Offshore Bank Account Cayman Islands in 2026 (Detailed Guide)18 min read

Reading Time: 7 minutesThe subject we will examine is Offshore Bank Account Cayman Islands. Offshore bank account has become very common in the Cayman Islands, as it is all over the world.

Quick note ⇒ Nestled in the heart of the Caribbean Islands lies the enigmatic Cayman Islands, an illustrious British Overseas Territory that boasts an unrivaled reputation as a vanguard of offshore financial prowess.

Renowned for its dexterity in investment and banking services, this hidden gem captivates the imagination with its audacious offshore finance industry, commanding an astonishing 75% stranglehold on the world’s offshore funds.

Such an unparalleled feat solidifies its exalted status as one of the most coveted global financial epicenters.

Emerging as the sixth-largest offshore banking behemoth on the international stage, the Cayman Islands derives its economic vitality from the thriving offshore business and finance sector.

This indomitable economic force propels the Cayman Islands to claim the prestigious rank of the 14th largest GDP in the world, an unequivocal testament to its resounding financial clout.

Where in the World is the Cayman Islands?

The Cayman Islands, an awe-inspiring assemblage of islands and an overseas territory of the United Kingdom, are ensconced in the resplendent turquoise waters of the Caribbean Sea.

This archipelago encompasses three principal islands – Grand Cayman, Little Cayman, and Cayman Brac – which are nestled amidst an underwater mountain range stretching from Belize to Cuba. These islands lie roughly 180 miles (290 km) distant from the vivacious shores of Jamaica.

Presiding over this paradisiacal oasis is George Town, a bustling metropolis perched upon the largest of the islands, Grand Cayman.

Can I Open Offshore Bank Account in the Cayman Islands?

The Cayman Islands boasts a robust financial services industry and favorable tax laws, making it an alluring haven for those seeking a foothold in this jurisdiction.

Whether your aim is to reside, labor, or invest in these islands, a bank account becomes paramount for managing your financial affairs in the region.

Although the process of initiating a bank account in the Cayman Islands may prove more intricate compared to other domains, adhering to the requisite procedures will set your enterprise on the correct trajectory.

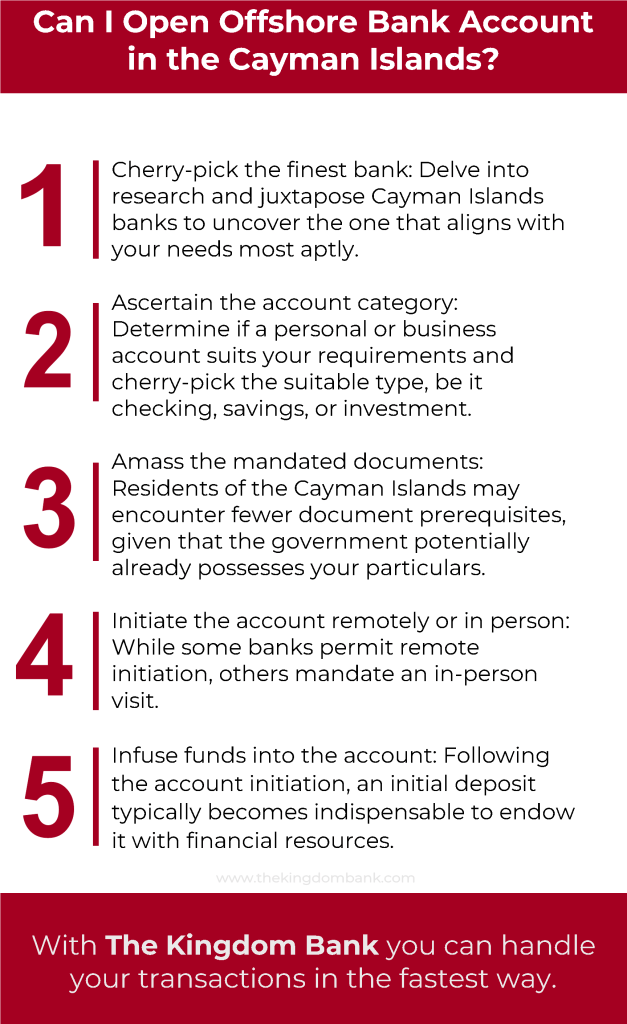

Procedures for Opening an Account in the Cayman Islands

- Cherry-pick the finest bank: Delve into research and juxtapose Cayman Islands banks to uncover the one that aligns with your needs most aptly.

