What is a Corporate Banking Account for Business?13 min read

Reading Time: 6 minutesCorporate banking account can assist a business appear more professional while offering liability protection, as well as financial advantages such as investment solutions and credit-card services.

When looking at possible accounts for your money, be sure to compare interest rates, fees and other factors when assessing potential locations for it.

Choosing the right bank can have a major effect on your business. In this article we’ll go over how to open a corporate banking account and cover some essential aspects to know.

TİP ⇒Opening up a corporate banking account can be a straightforward process, though some documentation is required. Most banks will ask for government-issued ID, EIN number, incorporation documents for your company through online channels.

Requirements generally differ between banks. For instance, some may request you present either your registration certificate or state license as proof of residency.

What is a Corporate Banking Account?

An account created exclusively for your business enables you to separate its finances from those of your personal funds. Making spending and budgeting simpler and showing clients, vendors, and investors that your company is legitimate.

Opening a corporate banking account can be done online, in person, over the phone. Most banks generally require short applications with basic paperwork in order to open.

Once complete it’s important to compare fees and features offered by each bank in terms of cost-efficiency and convenience before selecting the one most suitable for your business.

Corporate accounts for business bring similar advantages as personal ones for companies, including wealth protection, clear financial records and access to loans for business use.

Furthermore, these accounts can offer more investment solutions. Many banks and credit unions provide this service; online banking services also often provide this as part of their overall offering.

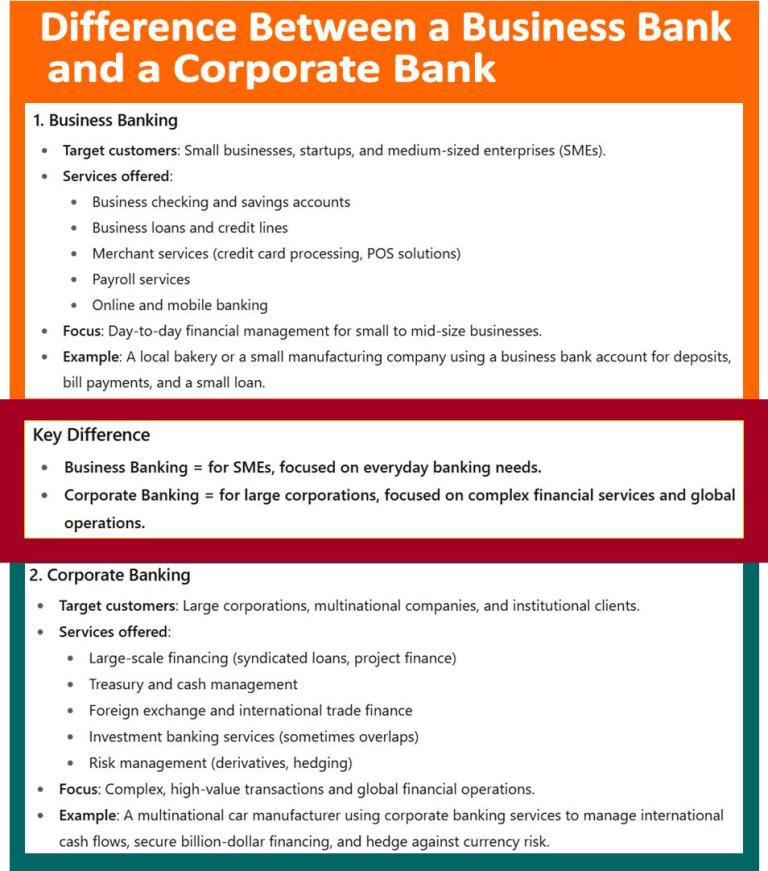

What is the Difference Between a Business Bank and a Corporate Bank?

Corporate accounts provide businesses with an effective means of managing wealth, bills, and financial transactions pertaining to their company while keeping personal and professional finances distinct.

These accounts help businesses regardless of industry size or scope. Furthermore, they’re needed when applying for credits or funding sources, filing taxes or making insurance claims so it’s essential that one understands all types of available accounts available to them.

Corporate banking accounts do not fit all, making it imperative to find one suitable to your financial needs. Considerations include type, fees and online accessibility as well as any services and support provided by the bank.

Some provide free or low-cost electronic transactions while others may charge monthly service fees. Your choice will ultimately depend on what best meets the requirements and complexity of your financial needs.

