Can Small Businesses Access B2B Banking Services?22 min read

Reading Time: 8 minutesCan Small Businesses Access B2B Banking Services? Yes, it can. We’ll explain the details of this topic in this article.

Access to banking solutions is crucial for small businesses. With B2B banking accounts, you can seamlessly handle many of your small business’s transactions.

These accounts enable you to manage all your corporate needs, including intercompany money transfers, bulk payment management, foreign exchange transactions, and cash flow monitoring.

Your business can access the same financial privileges as large companies with your banking account. These accounts allow you to manage regular supplier payments, international trade, or project-based cash management processes.

Benefits to Your Business ↵ B2B banking services save your business time and make your financial processes much more transparent. B2B banking providers provide access to a wide service network, from traditional banks to fintech-based solutions.

B2B banking digital solutions enable your small business to manage all financial transactions at a low cost. Payments can also be completed much faster. You can manage your transactions instantly through an online dashboard or mobile app.

As a small business owner, you can compete with larger companies. You can manage your finances with the particular advantages of speed and efficiency.

Large businesses enjoy many financial privileges in banking. However, small businesses cannot benefit from a significant portion of these privileges. Thanks to B2B banking accounts, your small business can benefit from these privileges.

Quick Note ↵ With these accounts, you can make regular supplier payments, conduct foreign exchange transactions, and complete bulk money transfers with a range of advantages. You can also manage your cash flow.

You can manage all these processes from a single dashboard through your B2B banking account. This helps save you time. Furthermore, your payments and collections are completed quickly and securely.

Traditional banking transactions and fintech-based digital platforms can be handled through B2B banking providers.

These institutions offer B2B payment solutions, providing you with access to low transaction costs. Transfer times are also very short. B2B banking with multi-currency support and easy online access also awaits your small business.

Your small business can strengthen its competitiveness in local and international markets, providing access to a professional, secure, and efficient financial infrastructure.

Discover the best B2B banking solutions for startups at The Kingdom Bank. Best B2B banking services for startups can be easy with The Kingdom Bank.

Can Small Businesses Access B2B Banking Services?

Yes. B2B banking simplifies your business’s financial transactions. You can handle supplier payments, bulk money transfers, and foreign exchange transactions with these solutions. You can also quickly manage your commercial Credit.

These services allow your small business to benefit from the financial advantages offered by larger companies.

With modern banking and digital solutions, you can professionally track your business’s cash flow. You can access all processes, including payment automation and international trade payments.

B2B banking services are much more than traditional bank corporate accounts. Digital solutions provided by fintech companies can also be integrated into B2B banking. Here are some key points to consider when choosing the best B2B banking solutions:

With these services, you can initially make payments with low transaction fees. You can also access real-time reporting. You can also benefit from a user-friendly interface. Additionally, you can utilise scalable financial management tools.

Your small business’s operations will be more efficient, which can increase your competitiveness in your market. If you’re looking for the best B2B banking services for startups, The Kingdom Bank is the place to be.

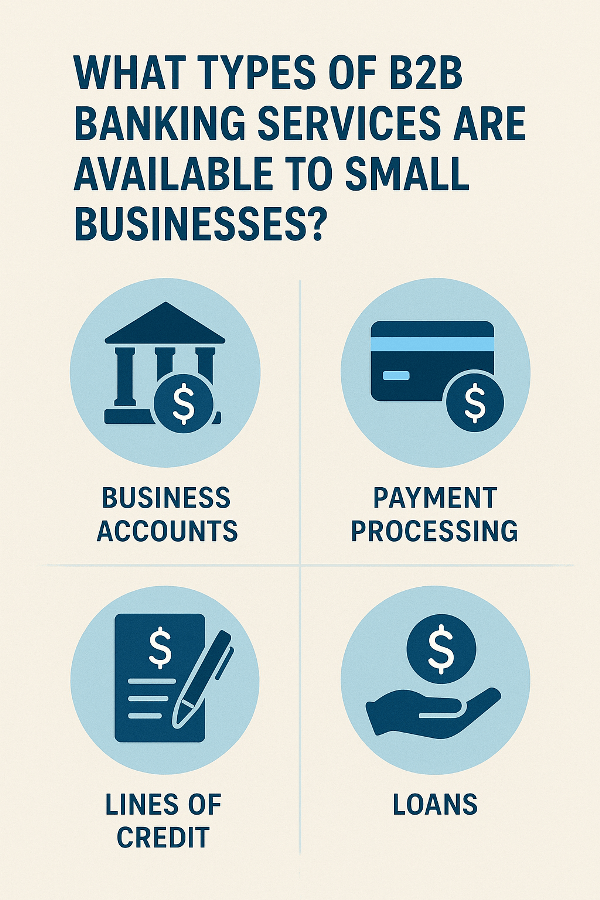

What Types of B2B Banking Services Are Available to Small Businesses?

B2B banking for small businesses involves financial transactions conducted through your business with another company.

B2B accounts make this process faster and more secure. You can make payments to suppliers, both domestically and internationally, through these methods.

