Investing in Crypto in 2025: Smart and Secure Strategies16 min read

Reading Time: 6 minutesInvesting in crypto has become one of the most advantageous digital investment systems. Cryptocurrencies are an innovative, emerging investment alternative with high levels of volatility that can fastly transform from thousands to nothing in just seconds.

TİP ⇒ Investing in Crypto is attracting more attention, especially in 2025. Success requires smart and secure strategies. This article is designed to meet your needs.

Yet many investors have noticed substantial returns within just a few short times thanks to cryptocurrencies’ great returns potential. If you’re planning to invest in crypto yourself, it is essential that you grasp how cryptocurrency works before launching.

Crypto is a digital form of money backed by algorithmic codes rather than by central banks. There are over 19,000 types of cryptocurrency projects but only a select few have found widespread popularity among investors and institutions alike.

Quick note ⇒ Cryptocurrencies can serve both as investments and new crypto payments alternatives now.

Bitcoin and other cryptocurrencies have fastly grown from digital assets into trillion-dollar technologies in a very short amount of time.

And cryptocurrencies are becoming popular investments as well as tools for buying goods in e-commerce platforms and services such as software, digital real estate day by day.

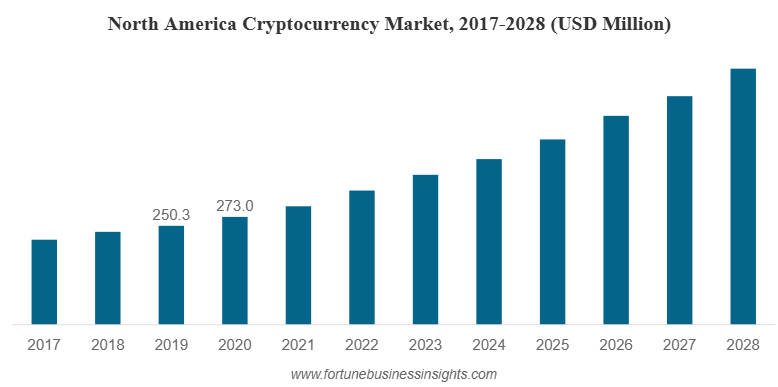

⇑ Chart source ⇒ Fortune Business Insight Cryptocurrency Market Size

You should be patient when investing in cryptocurrency. Furthermore, creating strategies like dollar cost averaging may reduce market volatility while increasing your earnings.

Investing in Crypto with a Crypto Friendly Bank

Crypto can offer investors with a productive means of diversifying their portfolio. Due to its low price relation with stocks, investing in crypto usually results in huge risk-adjusted returns than investing just in stocks.

However, how much cryptocurrency to invest depends completely on your risk tolerance and investment strategy. Cryptocurrency investments are greatly speculative and subject to sudden price swings.

It may even face sudden price crashes without any warning! As such, putting too much faith in it could pose numerous risks without proper preparation.

So, you must operate your crypto account through a reliable crypto friendly bank. You should search the most suitable platform for your crypto investing project entirely.

While cryptocurrency investments may appear profitable, investors still may prioritize low-risk assets such as bonds and rental properties before considering cryptocurrency investments.

It can be suggested that investors should limit exposure to investing in crypto to no more than 1%-5% of their total net worth. However, in the near future, these digital assets will be a major currency of the economy.

What Should a Beginner Know About Cryptocurrency?

Cryptocurrency is a digital asset that can be evaluated on digital exchange platforms offered by crypto friendly banks.

Since cryptocurrency does not bring intrinsic value, its price fluctuates depending on market demand and speculation, thus these assets are the great volatile investment with potentially huge returns for those adept at timing the market.

There are currently countless cryptocurrencies in the market and new ones being developed every day, such as Bitcoin for financial transactions.

When launching an investment project by using cryptocurrencies, diversify your portfolio by including several cryptocurrencies to reduce risk and protect from large price swings.

You can utilize popular cryptocurrencies including Bitcoin, Ethereum and Litecoin, however there are others as well.

Tips to Know Before Investing in Cryptocurrency

Before investing in cryptocurrency, it’s crucial to grasp its technology and risks. Investigate various cryptocurrencies available, and assess their growth potential.

Be mindful of how volatile the market can be while keeping a long-term project. Otherwise it is practical to get caught up in hype-induced decisions, like purchase when prices increase and selling when they decrease.

Cryptocurrency can be defined as a high-risk investment and according to older economists, these assets should not form the core of your portfolio.

Instead, think of it as a speculative asset outside your classical long-term investments and utilize funds specifically designated to buy cryptocurrency to speculate with it.

