International Banking in UAE (Why Should You Choose It)25 min read

Reading Time: 9 minutesInternational Banking in UAE is attracting the attention of global companies. Because the United Arab Emirates stands among the world’s premier locations for international banking and finance.

Banking across borders becomes highly advantageous in the UAE because of its strategic position between East and West and its stable political situation combined with excellent infrastructure.

This article explores the main factors that make the UAE an attractive destination for both individuals and businesses seeking international banking services.

The United Arab Emirates (UAE) currently stands as one of the leading global locations for international banking services.

Quick Note : The UAE combines its strategic position between Eastern and Western markets with advanced financial hubs and supportive business rules to deliver numerous benefits to cross-border banking clients. We will examine the primary factors that have allowed the UAE to become a preferred location for international banking operations.

Why International Banking in UAE is the Best Choice?

The UAE has developed a highly business-friendly atmosphere that facilitates every aspect of international trade and finance. The UAE functions as an essential trade center in the Middle East linking commerce between Asia, Africa, and Europe as well as other regions.

The nation has focused on building superior transportation and communication systems along with banking infrastructure to promote effective cross-border movement of goods, services and financial capital.

The UAE serves international businesses as a stable platform to access emerging Middle Eastern markets while meeting global regulatory standards.

UAE-licensed digital offshore banks such as The Kingdom Bank enable secure global financial transactions through their online banking services which function smoothly from any location.

What are the Benefits of International Banking in UAE?

The UAE delivers multiple concrete advantages that make it a desirable option for international banks while also providing strategic location and business-friendly conditions.

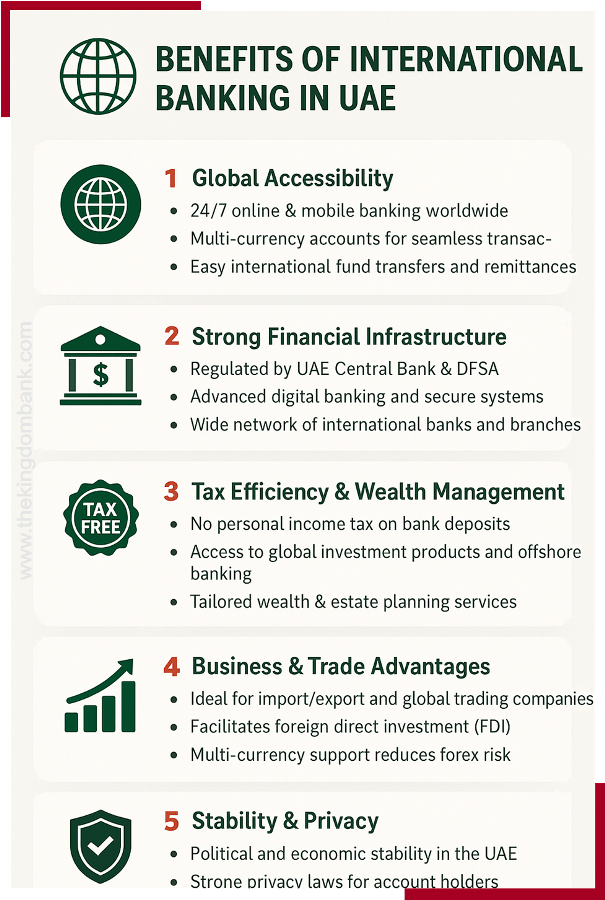

Benefits of International Banking in UAE

1 – Tax advantages

UAE maintains a straightforward taxation system which excludes both personal income and corporate taxes. Investments and business earnings from outside the country remain untaxed which results in substantial savings compared to countries with higher tax rates. Opening bank accounts in UAE enables international financial activities to be organized in ways that reduce tax liabilities according to legal standards.

2 – Political and economic stability

The UAE’s constitutional monarchy and democratically elected Federal National Council have granted the country more than half a century of unique regional stability. The UAE maintains steady economic growth through the development of its diversified sectors outside of oil. The consistent stability of the UAE generates increased confidence among international businesses and investors.

3 – Robust regulatory environment

The UAE provides a low-tax system while preserving strict transparency and oversight standards through the Central Bank of the UAE and the Financial Services Regulatory Authority. International banks functioning in the UAE need to follow worldwide anti-money laundering rules to protect client assets and maintain fully compliant transactions.

4 – Access to global markets

Apart from its strategic position between Western and Eastern markets the UAE maintains multiple bilateral trade agreements and allows visa-free entry to more than 80 countries. The comprehensive network of global connections enables UAE-based businesses to conduct international trade and investments.

5 – World-class lifestyle and infrastructure

The UAE’s world-class airports, seaports along with advanced road networks and telecommunication systems combined with a multicultural business environment and luxurious lifestyle options make it an attractive relocation destination for global professionals and their families. The current infrastructure in the UAE eliminates real obstacles when managing worldwide operations.

Let’s summarize the above items more clearly with an infographic.

