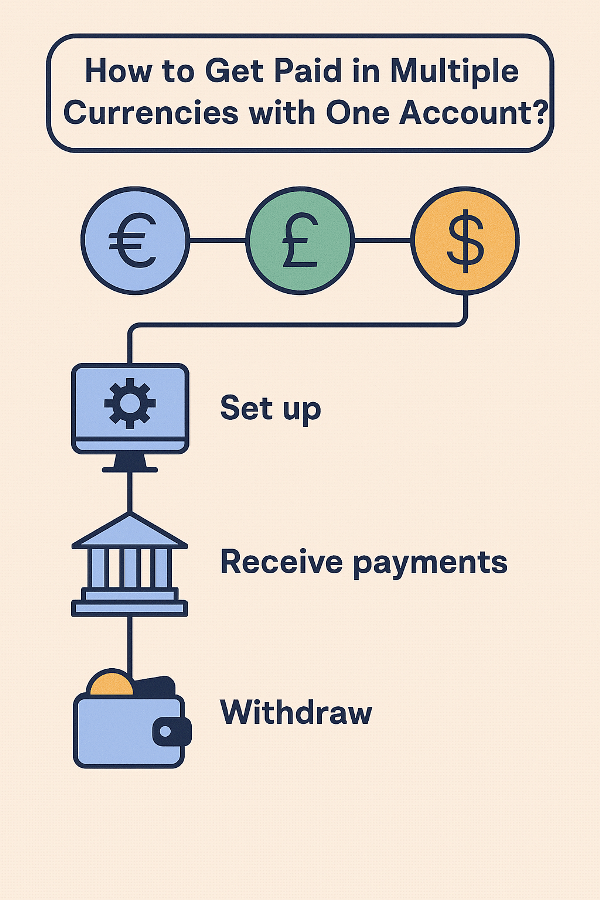

How to Get Paid in Multiple Currencies with One Account?22 min read

Reading Time: 8 minutesWe will cover How to Get Paid in Multiple Currencies with One Account. By creating a multi currency account through digital banking platforms, you can gain the infrastructure to receive payments in the local currencies of different countries.

Moreover, you can benefit from these accounts not only for your business’s cross-border transactions but also as an individual customer living as an expat.

TİP ↵ Having accounts that can handle these types of transactions with multiple currencies can be crucial for freelancers, one of the professions that has become increasingly popular since the pandemic.

A business’s customers, suppliers, and payment institutions may all be located in different countries.

In such a business model, commercial relationships with each participant may be managed using different currencies.

In such cases, if businesses manage the process with traditional banking solutions instead of using a digital multi-currency account, operational efficiency will be negatively impacted by conversion costs and transaction costs.

Because transactions are often conducted in different currencies on popular freelancing platforms like Upwork, freelancers are increasingly interested in these types of accounts and digital banking products.

Often asked, “What is a multi-currency account?” The clearest answer to the question is “a digital banking service where different exchange rates can be used in payments or transfers through a single account without conversion costs.”

A multi-currency account provides businesses with the infrastructure to receive payments not only in the local currency of their country of residence but also in different currencies from all potential customers globally.

Furthermore, these accounts not only allow for payments in different exchange rates but also offer solutions suitable for investment-related transactions, such as holding and managing different currencies on a single dashboard.

FOR EXAMPLE ↵ an online store operator on an e-commerce platform like Amazon, while receiving payments in USD from customers in the US, must have a EURO-compatible banking account to receive payments from potential customers in Europe.

At this point, they should consider the international multi-currency account services offered by digital banking.

This account not only reduces the cost of managing commercial relationships with suppliers in different countries but also provides the flexibility of a financial infrastructure to receive payments from customers anywhere in the world.

The increasing globalization and digitalization are increasingly making this type of financing increasingly important.

Are There Fees for Receiving Funds with a Multi Currency Account?

As with any digital banking account, some transaction fees may apply to multi-currency accounts for businesses. However, these fees are quite reasonable, unlike traditional corporate bank accounts.

Accounts opened for individual use generally have higher transaction fees, while businesses often enter into collective agreements because they handle a large number of transactions.

