Easiest Way to Do Cross Border Payments11 min read

Reading Time: 5 minutesWith this 2025 guide, you will make your cross border payments faster and easier. As businesses interact with partners, suppliers, and customers across borders more than ever, efficiently managing cross border payments has become increasingly important.

In today’s globalized world, international trade and commerce are booming. While international money transfers have traditionally involved complex paperwork and lengthy waiting periods, modern digital banking platforms have thankfully streamlined the process.

In this article, we’ll explore the ins and outs of cross border payments – what they are, how they work, typical processing times, suitable payment methods, exchange rates, and associated costs and fees.

We’ll also discuss how The Kingdom Bank, a premier digital bank, offers one of the easiest ways to send and receive international funds.

By the end, you’ll understand why more and more businesses are turning to digital banking providers like The Kingdom Bank for fast, low-cost cross border payment solutions.

What are Cross Border Payments and How Do They Work?

A cross border payment simply refers to a financial transaction involving the transfer of funds from an individual or business in one country to a recipient in another country.

Traditionally, such payments were made through bank wires and involved numerous intermediary banks, resulting in long waits and hefty fees.

Today, many digital banks have streamlined the process through advanced payment infrastructure and partnerships.

At its core, a cross border payment through The Kingdom Bank works similarly to a domestic transfer.

Funds are deducted from the sender’s account and credited to the recipient’s account in real-time or within one business day.

Behind the scenes though, The Kingdom Bank’s payment networks allow the transfer to occur directly from its proprietary financial rails rather than relying on legacy clearing systems.

This results in remarkably fast processing times, increased security, and lower costs compared to traditional bank wires. It’s truly one of the easiest ways to send money internationally!

What are the Processing Times for Cross Border Payments?

When it comes to cross border payment processing times, speed and certainty are top priorities for businesses. Historical barriers caused by multiple intermediary institutions often resulted in waits of 3-5 business days just for funds to reach the recipient, creating delays and uncertainties that impacted cash flow.

With The Kingdom Bank’s seamlessly integrated global payment networks, standard cross border payments are typically delivered within one business day.

And for many major currencies pairs between high-volume corridors, funds may arrive instantly through The Kingdom Bank’s proprietary clearing infrastructure.

This represents a huge improvement over traditional banking. No more waiting around wondering when an international transfer will complete.

With The Kingdom Bank, businesses enjoy fast and predictable settlement of funds so they can rely on cross border payments to keep business moving at the pace of today’s digital economy.

What are the Most Suitable Payment Methods for Cross Border Payments?

When it comes to choosing a payment method for cross border payments, factors like processing speed, costs, recipient location, and currency must be considered.

Here are some of the most commonly used options and when each may be most suitable:

- Wire Transfer – For urgent payments, bank wires provide same-day delivery but generally charge higher fees. Best for time-sensitive international transfers.

- Automated Clearing House (ACH) – Processed like an electronic check, ACH is slower at 1-3 business days but lower-cost. Ideal for routine supplier or payroll payments.

- Credit/Debit Card – Convenient option but typically carries higher costs. Best when paying individuals. Some digital banks like The Kingdom Bank pass on discounts for business card payments.

- Cryptocurrency – Emerging option that promises faster low-cost settlements, but volatility risks remain. Crypto exchanges integrated with The Kingdom Bank minimize risks.

How are Exchange Rates Determined in Cross Border Payments?

One factor that significantly impacts cross border payments is foreign exchange, or FX, rates. When funds are transferred between different currencies, they must be converted at the prevailing rate.

For major traditional banks, their internal rates are often less competitive than wholesale interbank rates.

However, digital banks like The Kingdom Bank have direct access to deep liquidity pools and real-time exchange rates.

Through our payment infrastructure, we are able to source highly competitive rates and pass savings directly to clients. Rates are locked in at the time of initiation for added transparency and certainty.

What are the Costs and Fees for Cross Border Payments?