- Ascertain the account category: Determine if a personal or business account suits your requirements and cherry-pick the suitable type, be it checking, savings, or investment.

- Amass the mandated documents: Residents of the Cayman Islands may encounter fewer document prerequisites, given that the government potentially already possesses your particulars.

- Initiate the account remotely or in person: While some banks permit remote initiation, others mandate an in-person visit.

- Infuse funds into the account: Following the account initiation, an initial deposit typically becomes indispensable to endow it with financial resources.

♦ Let’s show these as an infographic ⇓ ⇓

How Much Money Do I Need to Open a Offshore Bank Account?

The expense associated with onboarding novel clients has undergone an astronomical surge in the bygone quinquennium.

Important Information : This astronomical surge can be ascribed to a myriad of factors, encompassing the amplification of information-sharing treaties, more rigorous regulations, stricter Know Your Customer (KYC) and Anti-Money Laundering (AML) prerequisites, and intensified scrutiny on offshore banks in their entirety.

Regrettably, these magnified costs are ultimately shouldered by the consumer. In the realm of offshore banking, it has become customary for banks to levy charges for scrutinizing submissions.

Whilst there may be circumstances where these charges are waived or reimbursed, they typically span from $150 to $2,000 per submission.

It is worthy to note that these figures do not encompass any remunerations paid to third-party introducers. The account opening fees mentioned are imposed directly by the bank. The Kingdom Bank will be the best choice for this.

Is it Illegal to Have a Bank Account in the Caymans?

Cayman Islands banks unveil an array of accounts meticulously crafted to cater to your specific desires.

Whether you yearn for an offshore bank account, an investment fund account, or a prestigious private bank account, Cayman banking can furnish you with an account that harmonizes flawlessly with your business and personal prerequisites.

With offshore banking, private account holders can perform all their transactions from the Cayman Islands.

Understanding the disparities between an offshore account and an investment account assumes paramount importance since each one possesses its own distinctive tax ramifications.

Contrary to prevailing notions, it is not obligatory to physically voyage to the Cayman Islands in order to inaugurate an account. Accounts can be inaugurated remotely via mail, thereby obliterating the necessity of a visit.

To unearth a Cayman Islands bank with fiercely competitive rates, you can harness online resources or approach your local British embassy for a roster of highly recommended banks.

Furthermore, it is imperative to ascertain whether the banks mandate an “apostilles” stamp since this constitutes a special certification that might prove indispensable for international treaty compliance. With The Kingdom Bank you can handle all transactions easily!

Why Do People Have Offshore Accounts in the Cayman Islands?

A financial haven beckons as a jurisdiction that legislates to seduce businesses and offers alluring tax conditions, such as a “zero-tax” policy and offshore banking services.

Amongst the myriad of tax havens worldwide, the Cayman Islands shines as one of the most eminent. This territory enthralls investors with its complete absence of capital gains tax, income tax, estate tax, corporate tax, withholding tax, and gift tax.

Moreover, businesses operating within the Cayman Islands are exempt from the onerous stamp duty on transactions. Despite being under the dominion of the United Kingdom.

The Cayman Islands possesses its own constitution and laws that classify it as a tax haven. It consistently spurns any tax treaties with foreign nations, thereby shielding offshore corporations from scrutiny by their home countries’ tax authorities.

The lack of a corporate tax policy in the Cayman Islands endows it with a particularly irresistible allure to international companies.

With an awe-inspiring 100,000 registered companies, approximately 20,000 of which reside in the acclaimed Ugland House, a five-story building, this British Territory has firmly cemented itself as a leading global hub for businesses seeking tax advantages.

Offshore Bank Account with No Minimum Deposit

When delving into the mysterious world of offshore banking, one can venture to embark on an account-opening adventure without any initial deposit. Nevertheless, it behooves us to grasp the notion that banks are profit-seeking creatures.

Therefore, should you choose not to nurture a deposit with these financial beasts, brace yourself for the lurking specter of fees that may manifest in unexpected corners.

It is of utmost importance to apprehend the myriad of ways these banks levy charges upon those who dare to keep an empty vault.

