Euro IBAN Account and Multi-Currency (Which is the best choice)24 min read

Reading Time: 9 minutesWith a Euro IBAN account, you can quickly make SEPA transfers within Europe with low commissions. You also avoid any legal obstacles. You can use this account in e-commerce, consulting, and digital services.

TİP ↵ You can receive direct payments with these accounts through platforms like The Kingdom Bank. You can also conduct online transactions with digital banks that have offshore business banking infrastructure. An offshore debit card allows you to manage your international spending easily.

A multi-currency account allows you to conduct transactions in different countries while also benefiting from offshore operating profits.

Holding a balance in currencies like USD, GBP, and EUR reduces your currency conversion costs. With business offshore banking systems, you can conduct transactions with high confidentiality. You also benefit from low taxes and mobile access.

The Kingdom Bank allows you to manage your multi-currency transactions on one screen. Here, you can manage your global operations in a single interface.

Here, you can make payments based on your payment habits and geographic location. You can make transactions in all currencies by obtaining a business offshore debit card.

A Euro IBAN account allows you to make SEPA transfers anywhere in Europe. This significantly reduces your commissions. You can also make payments as you wish using platform like The Kingdom Bank.

If you’re receiving payments from a customer in Europe, you can use this account type on your mobile device. If you choose the best online debit card, you can use these accounts securely. You can also check your balance in real time.

A multi-currency account allows your business to receive payments from different countries in the currency of your choice. With an offshore banking infrastructure, you can protect your money in various currencies such as USD, GBP, and EUR. You can also conduct transactions in these currencies.

An offshore account offers the advantage of confidentiality in your financial transactions. You also expect lower tax rates. Additionally, you can manage your finances flexibly.

Obtaining an offshore debit card for your business can be very easy at The Kingdom Bank.

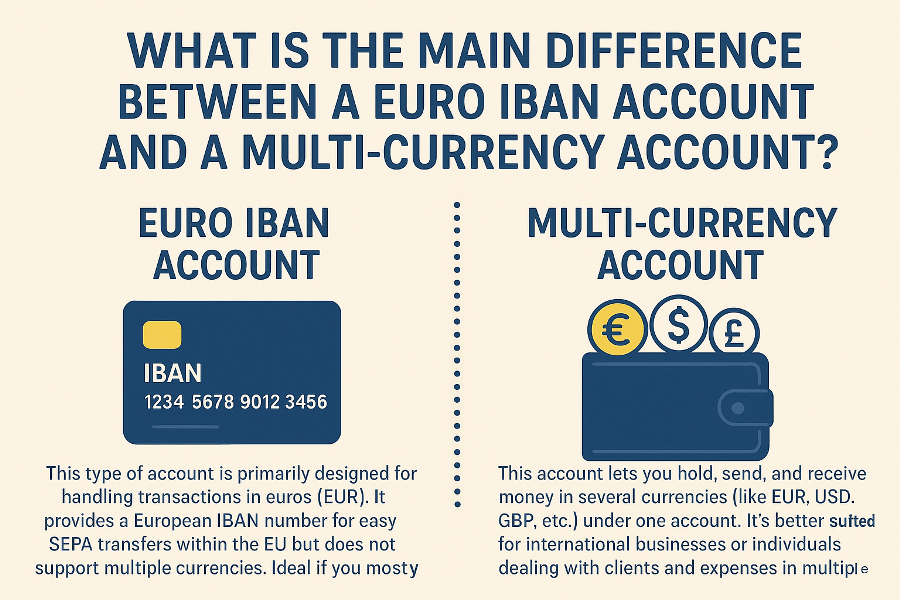

What is the Main Difference Between a Euro IBAN Account and a Multi-Currency Account?

A Euro IBAN account allows you to make SEPA-compliant money transfers in Euros only. Commissions are reduced for intra-European transactions.

It also allows you to execute transactions quickly. With these accounts, your business can receive direct payments from customers in Europe. You can benefit from this account type in many sectors.

Once you configure your account as an offshore bank account, you can manage your Euro IBAN account from the mobile app. This allows you to conduct secure transactions in compliance with European regulations.

A multi-currency account allows your business to accept payments in multiple currencies from different countries.

An offshore bank account minimizes your currency conversion costs. Digital banks with this infrastructure allow you to hold balances and conduct transactions in currencies such as USD, GBP, and EUR. These transactions result in lower tax rates.

The best debit card online is with The Kingdom Bank!

How Does a Euro IBAN Account Work Compared to a Multi-Currency Account?

A EURO bank account allows your business to make transfers within Europe. Payments are made at low cost and are legally compliant. You can only transact in Euros with these accounts. European-based digital banks offer these services.