What is the Use of a Corporate Banking Account?

Corporate banks also offer investment management as an additional service, providing companies with consultants and funds to purchase or sell bonds, stocks, new companies or other assets. Furthermore, this service helps diversify investments while decreasing risk for business.

Corporate accounts for business provide many other advantages to their customers in addition to those listed above. For instance, they can help separate personal and business expenses, making keeping track of taxes online.

These accounts also simplify filing tax returns by eliminating the need to report business income/expenses separately on personal income tax returns.

One important advantage of having a corporate banking account is the protection it offers from being personally liable for company debts in case of bankruptcy, unlike personal accounts which can lead to losing money when used.

Important Information ⇒ These accounts assist in maintaining a professional image while making it simpler to file accurate taxes.

Your company bank account can serve as an ideal method for collecting customer payments made using credit cards, and other forms of online payment such as cryptocurrencies.

However, in order to accept credit or debit card payments you will require a merchant account as well. This stage becomes especially crucial if conducting international business or selling products or services online.

Your company can take these advantages of corporate banking thanks to The Kingdom Bank. You can reach The Kingdom Bank to launch your corporate banking transactions online.

What is the Difference Between Corporate Banking and Private Banking?

While corporate banking provides services that cater to huge businesses and organizations, including loans and financial advisory, private banking caters more closely to individuals and families by offering investment advice and wealth management.

Both types of banking have their own distinct set of advantages and disadvantages.

The major distinction between corporate and private banking lies in who they serve businesses versus individuals. Private banking may cost a bit more, but can provide access to more services and products, plus personalized service for individuals who have important financial needs.

Corporate banking requires more recurring relationship management through credit than idea generation or investment banking like transaction execution. For instance by providing daily working capital requirements through credits, or helping set up tax planning services for clients.

When operating in private banking however, credit facilities could be used more long-term for acquisition financing, bridge funding or debt capital markets (DCM). These can be counted for corporate account examples.

Private banking typically requires more of an emphasis on sales and marketing than research, idea generation and deal execution compared to investment banking roles.

Private banking workers could involve finding new clients, meeting with existing ones and helping them expand their investments. Private bankers tend to be separated between

Relationship Managers (RM) and Investment Professionals (IP), with one role focused on building client relationships while finding new business. The other takes responsibility for current accounts that need consultancy while reporting back on portfolio performance to RM.

Both roles require equipped individuals who can network easily to generate new business, with experience in equity, fixed income and international currencies to demonstrate expertise in various fields.

Both roles entail extensive education and experience, but private banking tends to pay more. Travel is likely necessary depending on the size of your client base. Meeting clients directly may also prove challenging if not in your country.

Requirements for Corporate Banking Account

Opening a corporate banking account might seem complex, but the process can actually be quite straightforward. Before opening one at online banking. However, certain requirements must be submitted first.

These may differ depending on which platform your bank works with ,generally speaking, though you’ll need a corporate resolution approved by your board of directors and an authorized signatory list for your account.

Your business requirements may differ depending on the bank and account type you’re opening. Typically this involves providing two forms of identification as well as your company’s proofs of incorporation for review.

When opening an international corporate account with foreign banks, additional documentation may be needed such as valid passport or visa documents. However, these steps can be done easier and with less time in The Kingdom Bank.

To manage a corporate banking account, you must be an executive or high-level representative of your company, with at least 30% ownership (usually expressed as a percentage of total assets) which can be verified via official documents like corporate resolutions or tax registration certificates.

Most banks charge a monthly service fee for corporate accounts. However, some will waive it if certain requirements are met. Furthermore, transaction or overdraft fees may also be asked.

There may also be minimum deposit amounts needed to open accounts, maximum ATM cash withdrawal limits per day or number of transactions per day which vary by bank.

When determining a corporate banking account, it’s essential to take into account how often you will use the account.

If you anticipate depositing and withdrawing significant sums often, an account with a higher limit might be a more right decision. In addition, make sure the bank accepts online payments such as The Kingdom Bank.

TİP ⇒ Another important consideration when selecting a corporate bank is security. A great way to safeguard your funds is selecting one with FDIC or NCUA insurance. This will guarantee they remain safe even if the bank fails. As The Kingdom Bank we offer these reliability standards.

About The Author