Making your payments this way reduces your costs and also makes your operations more efficient. If a small business wants the same level of financial resources as its larger competitors, it can access B2B banking services.

B2B Banking Services for Businesses in 2025

- Corporate Account Management: You can manage bulk payments, invoice tracking, foreign exchange transactions, and cash flow through dedicated accounts opened in your company’s name.

- Digital Banking Solutions: Offers 24/7 access, automatic payment orders, and instant balance and report views via web and mobile applications.

- B2B Payment Systems: Enables secure, fast, and low-cost money transfers to suppliers, dealers, and business partners.

- International Trade Services: Provides a secure payment infrastructure in the global market with solutions such as foreign exchange accounts, SWIFT transfers, and letters of Credit.

- Integration and Automation Tools: Works seamlessly with ERP or accounting software, reducing manual processing overhead and minimising error risk.

If you’d like to learn more about how B2B banking works, contact The Kingdom Bank now.

How Do Small Businesses Benefit from B2B Banking?

Small businesses conduct financial transactions with their business partners and suppliers in various ways. Benefits of B2B banking for your business. With this type of banking, you can complete your financial transactions quickly, securely, and efficiently.

You can manage your payment processes, collections, international trade transactions, and automation processes through these systems. You can achieve time and cost advantages for your business in many areas.

With the right B2B banking solutions, your business can compete with its larger competitors. You can manage your financial processes most efficiently.

Here are ways small businesses can benefit from B2B banking:

- Payments and collections are handled with the highest security standards through encryption, multi-factor authentication, and transaction tracking.

- B2B banking online access: Offers 24/7 account tracking, payment order placement, and instant reporting via web and mobile platforms.

- Operational efficiency: Reduces manual processing overhead with automatic payment orders and accounting integrations.

- Global trade support: Creates a reliable payment infrastructure in the international market with solutions such as foreign exchange accounts, SWIFT transfers and letters of Credit.

Click here now to learn “how does B2B banking work?” B2B payment solutions are waiting for you here.

Are There Minimum Requirements for Small Businesses to Use B2B Banking?

Your small business must submit certain documents to benefit from B2B banking services. Basic corporate documents such as company registration documents, tax identification numbers, and authorised signature circulars are sufficient.

The advantages of using banks or fintech-based B2B banking services await you. This allows your business to manage its payment processes digitally and begin to reduce operational costs.

You can also strengthen your relationships with suppliers. You can manage all your processes, such as bulk payments, invoice collection, and cash flow management, from a single dashboard.

Bonus Tip ↵ Working with an advanced platform allows you to access B2B banking with multi-currency support.

These services help your small business navigate international trade flexibly. You can transact in different currencies as needed. You won’t be affected by exchange rate conversions. Transfers will also be fast and save you money.

Important ↵ Furthermore, B2B banking compliance and security measures ensure full legal compliance. During this process, you should also utilise standards such as strong encryption technologies, multi-factor authentication, and transaction tracking.

This allows your small business to securely manage its financial processes in both local and global markets. Visit The Kingdom Bank now to learn how to choose a B2B banking partner and take action.

How Can Small Businesses Choose the Right B2B Banking Services?

If you have a small business, you should first learn about B2B banking fees when choosing B2B banking services. This includes per-transaction commissions, monthly account maintenance expenses, foreign currency transfer costs, and additional service fees.

Your business should choose platforms that offer low-cost and comprehensive services tailored to its needs. This makes the financial management process more budget-friendly. Reliable B2B banking customer support ensures prompt responses at all times, helping you avoid any potential issues.

If you operate in the international market, you can benefit from international B2B banking services. This allows you to transact with advantages such as multi-currency support, fast transfer times, and compliance with global regulations.

To learn “How B2B banking improves cash flow management?” visit our website The Kingdom Bank.

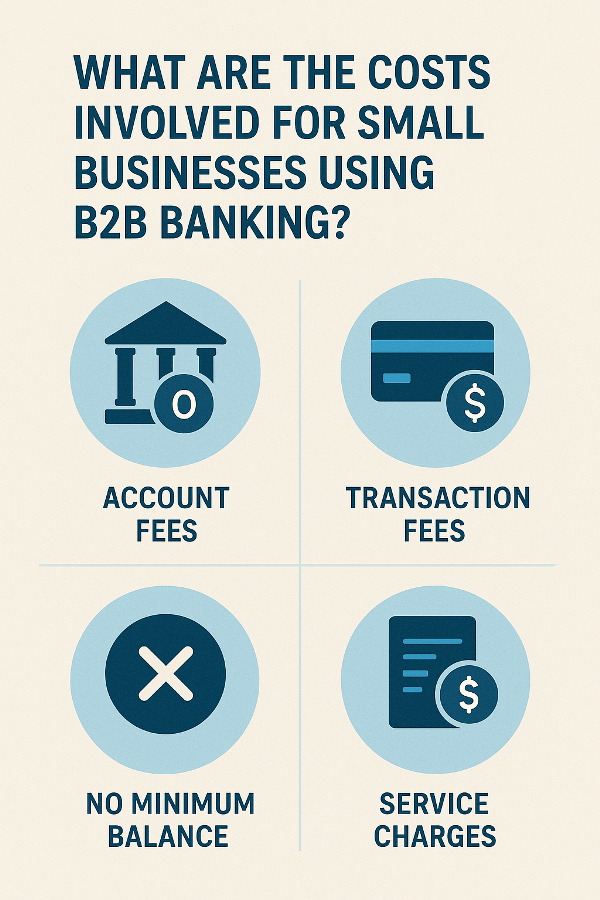

What Are the Costs Involved for Small Businesses Using B2B Banking?