How Does the UAE’s Regulatory Environment Support International Banking?

The UAE combines maximum business freedom with strict prudential oversight in the banking sector through two leading regulatory organizations.

The Central Bank of the UAE (CBUAE) acts as the top banking regulator which develops monetary policy and oversees the stability of the financial system while regulating banking institutions.

The Central Bank of the UAE issues directives which require banks to implement best practices in risk management, anti-money laundering controls, corporate governance, and consumer protection.

The Financial Services Regulatory Authority (FSRA) administers licensing and supervisory functions for all financial operations within the UAE’s free zones and international financial centers.

Digital offshore banks such as The Kingdom Bank deliver offshore banking services to international clients. The FSRA conducts regular audits on all licensed entities as part of its compliance maintenance strategy.

The CBUAE and FSRA work together to establish a strong regulatory framework which protects international clients’ assets and interests while avoiding excessive bureaucracy.

To keep their operating licenses banks must show that they meet the solvency and liquidity requirements along with other prudential standards from these regulatory bodies.

What Makes the UAE a Secure Destination for International Banking?

The UAE creates a robust and proactive multi-dimensional security approach to ensure international clients experience complete peace of mind alongside its prudent regulatory environment.

What Makes the UAE Safe for International Banking

1 – National security infrastructure

The UAE boasts one of the most powerful national security systems in the region which receives global intelligence partnership support. Advanced surveillance technology tracks activities with the goal of identifying and thwarting criminal schemes.

2 – Cybersecurity readiness

The UAE leads digital innovation while focusing heavily on cybersecurity readiness. Banks operate within strict information security guidelines and perform regular third-party penetration tests and audits. Government CERT teams maintain continuous operations to eliminate new online threats.

3 – Legal protections for investors and depositors

The commercial and civil legislation of the UAE protects contracts and the rights to private property. The UAE operates strong court systems which resolve disputes without bias according to standards recognized globally.

Both domestic and international bank deposits held by Emirati banks such as those with The Kingdom Bank receive insurance protection against risks.

4 – Adherence to global compliance standards

The UAE’s banking regulatory system strictly follows FATF guidelines making it impermeable to money laundering and terrorism financing activities. Rigorous adherence to know-your-customer (KYC) and due diligence procedures helps prevent unintentional support of financial crimes.

The multilayered security approach ensures international clients and businesses that their assets and data will stay fully protected when banking and investing under UAE jurisdiction.

How Does International Banking in the UAE Offer Tax Advantages?

The UAE provides a tax-free environment for both businesses and individuals which distinguishes it from many countries that impose high personal income taxes or dividend taxes.

International banking operations in the UAE result in multiple advantages for involved parties.

- The UAE does not impose taxes on revenues generated from overseas operations and foreign investments. Businesses have the option to keep profits for later reinvestment or to bring them back to their home country.

- Interest income and capital gains from Emirati bank accounts such as those with The Kingdom Bank remain exempt from withholding and capital gains taxes.

- International professionals have the benefit of negotiating compensation packages that maximize tax efficiency when working or establishing businesses in the UAE.

- Corporate tax rates of zero on worldwide income enable companies to offer more competitive prices to international clients.

- Holding precious metals offshore becomes straightforward since the UAE imposes neither taxes nor capital controls on them.

- International trusts and foundations set up in the UAE benefit from complete tax exemption on worldwide income and inheritance which positions them as powerful tools for estate planning.

The UAE gains a critical edge in global investment and banking through its tax exemption status and its prime location backed by strong infrastructure which leads to maximum after-tax returns.

The UAE delivers an unmatched value proposition through its strategic location, political stability and world-class infrastructure together with strong regulations and complete tax exemptions.

Digital offshore banks such as The Kingdom Bank provide worldwide clients with secure access to a unified online platform for managing their international banking activities. As the UAE economy undergoes rapid diversification international commerce opportunities will continue to grow.

International banking objectives can be best achieved by utilizing the resources provided by the UAE through forward-thinking financial institutions such as The Kingdom Bank.

What Types of Accounts are Available for International Banking in UAE?

UAE banks provide multiple account options that support international financial transactions to meet cross-border banking requirements.

UAE International Account Types

- Current Accounts function as transactional accounts which facilitate deposits and withdrawals across multiple currencies. Current accounts provide optimal solutions for managing business expenses as well as payroll operations and daily international financial transactions.

- Savings accounts deliver better interest rates compared to current accounts when you need to save money in multiple currencies for long-term growth.

- Time Deposit Accounts provide higher interest rates than savings accounts and require funds to be locked in for specific durations ranging from one month to five years.

- Escrow Accounts function as temporary holding places for funds dedicated to specific uses such as real estate transactions until all contractual requirements have been met.

- Multi-Currency Wallets store various currencies together and enable users to perform currency exchanges along with international transfers.

- Corporate Accounts provide specialized features for multinational companies including the ability for multiple users to access the account with payment routing functions and centralized billing systems.