When choosing an exchange to invest in, prefer one with an excellent reputation and ample trading volumes. Be wary of those with lower trading volumes as these may be vulnerable to scams or hacking practices.

Additionally, you should remember to diversify your crypto investments by buying various cryptos so as to lower risk.

Cryptocurrency Investing Tips for Beginners

1 – Do Your Research

Never invest based on advertising or social media posts. Be sure to examine the technology behind the cryptocurrency you’re investing in, its use cases, its development team, and its supporting community. Don’t start without research.2 – Understand Volatility Well

Cryptocurrencies are highly volatile. Volatility refers to price fluctuations over time in financial markets. Prices can fluctuate significantly within hours. Be prepared for sudden fluctuations. Don’t invest money you can’t afford to lose.3 – Prioritize Security

Always use well-known, reliable exchanges. Enable two-factor authentication. To reduce the risk of hacking, don’t hold your long-term assets on exchanges. Consider moving them to hardware wallets instead.4 – Diversify Your Portfolio

As with traditional investing, don’t invest all your money in a single cryptocurrency. Spread your investment across different cryptocurrencies to balance the risk.5 – Stay Informed on Current Developments

Laws and regulations regarding cryptocurrencies vary and continue to evolve from country to country. Be sure to follow these developments.6 – Beware of Scammers

If something sounds too good to be true, it probably is. Don’t be fooled by scams designed to deceive you. Be wary of fake schemes and non-transparent individuals.7 – Plan for Taxes

Cryptocurrency gains are taxable in many jurisdictions. Keep records of your transactions and be sure to consult a tax professional to avoid surprises at tax time.8 – Think Long-Term

While some investors day trade, many achieve success by building strong long-term projects. In such a rapidly evolving market, patience often pays off. So, plan for the long term.

How to Invest in Crypto in Digital Banking?

Many crypto friendly banks are increasingly offering their customers with access to cryptocurrencies and digital assets, while The Kingdom Bank’s digital asset management unit established a team dedicated to assisting customers invest in crypto assets.

You should not forget that any involvement with cryptocurrency could draw increased scrutiny from banks, particularly for clients considered high-risk.

Before signing on with any crypto friendly bank, it’s suggested to have an in-depth conversation with their banker directly about your individual conditions and client profile requirements.

Most banks only operate with early adopters of cryptocurrency who fulfill certain requirements such as being involved with projects using cryptocurrency as part of their business or financial project plans.

Apart from these crypto friendly banks, you could find an introducer. There are a number of lawyers, offshore “experts,” and corporate service providers that charge to introduce digital banking customers to bankers who launch crypto accounts.

Is Investing in Crypto Safe?

Even though there are some risks in investing in crypto, today with many developments it can be claimed that it is not a bad idea to invest in it.

There are various risks involved with investing in crypto, including its non-governmental backing and hacking practices. Users may lose all or some of their crypto investments as a result.

This has already happened before so only invest what you can afford to lose and choose wisely among numerous cryptocurrencies each with different features and risks.

Before launching any crypto investment in digital banking , it is also greatly essential to do your homework. One productive way is reading a crypto’s whitepaper which should outline its purpose and scalability.

Furthermore, researching who owns any reliable and reputable exchange you consider also plays a significant part.

How to Manage Digital Assets with Crypto Investments?

While cryptocurrency investing has become a greatly widespread way to diversify your portfolio, it remains a high-risk asset.

Therefore, only invest a proportion of assets that you can afford to lose, as well as doing in-depth research before buying any type of coin. This should involve researching who owns its marketplace and grasping how the currency works.

Staying abreast of news related to the crypto market can also assist keep you abreast of changes that could have an impact on your crypto investments.

Make sure to store any cryptocurrency that you own in a secure wallet to safeguard it against hackers and other known security risks.

Best Digital Bank to Invest in Crypto

Investing in crypto offers many advantages, involving diversification and potentially high returns. Like in all types of investments, cryptocurrency is risky only when you invest what you can afford to lose.

When buying coins directly through an exchange either acting as broker or an exchange-traded fund manager, ensure it provides great security features with low transaction fees.

Cryptocurrencies may be volatile investments, yet many users have faced substantial returns. To maximize returns and minimize price fluctuations and risks, even though bonds and rental properties tend to offer less risk exposure, cryptocurrency should be a major part of your overall portfolio.

If you need help getting started or don’t know how best to proceed with cryptocurrency investing, you can consult The Kingdom Bank. As a reputable crypto friendly bank, we offer a fast and secure crypto investing environment for you.

Although the best bank depends on your special needs, as The Kingdom Bank, we provide all types of services to your crypto investing needs for your individual projects or financial projects alike. You can contact The Kingdom Bank to open this profitable door of the future!

About The Author