How to Do Cross Border Payments? (Current Guide)13 min read

Reading Time: 5 minutesCross border payments provide financial transactions between two different countries. These financial transactions range from transferring money to trading in goods, products or services. It is a solution for those who need international payment methods.

Cross border payment systems are on the rise, from migrants sending home remittances to online marketplaces expanding rapidly. Unfortunately, however, the current system is costly, slow and opaque.

The global architecture that facilitates these flows is intricate, consisting of numerous actors and intermediaries who create infrastructures to link locations together. However, these networks typically only permit payment firms limited access.

What is the Cross Border Payment System?

Simply “what is a cross border payment?” To answer the question, It can be said that cross-border payment means financial transactions between two different countries.

These financial transactions range from transferring money to trading in goods, products or services. It is a solution for those who need international payment methods.

As commerce continues to become more globalized, there is a rising need for quick, secure and accessible cross border payments.

Families sending money home or companies importing products from overseas suppliers both require cross border payments; improving them so that they are cheaper, faster and easier for everyone would make a significant impactful statement about our economies and societies.

We can summarize cross-border payment transactions as follows.

What are the Types of Cross Border Payments

The most popular types of cross border payments are bank transfers, SWIFT and IBAN, payment service providers , wire transfer and cryptocurrencies.

Cross border payment gateway can be complex, often necessitating multiple intermediaries for transaction fees and processing times to be higher than domestic ones – an expense and delay that is especially burdensome for smaller businesses making occasional international transactions.

Bank for International Settlements’ (BIS) cross border payment gateway interoperability efforts aim to break down these barriers by creating technical, semantic and business system compatibility across payment systems.

It can be accomplished using one of four stylised models: single access point, bilateral linkage hub-and-spoke network or common platform.

Some of these projects are already reaping fruit. The Kingdom Bank provides a common cross border payment service for financial institutions and corporations in the world, which will launch in 2022 with the aim of reducing transaction costs and processing times associated with cross border payments.

Users increasingly demand fast, secure and accessible cross border payments due to eCommerce, global trade and migration trends. Such payments play an especially crucial role for developing and emerging economies due to international remittance contributions to GDP growth.

Although cross border payment gateway pose unique challenges, there are strategies available that can help improve quality.

Examples of the B2B Connect provides corporate customers with an efficient method for sending and receiving international payments more cost effectively by improving fee transparency and helping companies manage cash flow more easily.

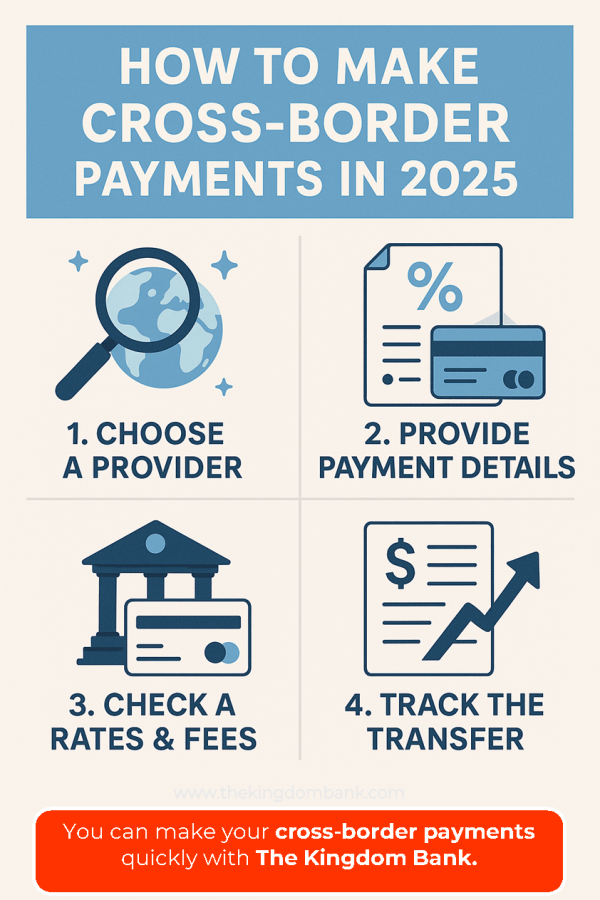

How Cross Border Payments are Done?