Though the gates of a free offshore bank account may swing open for all, it is of paramount importance to pinpoint those banks that cater specifically to your unique client profile.

Furthermore, it is crucial to fathom the bank’s cunning machinations in generating revenue from your account, should you dare not bestow it with initial funds.

This profound understanding takes on an even greater significance in the enigmatic realm of offshore banking, where the pursuit of consumer lending is but a secondary fount of income for these financial enigmas.

Offshore Bank Account Cayman Islands Interest Rate

In the Cayman Islands, folks can venture beyond the norm of checking and savings accounts and dive into extraordinary means of boosting their assets.

While the typical banking choices offer diverse interest rates, a fixed deposit, also dubbed a fixed term deposit, unveils an alluring chance to attain the utmost gains.

By stashing away a predetermined sum for a designated stretch, individuals can lock in the most advantageous interest rates that the Cayman Islands banking realm has to offer.

Moreover, these alternative pathways furnish folks with a myriad of prospects to fortify their fiscal standing and seize upon their investments.

Offshore Bank Account Cayman Islands Fees

Non-residents seeking to start an account with Cayman are typically required to initiate with a princely sum of US$1,000, while the threshold for CDs commences at a more substantial US$5,000.

Cayman grants the privilege of holding funds in a plethora of major currencies, encompassing CI$, US$, CAD$, Sterling, and others. It is worth noting, though, that specific currencies might call for loftier account balances.

Notwithstanding these stipulations, it is judicious for Americans to cast their gaze upon Cayman National solely if they are prepared to safeguard a minimal balance of $30,000 within their account.

Cayman National reserves the title of “premium accounts” exclusively for those that boast balances of $250,000 or beyond.

Is there an update regarding the Cayman Islands Offshore Bank Account?

Yes. Especially there are notable developments in 2026 related to offshore banking and financial reporting in the Cayman Islands.

Particularly affecting how bank accounts and financial institutions (including offshore accounts) are regulated and reported.

Here’s a brief summary of the key updates:

1. Updated International Reporting Rules (CRS 2.0 / CARF)From 1 January 2026, the Cayman Islands implemented major revisions to its Common Reporting Standard (CRS) regime, often referred to as CRS 2.0. These changes align the territory’s tax-information exchange framework with the latest Organisation for Economic Cooperation and Development (OECD) standards. Source → Cayman Islands 2026 Updates

2. Regulatory and Fee Changes in the Financial Sector

Alongside CRS reforms, wider regulatory tweaks around funds, fees and licences are underway, which can indirectly affect offshore banking services in the Cayman Islands. Source → Cayman Islands CARF and CRS 2.0 Update

3. Regulatory and Fee Changes in the Financial Sector

Alongside CRS reforms, wider regulatory tweaks around funds, fees and licences are underway, which can indirectly affect offshore banking services in the Cayman Islands. Source → Cayman Islands Fund Update

4. Strategic Moves by Banks

Clarien Bank has agreed to acquire the Cayman Islands banking business of NCB Financial Group, planning to expand its banking and investment management services in the Cayman Islands subject to regulatory approvals.

Benefits of Having an Offshore Bank

Let’s dissect each benefit with intricate scrutiny.

- Fortification and safeguarding: Employing offshore bank accounts can abet individuals or companies in alleviating the perils associated with retaining money in domestic banks. By selecting an offshore bank situated in a meticulously governed and transparent jurisdiction, such as the Isle of Man, for instance, individuals can exude confidence that their funds are well-fortified.

- Confidentiality and service excellence: A notable advantage of possessing accounts held beyond one’s homeland is the amplified privacy it bestows.

- Ease and accessibility: For jet-setting professionals, the ability to uphold a solitary bank account regardless of how frequently they relocate is a monumental convenience.

- Tax strategizing: Offshore banking can provide expat tax benefits; however, the applicability of these advantages hinges on individual circumstances, such as the country of residence.

- Offshore investment: Affluent individuals often engage in offshore investment as a customary practice.

- Preferential foreign exchange provisions: Individuals who conduct international business can reap the benefits of conserving and transacting in foreign currencies.

Let us remind you :Having a The Kingdom Bankaccount is one of those benefits! You can contact us for Offshore Bank Account in the Cayman Islands.

Update information: This article was updated in 2026.

About The Author