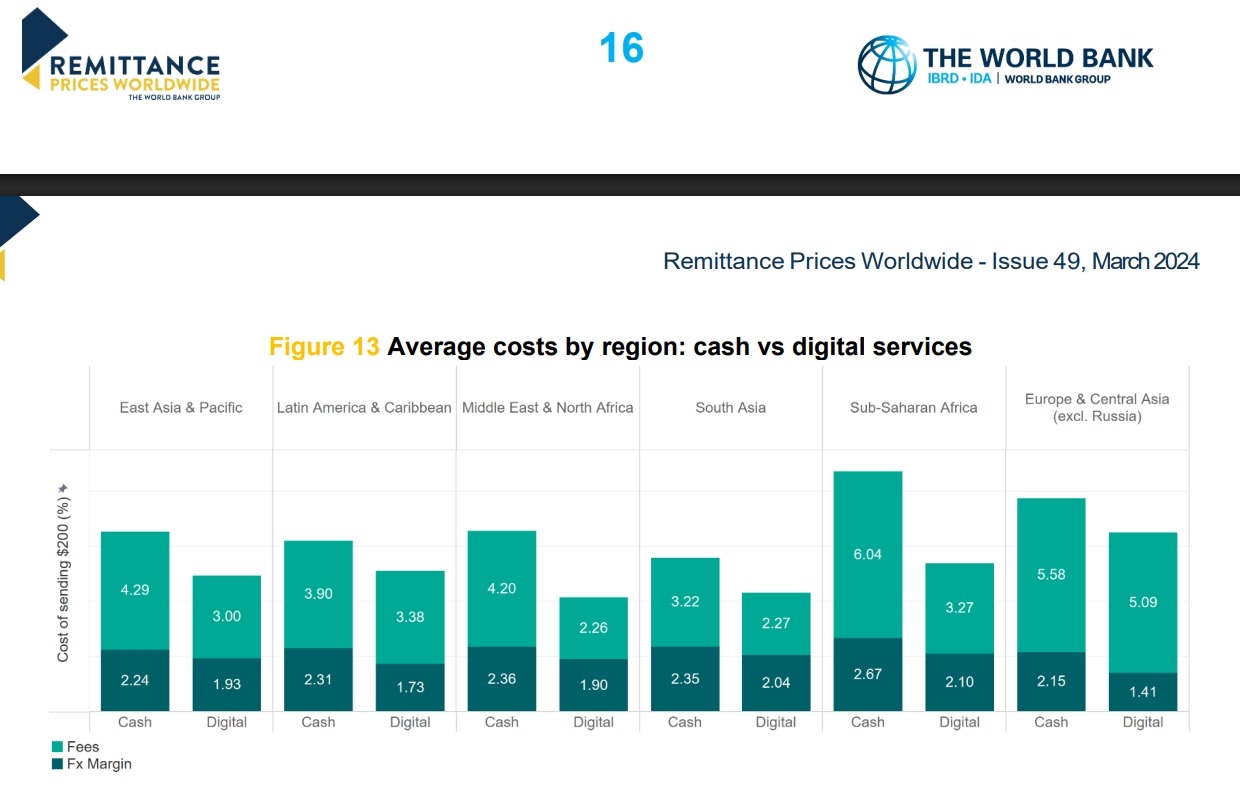

Fees have historically posed one of the greatest barriers to cross border payments, with traditional international money transfers incurring an average total fee of 6-8% according to World Bank data.

Charges vary extensively depending on the payment method, currencies involved, intermediary institutions, and other factors.

Digital banks aim to reduce these obstacles through streamlined technology and scale. At The Kingdom Bank, transparent pricing makes it easy to understand costs upfront.

Standard cross border payments within its network are extremely affordable, priced from just $5-$15 per transaction depending on currency and route.

Compare this to average wire fees of $35-$50 through legacy institutions. The Kingdom Bank also harnesses its payment volume to negotiate competitive exchange rates with no hidden FX fees deducted from amounts received.

Savings really add up for businesses processing frequent international money movements.

Additional optional services like same-day delivery or account currency conversions are priced reasonably to avoid surprises.

Truly, with The Kingdom Bank’s great competitive rates and lack of unnecessary intermediary charges, businesses discover cross-border payments don’t have to break the budget after all. It delivers one of the cheapest and simplest solutions available.

Whether you’re an established multinational or an online SaaS startup with global clients, efficiently processing cross border payments is essential in today’s digitally connected world.

While traditional methods often fall short, modern banking platforms are reinventing international money transfers to be faster, easier, and significantly more affordable.

For any business regularly conducting cross border payment transactions, The Kingdom Bank provides a seamlessly integrated solution with ultra-competitive exchange rates, low fees, and remarkably fast processing – all through an intuitive digital experience.

It removes barriers that once made international transfers complex and costly, simplifying global commerce.

If you’re ready to take advantage of fast, affordable cross border payment solutions and focus less on finances so you can focus more on growing your business globally, sign up today to open a The Kingdom Bank business account free of charge.

Let us handle your international payments while you get back to what really matters.

About The Author