Due to globalization and increasing international trade, remittances, and eCommerce, there has been an ever-increasing need for fast, efficient cross border payments that are accessible and fast – yet costly due to slow speeds or limited access.

There are however multiple barriers preventing this kind of payment process from taking place effectively: high costs, slow speeds or limited access may impede their smooth running.

The Financial Stability Board, in collaboration with the BIS’ Committee on Payments and Market Infrastructures (CPMI), created a G20 roadmap for improving cross border payments which was approved by its Leaders in 2021.

This roadmap provided vision, objectives, steps for improvement, as well as 19 building blocks designed to address frictions underlying high costs, slow speed payments and limited access.

CPMI is now transitioning into the final stage of practical implementation and developing solutions.

This involves the coordination of change programmes with central banks, public authorities, standard-setting bodies and private companies worldwide as well as partnerships with innovative private companies offering innovative solutions for improving cross border payment systems.

Another example is a new cross border payment gateway using blockchain technology to verify identity of recipients; potentially cutting down failed payments that cost the global economy $118 billion every year.

What Currency is Used for Cross Border Payments?

Payments are integral components of global commerce and economic activity, yet the global payment system remains expensive, slow, and opaque – an obstacle that impedes cross border trade, international development initiatives, and financial inclusion efforts.

Luckily, emerging solutions exist which could streamline global payments.

These innovative new technologies aim to enhance cross border payments’ speed, cost and transparency by improving speed, costs and transparency for consumer and business payments alike.

Their purpose is to address four primary obstacles to cross border payment: high costs, slow speeds, limited access and limited transparency.

One such system is the Single Euro Payments Area (SEPA), a network allowing banks in Europe to exchange euro payments using existing infrastructure and reduce costs associated with transacting these transactions across borders – increasing speed and convenience as a result.

Alongside innovative solutions, many central banks and global organizations are working to remove persistent obstacles to faster, more inclusive cross border payments.

With The Kingdom Bank, you can quickly meet future trends such as cross border payment solutions. As The Kingdom Bank, we provide you with the tips you need to make it convenient for cross border payments.

What are Traditional Cross Border Payment Methods?

Traditional cross border payments can be costly and time consuming, as they involve numerous intermediaries and currency conversions, which leads to high transaction fees and prolonged processing times, negatively affecting smaller businesses which only need global transactions occasionally with suppliers.

Furthermore, limited payment system access, limited operating hours, and differing national payment systems present further obstacles for firms looking to process cross border payments.

To address these challenges, the Financial Stability Board (FSB), together with other international bodies and standard-setting organizations like CPMI and other bodies like ISOs, developed 19 building blocks designed to facilitate cross border payments. This forms the basis of an action plan which was approved by G20 in 2021.

This Roadmap set four specific goals for improving cross border payments: faster speeds, lower costs, greater accessibility and increased transparency.

Meeting these targets would yield wide and lasting advantages in international trade, global development and financial inclusion.

To address the Roadmap’s concerns, the Financial Stability Board has initiated a multistakeholder initiative to create a pan-African cross border payments platform in cooperation with central banks.

Furthermore, this effort explores ways of increasing national payment system interoperability to reduce friction for existing cross border payment services and eliminate intermediaries; supported by World Bank Group and other international organizations including G20. Despite global political tensions, FSB remains optimistic in its efforts to advance cross border payments.

Best Bank to Do Cross Border Payments

Many financial institutions worldwide are working diligently to deliver more efficient and affordable cross border payment solutions for both business and consumer use cases.

Their work is driven by international remittance needs, global eCommerce growth and global trade expansion as well as consumers traveling across borders for shopping or visiting family.

Traditional cross border payments services involve intermediaries who require extensive manual handling, are costly and slow, often lack transparency regarding fees, making them unattractive to smaller businesses who tend to favor domestic supply chains over global ones.

However, blockchain technology offers us an unprecedented chance to develop more efficient, transparent, and convenient cross border payment systems.

New initiatives being taken by both central banks and the private sector to use this innovative payment method may make this possible.

Contact The Kingdom Bank, a reliable service in the field of cross border payment solutions. The Kingdom Bank also offers a streamlined B2B cross-border payment solution that simplifies international transactions for your business projects.

Thanks to its innovative vision in digital banking, The Kingdom Bank is with you in every step you need to meet cross border payment solutions.

About The Author