If you convert these accounts into offshore bank accounts, you can open them without physically visiting a branch.

You can use the debit card provided through the account at European POS devices and ATMs. You can securely shop online by creating a virtual debit card.

If you open a multi-currency account, you can perform financial transactions in different currencies. This reduces your currency conversion costs. You can also seamlessly make payments to international suppliers.

Using an offshore bank account maximizes privacy. You can also reach customers in different countries.

With virtual debit card integration, you can make online payments in other currencies. You can also set separate limits for each transaction.

Which Account is Better for Frequent Euro Transactions: a Euro IBAN Account or a Multi-Currency Account?

You should choose the right account type for frequently used Euro transactions. This determines your business’s financial efficiency and international payment capabilities. If you do extensive trade with Europe, you can open a Euro IBAN account.

Both account types meet different needs. Both have different operational advantages. You can also use online debit card and offshore bank card integrations for your business.

Let’s compare the two account types for frequently used Euro transactions:

1 – Euro IBAN Account

A Euro IBAN account allows your money transfers to be SEPA-compliant. You can make payments anywhere in Europe quickly and with low fees. It also helps you avoid legal issues.

You can integrate your business with an online debit card. This allows you to receive payments directly from European customers.

You can also perform transactions through mobile banking. If you work with digital banks with offshore infrastructure, you can securely spend internationally by supporting your accounts with a virtual debit card.

2 – Multi-Currency Account

A multi-currency account allows your business to receive payments from different countries in your preferred currency. This eliminates the impact of currency conversion costs. Using an offshore business debit card offers many advantages.

Integrating with a virtual debit card allows you to make online payments in different currencies and apply different limits to each transaction. If you’re looking to open an online debit card for your business, visit The Kingdom Bank now.

Can a Euro IBAN Account Handle Currencies Other Than the Euro Like a Multi-Currency Account?

If you open a Euro bank account, you can only transact in Euros. Transactions in other currencies can be difficult. This account type offers advantages for transfers within Europe.

If you use it in conjunction with an online debit card, you can work with customers in Europe. You can also easily conduct transactions through mobile banking.

However, if you want to transact in different currencies with your Euro bank account, you should open a foreign currency account. Some banks offer currency conversion services linked to a Euro IBAN account.

A multi-currency account allows your business to receive payments in different countries. You can accept these payments in other currencies. This also reduces currency conversion costs.

If your bank has an offshore infrastructure, you can transact in different currencies. You can also make online payments in other currencies using a virtual debit card.

An offshore bank account for business can be opened with The Kingdom Bank. If you want to open an offshore debit card for business, visit our website.

What are the Fees Associated with Euro IBAN Accounts Versus Multi-Currency Accounts?

Euro IBAN accounts and multi-currency accounts make international financial transactions easier for your business. However, you’ll pay different fees for these two account types.

The costs for account opening, money transfer, currency conversion, and card usage are different.

Euro IBAN account fees are as follows:

- Account Opening Fee: Generally free. Digital banks do not charge fees for online applications.

- SEPA Transfer Fee: Transactions can be made with low fees between £0 and £1. SWIFT is not used.

- Currency Conversion Fee: A conversion fee of 1–2% may apply for non-Euro transactions.

- Debit Card Usage Fee: Online debit cards are generally free. A physical card may have an annual fee of £10–£30.

- Virtual Card Fee: Virtual debit cards are offered free of charge on most platforms.

- Monthly/Annual Account Fee: Digital banks like The Kingdom Bank generally do not charge a fixed fee.

Now let’s look at the features for the other payment method.

Multi-currency account fees are as follows:

- Account Opening Fee: Generally free. Platforms like The Kingdom Bank offer fast online registration.

- Currency Conversion Fee: A commission of 0.35–1.5% is charged based on the actual exchange rate.

- Transfer Fee: Varies by country and currency. For example, a USD transfer may cost between £1 and £5.

- Balance Holding Fee: Holding a balance in multiple currencies is free.

- Virtual Card Fee: Generally free, small commissions may apply per transaction.

For your international banking transactions, visit The Kingdom Bank now. Offshore banking for business transactions can be done here

Meta Decs. Compare Euro IBAN vs multi-currency accounts for global payments—SEPA, FX rates, offshore perks & virtual cards with The Kingdom Bank.

How Do International Business Payments Differ Between Euro IBAN and Multi-Currency Accounts?

If you’re making international business payments in Europe, you can open a Euro IBAN account. You won’t pay high fees for SEPA transfers with these accounts. You won’t encounter any legal issues either. However, you can only transact in Euros.

You can seamlessly receive payments from your European customers. Your business can manage its account seamlessly via the mobile app. Offshore business banking transactions can be managed securely with the mobile app.