Your small business can securely manage its financial transactions digitally through B2B banking. However, to take advantage of these benefits, you must meet certain costs. These costs vary depending on the service you purchase.

We’ll explain B2B banking fees and other costs immediately.

B2B Banking Fees

- Account Opening and Administration Fees: Some banks or fintech platforms charge an initial fee for opening a corporate account and may charge a monthly/annual account management fee.

- Transaction Fees: Commissions may apply per transaction for wire transfers/EFTs, international money transfers, or foreign exchange transactions.

- Subscription and Package Fees: Additional features such as customised reporting, integration, or multi-user support may require a package-based subscription fee.

- POS and Payment Infrastructure Expenses: Certain setup and transaction fees may apply when using online collections, virtual POS, or API integration.

- Exchange Rate and Conversion Differences: International transactions may incur exchange rate difference fees, with bank or provider margins added.

Start trading with The Kingdom Bank now for B2B banking compliance and security measures.

Can Small Businesses Get Customised Solutions Through B2B Banking?

Next-generation B2B banking services help your small business with its basic financial transactions. They also offer solutions tailored to your specific needs. You can seamlessly track your cash flow in these accounts.

You can transact in multiple currencies if you wish. You can make timely payments to suppliers and take advantage of automatic invoicing features. You can also access different services depending on the scope and scale of your business.

B2B banking for small businesses offers the same service quality as large businesses. You can access these services flexibly and affordably. Customised solutions also include industry-specific payment infrastructures.

These platforms also offer personalised reporting tools and integrated accounting systems. You can use all services within a secure B2B banking infrastructure. This ensures your data is protected and your financial transactions run smoothly.

Small businesses can use financial systems tailored to their operational infrastructure. If you’d like to take advantage of these solutions, you can contact The Kingdom Bank.

“How B2B banking improves cash flow management?” You’ll see over time. We offer B2B banking solutions for growing businesses.

How Does B2B Banking Support Cash Flow Management for Small Businesses?

If you have a small business, you can maintain a balance of income and expenses with B2B banking services.

This helps ensure your business’s operational continuity. The B2B banking system offers advanced reporting and automatic payment plans. You can also implement financial integrations.

B2B banking digital solutions enable you to easily monitor and predict your cash flow. B2B banking customer support provides immediate assistance in the event of an issue. This eliminates any financial concerns.

Bonus Tip ↵ B2B banking solutions contribute to your cash flow by

Identifying potential cash shortages early by monitoring income and expenses in real time.

B2B Banking and Cash Flow Management Support for Small Businesses

- Avoiding late payment interest by making regular invoices, salary payments, and supplier payments on time.

- Visualising cash flow with graphs and detailed reports can support strategic decision-making.

- Maintaining liquidity balance by managing exchange rate fluctuations in international transactions.

- Maintaining uninterrupted cash flow by quickly resolving financial transaction issues.

Are Online B2B Banking Services Accessible for Small Businesses?

Digital transformation is accelerating in every field. B2B banking solutions are suitable for businesses growing online, as well as for small businesses. Thanks to cloud-based and mobile-friendly systems, you can access a wide range of services at low costs.

This allows your business to integrate into local and global markets efficiently. Advantages of using B2B banking services include fast account management and automatic payments. You can also schedule collections.

Multi-currency support simplifies your international trade activities. Currency conversion, exchange rate monitoring, and multi-account management offer significant convenience during these processes.

With The Kingdom Bank, you can securely manage all your financial processes without being constrained by geographical boundaries. If you’d like to learn how to choose a B2B banking partner, visit us now. B2B banking online access is carried out on our website.

How Secure Are B2B Banking Services for Small Businesses?

Digital banking solutions and advanced encryption technologies are among the top benefits of B2B banking. Small businesses can utilise security measures such as identity verification, two-factor login, and instant transaction monitoring for their online transactions.

Security measures provide your business with a secure environment for financial data and business transactions. Cloud-based systems and mobile applications offer online access to B2B banking, allowing you to conduct financial transactions from anywhere securely.

International B2B banking services simplify your international transfer processes, allowing you to take advantage of fraud prevention protocols. You can manage exchange rate fluctuations and safely transact in multiple currencies.

All of these advantages enable you to achieve your growth goals and eliminate financial risks along the way. If you’d like to learn more about how B2B banking services, visit our website The Kingdom Bank now.

About The Author