If you use this type of account for international payments, you should be prepared to incur certain transaction fees. However, if you conduct transactions through individual accounts, you should expect slightly higher transaction fees, even if they are small.

Remember ↵ At The Kingdom Bank, we always offer transparent pricing for these multi-currency account with debit card services, and you won’t encounter hidden fees during transactions.

Choosing the best multi-currency account for individuals is crucial when opening a personal account.

To best manage this process, it’s recommended to choose a reputable online banking platform, access transparent pricing policies regarding transaction fees and currency conversion fees, and prioritize those with advanced and modern infrastructures.

How Do Currency Conversions Work in a Multi Currency Account?

If you frequently need international payments or transfers at different exchange rates, you can manage them most efficiently with an international multi-currency account.

With traditional banking accounts, you’ll have to pay a new conversion fee based on the current exchange rate each time you make these types of transactions.

However, if you manage your savings or business capital through a digital banking account, currency conversion costs will be significantly lower.

These accounts allow you to maintain balances in different currencies, such as EURO, USD, and GBP, and the relevant exchange rate is sent or received through the correct account.

This process eliminates the need to pay separate currency conversion fees for each transaction.

E-commerce businesses that utilize digital banking services such as multi-currency accounts for online sellers have the opportunity to view payments received from different countries through a single account or dashboard.

This allows them to maintain greater financial flexibility when managing both transaction history and new orders.

Can a Multi Currency Account Hold and Manage Multiple Balances at Once?

Yes, thanks to digital banking tools, you can manage multiple balances simultaneously, whether you’re managing a multi-currency business account or a personal account.

You can simultaneously maintain and manage a separate balance in EURO and a separate balance in USD.

Online banking platforms often offer mobile apps that allow you to manage multiple accounts from a single dashboard. For example, The Kingdom Bank’s easy-to-use mobile app allows you to manage different exchange rates from a single account.

For those running online stores on e-commerce platforms like Amazon, this account type provides the financial infrastructure necessary to receive payments from European customers in EURO, to pay suppliers in China in CNY, and to receive payments from local customers in USD.

If you’re earning income from your online skills on a freelancing platform like Upwork, you should consider the digital banking products offered under the multi-currency account for freelancers category.

This allows you to increase your potential client base by responding to job postings from anywhere in the world and to avoid conversion costs when making international transfers with different currencies.

Moreover, many digital banking platforms offer special offers and transaction fees for individual accounts in the freelancer working model.

Is It Safe to Accept International Payments via a Multi Currency Account?

The security of accepting cross-border payments through a digital multi-currency account can vary depending on many factors. Factors such as which banking platform you use and which platform you use to manage your transactions are important.

However, international payments made through accounts offered by digital banking platforms like The Kingdom Bank, which offer security standards in line with global banking procedures, are generally completely secure.

Services such as multi-currency accounts for expats can be managed completely securely within the scope of global banking regulations. If you manage the process with a reputable and reliable banking platform, you won’t have to worry about security.

However, it’s also important to remember to implement personal security measures such as multi-factor authentication and advanced encryption.

How Can Small Businesses Use a Multi Currency Account to Get Paid Globally?

The benefits of a multi-currency account are available not only to large-scale global businesses but also to small businesses. These accounts provide the financial infrastructure to easily receive payments from customers anywhere in the world, even if you’re a small business.

Having a multi-currency account can meet the needs of not only large global companies but also small businesses.

In recent years, many small businesses across various sectors have begun selling their products and services globally through social media platforms like Instagram. For these types of projects, having an account like this will make it easier to trade with different currency exchange rates.

You’ll also avoid additional currency conversion costs when paying suppliers for raw materials or products you purchase for sale. Efficient supply chain management is even more crucial for small businesses than for global companies.

Regardless of your industry, you can visit our website The Kingdom Bank now to learn how to open a multi-currency account. Opening a digital account in minutes gives you the flexibility to trade with different exchange rates.

How Does a Multi Currency Account Help You Get Paid in Different Currencies?

One of the primary goals of a business is to grow globally and accept payments in different currencies. Thanks to the multi-currency accounts offered by digital banking platforms, you can hold balances in multiple currencies and send them to different recipients in seconds.

