Is Online Banking Safe for E-Commerce Payments?26 min read

Reading Time: 10 minutesE-commerce payments are extremely important because you must ensure the security of your online customers.

Online banking and e-commerce payments provide ease of use and speed in modern financial transactions, but they also bring cybersecurity risks.

In transactions made over the Internet, bank account information, personal data, and payment details must be protected at a high level; measures such as data encryption, secure connections, and two-factor authentication play a significant role in this process.

However, due to threats such as fraud and identity theft, both consumers and businesses must continually implement up-to-date cybersecurity measures. Online banking account for e-commerce business is required to receive secure payments.

The security of payment transactions is continually improving, depending on the compliance of the infrastructure used with international security standards and regulatory requirements.

Modern e-commerce platforms protect customer data with secure payment gateways, intrusion detection systems, and regular security audits.

The Kingdom Bank allows you to make secure payments through your online bank account with the most up-to-date methods.

In this article, you will receive detailed information on whether e-commerce payments through online banking are reliable. After opening an e-commerce banking account for transactions, you can make payments without any problems with security measures.

If you are making commercial payments, you can use online banking. You can make online payments quickly and easily.

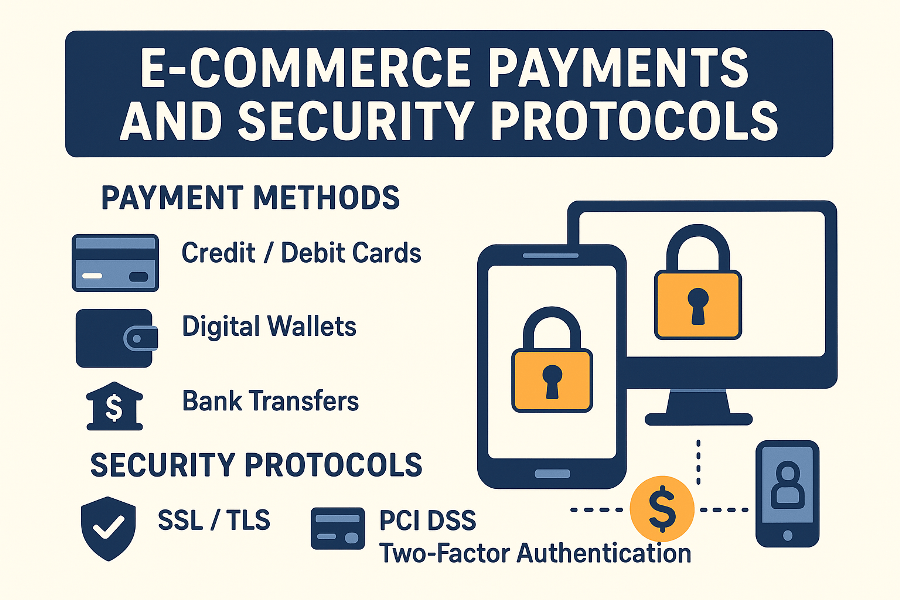

E-Commerce Payments and Security Protocols

Security protocols are evolving with the development of new technologies. Thus, banks protect your data in e-commerce transactions. You can make payments with measures such as strong encryption, two-factor authentication, dynamic risk analysis, and advanced firewalls.

⇓ We can summarize this with an infographic;

If you are making a large commercial payment, you can be protected against fraudsters with online banking. A special online bank account provides transparent reports on your financial transactions.

Interruptions in a commercial payment you will make for your business will bother you. To eliminate these interruptions, consider opening an online bank account. In this way, you can complete your payment quickly and securely.

Thanks to its advanced security infrastructure, an private online bank account is a reliable payment method for commercial payments.

The fastest address to open a special online bank account is The Kingdom Bank! Visit the website now and open your account.

Is Online Banking Safe for e-Commerce Payments?

Online banking and e-commerce payments are carried out with high-security standards thanks to advanced encryption technologies, two-factor authentication, and constantly updated cybersecurity infrastructures.

These measures significantly reduce the risks of fraud and data leakage, thereby protecting users’ financial data.

Consequently, users can enjoy fast, smooth, and secure payment transactions by choosing reliable payment platforms.

You can make secure payments at the end of e-commerce transactions with The Kingdom Bank. E-commerce banking enables you to make payments smoothly with the latest technologies.

How Does Online Banking Protect Against Fraud in e-Commerce Transactions?

For e-commerce businesses, private online bank account provide effective measures against fraud attempts, offering multi-layered protection to ensure the security of users’ financial data and transactions.

This comprehensive protection is supported by modern technologies and security protocols.

Fraud protection measures for online e commerce transactions are as follows;

- Data Encryption: Encrypting all data transmission with protocols such as SSL/TLS ensures that information is protected during transfer.

- Two-Factor Authentication (2FA): In addition to the password, account access is secured by verifying one-time passwords (OTP), mobile approval codes, or biometric data.

- Real-Time Transaction Monitoring: Advanced monitoring systems used for unusual activities and anomaly detection instantly identify suspicious transactions and provide the opportunity for intervention.