You can also use debit cards and virtual cards during this process. Opening a multi-currency account allows you to receive services in your preferred currency, regardless of country.

If your business integrates a virtual debit card, it can make online payments in different currencies. Each transaction has a different limit, making international trade more efficient.

When choosing one of these accounts, visit The Kingdom Bank immediately.

Which Account Offers Better Currency Exchange Rates: a Euro IBAN or a Multi-Currency Account?

Businesses engaged in international trade should choose the right account to take advantage of exchange rates. Currency conversion costs vary for EURO IBAN and multi-currency accounts in different scenarios.

Integrating with an offshore bank card and an offshore business card allows for seamless online payments.

Let’s compare the two account types in terms of exchange rates:

Euro IBAN Account

This account allows you to make direct transfers in Euros. These transactions offer the lowest exchange rate conversion costs. This account type allows for transactions at a fixed exchange rate. Transaction fees are not as high as those associated with SWIFT.

If you are making transactions in currencies other than Euros, you will need to pay additional conversion fees. Furthermore, transactions may take a little longer. This option is advantageous for payments within Europe.

Multi-Currency Account

This account type automatically converts based on the real market rate. This minimizes the spread in foreign exchange rates. Many banks offering this service offer low commissions, ranging from 0.35% to 1.5%.

Integrating with an offshore business card allows you to manage payments to suppliers and customers in different countries. At this point, the flexibility of the exchange rate and cost control provide advantages over the Euro IBAN account.

How Do Euro IBAN Accounts Compare with Multi-Currency Accounts in Terms of Security?

Euro IBAN accounts offer high security standards for SEPA-compliant transfers. This account type protects all transactions according to European regulations.

Security protocols such as IBAN verification algorithms, two-factor authentication, 3D Secure integration, and transaction tracking await you in your accounts.

Using an offshore bank account, especially for businesses, allows you to conduct transactions in compliance with European regulations. By integrating with debit cards and virtual cards, you receive device or SMS verification for every transaction.

With multi-currency accounts, you can find flexible security solutions for transactions in different countries. Regulations vary by country.

Digital banks with offshore banking infrastructure utilize global security protocols such as AI-powered fraud prevention systems, IP and device authentication, and transaction limit controls.

You can also use it as an offshore bank account for your business. When transacting in different currencies, you’ll see separate security layers for each transfer. Debit cards and virtual cards become more effective with transaction-based verification and regional security filters.

The best debit card online can be yours through The Kingdom Bank. Conduct your international banking transactions digitally without any problems.

Which Account is Easier to Open: a Euro IBAN Account or a Multi-Currency Account?

If you’re looking to establish an international payment infrastructure, the account opening process should be straightforward. Digital banking and virtual card access can simplify your transactions.

While Euro IBAN and multi-currency accounts offer distinct advantages, opening processes have become quite accessible thanks to digitalization. Here, you can seamlessly conduct all your transactions on your mobile device.

Let’s consider both options for ease of account opening:

Euro IBAN Account

Opening an account with a Euro IBAN makes digital banking user-friendly. It also allows you to conduct financial transactions quickly. You can open a EURO bank account in just a few minutes after completing identity verification and address declaration on platforms like The Kingdom Bank.

Because your account is SEPA-compliant, you can seamlessly conduct transactions within Europe. Opening this account also allows you to use a virtual debit card. Online debit card integration simplifies many business processes.

Multi-Currency

Multi-currency infrastructure is more flexible. You can easily transact in different currencies. You can quickly open these accounts on platforms like The Kingdom Bank. You can also obtain an offshore debit card for business and create a virtual card.

You can set any limit you want on this account and choose your preferred currency. If you conduct global trade, you’ll benefit from easy currency conversion. You can use the online debit card for businesses at The Kingdom Bank. The Kingdom Bank will be your partner for business offshore banking.

Are Euro IBAN Accounts or Multi-Currency Accounts Better for Freelancers and Small Businesses?

Multi-currency accounts are more advantageous for freelancers. They can receive payments from different countries. You can keep your balance in currencies like USD, GBP, and EUR. Furthermore, the ability to trade at the real exchange rate reduces your currency conversion costs.

You can easily pay for online shopping and services with virtual debit card integration. Freelancers, in particular, can use this account type to process payments faster and more cost-effectively when receiving different payments.

A Euro IBAN account for your small business allows you to conduct transactions in Europe with low commissions.

This allows you to receive payments in euros from a European customer easily. Businesses can also integrate this account with an online debit card.

If you are based in Europe and primarily conduct transactions in Euros, you can open a Euro IBAN account.

If you are offshore banking for business, visit The Kingdom Bank. If you are going to open an offshore bank account for business, you can do so on our website.

About The Author