These types of transactions generally eliminate the currency conversion fees associated with traditional banking accounts. This allows you to manage all your international banking needs anytime, anywhere, from a single mobile app.

Transfers in different currencies are a relatively simple process for businesses. A multi-currency account allows a business to have accounts denominated in different currencies, such as USD, EURO, GBP, and JPY.

If a payment is received in EURO, the transaction is reflected in the EURO balance. However, if supplier payments are handled in an Asian market, the balance in that country’s local currency is used to manage the transaction.

Can Freelancers Use a Multi Currency Account to Receive Global Payments?

Freelancers who earn their living by selling their skills online on freelancing platforms like Upwork can receive payments from different countries simultaneously.

In such cases, they can access digital banking services that are compatible and integrated with these platforms, enabling them to trade in different currencies and hold them in their accounts.

Freelancing, one of the most common business models, especially after the pandemic, involves receiving payments through digital channels.

Freelancers handle job postings globally, not just in one country. Financially, they expect to be able to receive payments anywhere in the world.

If a freelancer’s company is based in the US but their operations are based in Europe, they will lose flexibility and incur high conversion costs by constantly converting between USD and EURO in traditional banking.

However, with a digital multi-currency account, they will be able to actively use both currencies and avoid the need for currency conversions every time. Furthermore, unlike other local investors, they will have more resilience and sustainable financial stability in the face of potential exchange rate fluctuations.

These accounts automatically implement the asset diversification strategies recommended for investors.

If you have any questions about how to open a multi-currency account or want to learn more about the digital transformation process, you can contact The Kingdom Bank right now.

One of the customer profiles that most show interest in our digital banking services, which we have been providing for years, is freelancers.

What Are the Benefits of Using a Multi Currency Account for International Clients?

The benefits of a multi-currency account are numerous for businesses that offer services or products not only locally but also globally.

Especially for businesses with an international customer base, using a traditional corporate banking account can lead to high transaction costs when dealing with different exchange rates.

However, these digital accounts allow businesses to avoid currency conversion costs. Furthermore, being able to invoice each customer in their local currency will enhance your business’s corporate identity and deepen the bond your customers form with your business.

Furthermore, being able to accept payments in different exchange rates in the global market will also accelerate your trustworthiness and reputation. Therefore, regardless of your industry, having a multi-currency business account is recommended.

If you want to develop more professional business relationships with your international customer base for your business, you can explore multi-currency account options now by visiting The Kingdom Bank.

This allows you to offer more flexible and inclusive financial services to potential customers, regardless of their country of origin.

To summarize these benefits, the main benefits of the multi-currency account for online sellers service can be listed as follows:

Benefits of Multi-Currency

- No currency conversion costs,

- the ability to create separate invoices for each currency,

- the creation of a corporate identity,

- and an increase in reputation in the global market.

How Fast Can You Receive Payments Through a Multi Currency Account?

International payments can typically take 1-2 business days to be completed with traditional banking accounts. However, thanks to the multi-currency account for businesses, one of today’s advanced digital banking services, your payments are completed in seconds.

This speed often leads businesses of all sizes and sectors to explore digital banking platforms and applications instead of SWIFT transfers.

At The Kingdom Bank, we transform our digital banking experience into the most innovative financial management tools for you.

Dozens of businesses in sectors such as e-commerce, import, export, and technology are evaluating services like our multi-currency account with debit card to complete cross-border transactions in seconds, without paying transaction fees.

One of the most important features of this service is its much faster processing speed compared to traditional banking.

Transaction activity in sectors like e-commerce is quite intense today, and online sellers offering advantages such as fast payment and product delivery are attracting greater attention in the global market.

Which Payment Platforms Work Best with a Multi Currency Account?

Today, many platforms offering different functions and services, such as Amazon, Shopify, Etsy, eBay, and Upwork, are fully integrated and compatible with online banking services like multi-currency accounts for businesses.

If you generate income through these platforms, you can access The Kingdom Bank and manage your accounts with different currency exchange rates through a single panel, integrating with these platforms.

Regardless of your industry, today’s e-commerce trend requires you to have the financial infrastructure to receive payments anywhere in the world. Don’t hesitate to contact us to stay ahead in the highly competitive markets of the future.

About The Author