- Fraud Detection Systems: Machine learning and artificial intelligence-supported systems monitor unusual transaction patterns and detect potential fraud situations at an early stage. Online shopping transactions are carried out smoothly thanks to these systems.

- Secure Payment Gateways: Payment transactions are carried out in the most secure environment using infrastructures that comply with international standards (for example, PCI-DSS compliant systems).

The Kingdom Bank, as the best online bank account, allows you to make all your e-commerce payments with minimum risk.

What Security Features Should I Look for in Online Banking for e-Commerce Payments?

Ensuring security in online banking services for e-commerce payments is of critical importance, not only for protecting users’ financial data but also for preventing fraud attempts.

At this point, technological infrastructures that enhance transaction security, certification processes by international standards, and regularly updated security protocols must be implemented.

The security features that should be sought for e-commerce banking are as follows;

1 – Data Encryption

Data encryption is one of the most critical security measures in online banking and online e-commerce transactions.

This technology ensures that users’ personal and financial information is rendered unreadable while being transmitted over the Internet during the business banking process.

Encryption methods such as SSL/TLS protocols prevent third-party access during the transfer of data between the sender and the recipient.

2 – Two-factor authentication (2FA)

Two-factor authentication envisages the use of one or more additional layers of verification in addition to just the username and password.

This method is usually carried out through one-time codes sent via mobile devices, e-mail confirmations, or biometric data.

3 – PCI-DSS Compliance

PCI-DSS (Payment Card Industry Data Security Standard) refers to international standards developed to protect payment card information.

Compliance with these standards within the scope of online banking solutions is critical for platforms that perform e-commerce payments to secure cardholder data.

4 – Real-Time Transaction Monitoring and Anomaly Detection

Real-time transaction monitoring systems provide continuous control over financial transactions under corporate banking accounts and instantly detect unusual or suspicious activity.

This mechanism is supported by artificial intelligence and machine learning algorithms; thus, unusual transactions are quickly identified as signs of fraud attempts or system breaches.

Thanks to anomaly detection, potential fraudulent activities are identified at an early stage, and the relevant intervention teams are notified.

5 – Secure Authentication and Access Controls

Secure authentication and access control mechanisms provide an essential layer of protection by ensuring that users and systems are accessible only to authorized persons for e-commerce payments.

Role-based access controls restrict access to sensitive information to only authorized employees, while unauthorized access is prevented through regular document and activity audits.

Can Online Banking Prevent Identity Theft During e-Commerce Transactions?

Multi-layered security measures are implemented to prevent identity theft during business banking payments.

These systems protect transaction data using modern encryption protocols, such as SSL/TLS, thereby preventing unauthorized access to users’ personal and financial information.

Additionally, security steps such as two-factor authentication (2FA) provide an extra checkpoint to verify user identity, rather than relying solely on passwords.

In this way, even if a password is compromised when you open an online banking account for businesses, it becomes much more difficult for fraudsters to access the account.

On the other hand, real-time transaction monitoring and anomaly detection systems for private online banking accounts enable intervention by detecting unusual movements at an early stage. Identifying suspicious activities plays a key role in preventing potential fraud attempts.

Additionally, user awareness and training programs against social engineering attacks help reduce the risk of identity theft.

Thus, online banking and e-commerce platforms operate under the principle of zero trust, effectively protecting customers’ data in business banking solutions and creating a robust defense mechanism against identity theft.

If you want to make e-commerce payments without identity theft, you can carry out your transactions with The Kingdom Bank security solutions.

How Do Encryption and SSL Certificates Enhance the Safety of Online Banking for e-Commerce?

Encryption in e-commerce business banking account payments ensures that customer information, Credit card details, and other sensitive data are protected during transfer.

With encryption protocols such as SSL/TLS, data is rendered unreadable to third parties during transfer between the sender and the recipient.

In this way, if the data is intercepted or intercepted, the intercepted information cannot be used; thus, fraud attempts are significantly prevented.

SSL certificates ensure that a secure and verified connection is established between the user and the server on an e-commerce site when making a payment via an online banking account, providing a secure transaction for e-commerce businesses.

These certificates provide an additional layer of protection against attacks such as fraud and phishing by verifying the identity of the site.

The secure connection is visually confirmed to customers with a lock icon that appears on their browsers, so users know that their transactions are taking place in a secure environment and feel confident that their financial data will be protected.

With The Kingdom Bank, you can use online banking in e-commerce securely with SSL certificates and encryption methods. Those who want to open an online bank account for business can contact The Kingdom Bank.

Are There Any Risks Involved in Using Online Banking for e-Commerce Payments?

If you are doing online shopping transactions, prefer reliable transactions. Online banking provides speed, convenience, and security for your accounts.

Still, it’s essential to understand the risks associated with transactions made using an online bank account for business.

If you are aware of the risks, your financial transactions and personal data will be secure.

We can list the risks in online e-commerce transactions as follows;

- You may be subject to a cyber attack. There is a risk of deliberate phishing, malware, and fraud attempts. You can prevent cyber-attacks with a strong password and two-way authentication.

- They may steal your personal information when you shop online. Check your account regularly for signs of identity theft. Always protect your information with the most up-to-date security software.