- Investment Accounts enable clients to access worldwide investment platforms including online stockbrokers and robo-advisors directly through their UAE accounts.

International bankers and clients benefit from a wide range of account options that deliver flexible solutions designed to meet their specific cross-border financial needs and objectives.

How Easy is It to Open an International Banking Account in the UAE?

The process of opening an international banking account in the UAE is simple and normally requires only a few days to complete.

- Access your bank’s website such as The Kingdom Bank and fill out the online application form for opening a new account.

- Submit essential KYC documents which include a valid passport as well as proof of address and references. Taxpayers living outside of the UAE must supply their visa information.

- After completing preliminary verification, arrange a meeting either in-person or via video call at a bank branch to complete account opening formalities.

- All account opening agreements should be signed at the meeting and any necessary documents for enhanced due diligence should be supplied.

- Corporate accounts need to provide both business registration papers and authorization letters for opening.

- Your new account requires an initial deposit which typically ranges from AED 5,000 to 10,000 depending on bank policies.

- Your new international UAE bank account becomes operational after receiving your online banking credentials and debit card delivery in 5-7 business days.

UAE banks make it easy for people to open international accounts from overseas through simplified digital registration and quick account processing.

International bankers and clients find the account opening process in the UAE highly attractive because of its simplicity.

What are the Best Banks in the UAE for International Banking?

In the field of international banking services and digital solutions The Kingdom Bank ranks among the leading options in the UAE.

The bank provides essential benefits for managing financial operations across international borders.

- Clients can manage multiple currencies through digital wallets and accounts that operate continuously around the world.

- Advanced digital banking platforms enable seamless international transactions for money transfers and investments through online and mobile services.

- Integrated online brokerage services grant users direct access to global stock exchanges and investment opportunities.

- Private banking provides custom wealth management advice along with specialized trust services for high-net-worth individuals.

- Our corporate banking services include features for multiple users and account aggregation while providing payment routing capabilities.

- Digital banking and financial information remains protected through top-level security features and robust data protection.

- A specialized banking team delivers individualized service with multi-lingual assistance.

The Kingdom Bank combines its complete digital approach with international banking expertise to serve the specific requirements of clients worldwide.

UAE-based The Kingdom Bank emerges as the top provider for sophisticated online financial services that operate across international borders.

How Does the UAE’s Economy Impact International Banking Opportunities?

The structure and expansion path of the UAE economy impacts international banking opportunities directly.

Here are the effects

- The UAE became a regional hub through oil wealth but subsequently expanded its economy to include sectors such as trade and finance which now fuel the need for cross-border financial services.

- Through infrastructure improvements and business reforms the UAE has become a strategic base for multinational companies looking to extend operations throughout the Middle East and into Africa and South Asia which in turn has increased the need for corporate banking solutions.

- The increase of personal wealth among international high-net-worth individuals living in the country leads to greater demand for private banking services along with wealth management and investment solutions.

- The Gulf Cooperation Council single market stimulates cross-border investment and trade flows throughout its regional membership.

- Islamic finance and fintech sectors are creating new collaboration opportunities between international banks and local banks for specialized global financial products.

The UAE’s expanding diversified economic landscape generates a dynamic demand environment that enables international banks to innovate cross-border solutions and seize new opportunities.

Are There Any Restrictions on Foreigners Using International Banking in the UAE?

The UAE banking and financial sectors open to international participation with minimal restrictions for non-resident and non-Emirati nationals to access global banking services.

Some key points:

- Foreign national residents and non-residents in the UAE have unrestricted access to open bank accounts and take loans while fully utilizing banking services.

- Businesses and individuals can move their profits from the UAE without any restrictions for both commercial and personal needs.

- Foreign entities can establish fully owned banks or financial institutions in this jurisdiction after obtaining the necessary regulatory licenses.

- Emirati sponsorship is not necessary for employment in the financial sector but workers must still obtain appropriate qualifications and work visas similar to requirements in other industries.

- Foreigners do not have to pay any personal income or wealth taxes as taxation remains minimal. Free zone businesses are subject only to corporate tax and many receive exemptions.

- The UAE operates without exchange controls allowing uninhibited importation and conversion of foreign currency.

The UAE’s open banking environment together with business-friendly regulations provide worldwide access to its superior international banking infrastructure for both individuals and companies.

International banking has made the UAE a top choice because of its advantageous geographical position, dependable business environment, superior financial systems and supportive business regulations.

Opening an international banking account at The Kingdom Bank permits individuals and businesses to access world-class online banking services while directly connecting them to opportunities throughout Middle East countries as well as regions in Africa and Asia and further beyond.

Visit The Kingdom Bank’s website or reach out to our professional team to discover more about opening an international bank account.

The Kingdom Bank from the UAE stands out as the top choice for handling your international banking needs whether you need private banking solutions or corporate banking services to manage cross-border finances.

About The Author