- Do not make transactions on networks with malware or insufficient security. In this case, your personal data may work. Use reliable and up-to-date antivirus programs. Also, prefer encrypted connections.

- If you are making e-commerce payments, there may be a technical failure in the banking system. System failures can negatively impact transaction continuity. Work with companies that provide 24/7 support service and can provide instant notifications.

How Do Two-Factor Authentication and Biometric Security Improve Online Banking for e-Commerce?

Two-factor authentication secures your online banking payments in your e commerce banking. Biometric security protects your personal data and financial information.

The advantages of two-factor authentication are as follows;

- A one-time code is sent to your mobile device in addition to your username and password. In this way, you secure your account even if your password is stolen.

- This application allows you to make a second verification. Thus, you can prevent fraud attempts and identity theft. All payment e commerce banking account for transactions become secure.

Let’s also consider the advantages of biometric security;

- In this process, fingerprint, facial recognition, or iris scanning is performed. The risk of access error is eliminated through the verification process using biometric data. You can make the verification process as risk-free as possible.

- You can log in to your account with biometric data. In this way, your user experience improves. In addition, the risk of unauthorized access to the system by third parties is eliminated.

Open a corporate banking account at The Kingdom Bank as soon as possible. Thus, complete your e-commerce payments safely and smoothly.

What Measures Do Online Banking Solutions Take to Ensure Secure e-Commerce Payments?

Use online banking solutions for e-commerce payments. This way, you can ensure speed and security. For this, you can benefit from layered and advanced security measures. These measures protect your sensitive financial data. It is also a good solution against cyber attacks and fraud.

We will explain the measures taken to secure e-commerce payments in online banking systems;

1 – SSL/TSL Encryption

SSL encryption encrypts the data transmission between the web server and your device. This way, your Credit card information and sensitive data are protected. Malicious people cannot learn this data. The best online bank account is one that uses an SSL certificate.

2 – Two-factor authentication (2FA)

User names and passwords may not be enough for security in e commerce transactions. You can also use two-factor authentication.

In this application, a one-time code is sent to your mobile device. You make the payment by entering this code on the screen. Thus, the risk of unauthorized access is eliminated.

3 – Fraud Detection and Monitoring Systems

Reliable banking systems use fraud detection and monitoring systems. They perform real-time transaction analysis for this.

They also use artificial intelligence-supported algorithms and risk assessment software. This way, they immediately detect potential fraud attempts. They also immediately detect unusual activities.

4 – Additional Security Protocols

They apply additional security protocols such as 3D Secure in e-commerce payments. These systems provide an additional layer of verification during payment transactions. This way, only the real account holder can make transactions. This way, you can eliminate fraud risks.

5 – Regular System Updates and Audits

Regular system audits are performed in online banking. They also apply system updates to enhance the system’s performance.

The most current threats are detected. The necessary precautions are then taken immediately. This way, they also take precautions against security vulnerabilities.

Businesses and customers can safely manage their e-commerce payments with The Kingdom Bank.

How Does Online Banking Prevent Unauthorized Access to e-Commerce Transaction Accounts?

Online banking systems prevent unauthorized access to business banking payments. They utilize multi-layered security systems for this purpose. You can benefit from these measures for commercial banking payments.

Your personal information and financial data are protected in this way. Thus, you are protected from malicious attacks. You can shop securely by making online payments.

Banks use advanced encryption, authentication, and continuous monitoring technologies. Thus, unauthorized access to the system is prevented from the very beginning.

The following measures can be taken to prevent unauthorized access;

- Protocols such as SSL and TLS are used during data transfer in payments. Financial and personal data are encrypted with these transactions. Thus, malicious people cannot read your data.

- They create an extra layer of security with the code sent to your mobile device. Thus, the risk of unauthorized access is eliminated.

- Methods such as facial recognition, fingerprint, or iris recognition are used. Thus, only you can access the data.

- AI-supported algorithms detect unusual session attempts. Thus, it temporarily locks your account in suspicious situations. Thus, account access problems are eliminated.

- You should use secure session management in e-commerce payments. Session timers update the session key regularly. At the same time, the session is closed after a specific period. So your account will not remain open for a long time.

Be sure to open an online banking account for e-commerce business. Go to our website now. Create an account in a few minutes with simple steps.

Can Online Banking Be Trusted for International e-Commerce Payments?

You can make your international e-commerce payments securely with online banking solutions. You can complete your shopping quickly and easily with our online payment option.

You can easily receive payments by opening an e-commerce business bank account. These accounts comply with international security standards. Advanced technologies, such as encryption protocols, two-factor authentication, and anomaly detection systems, keep your data safe.

When your customer makes a payment from a different country, the risk of fraud is eliminated. The online banking infrastructure is constantly updated.

Security policies are continually evolving. In addition, regulatory bodies conduct regular inspections.

Additional security applications, such as 3D Secure and biometric security, are also used. Thus, businesses and users can protect their financial information.

International e-commerce payments are safe and problem-free with online banking.

Choose The Kingdom Bank to open an e-commerce business banking account. Thus, make your international e-commerce payments securely.

About The Author