How To Trade Cryptocurrency in 202510 min read

Reading Time: 4 minutesCryptocurrency has emerged as a popular investment option in recent years. If you’re a first-time investor, it’s essential to gain a solid understanding of what cryptocurrency is and how it operates.

In this article, we’ll provide a comprehensive guide to investing in cryptocurrency in 2025.

What is Cryptocurrency?

Crypto-assets, also known as “cryptocurrencies,” are virtual assets that use blockchain technology and a decentralized ledger. They are not traditional currencies and their value is determined solely by supply and demand.

Cryptocurrency is a bank-free digital payment system that uses P2P sharing to send and receive payments globally. Transactions are virtual entries in an online database and recorded in a public ledger, while digital wallets store cryptocurrencies.

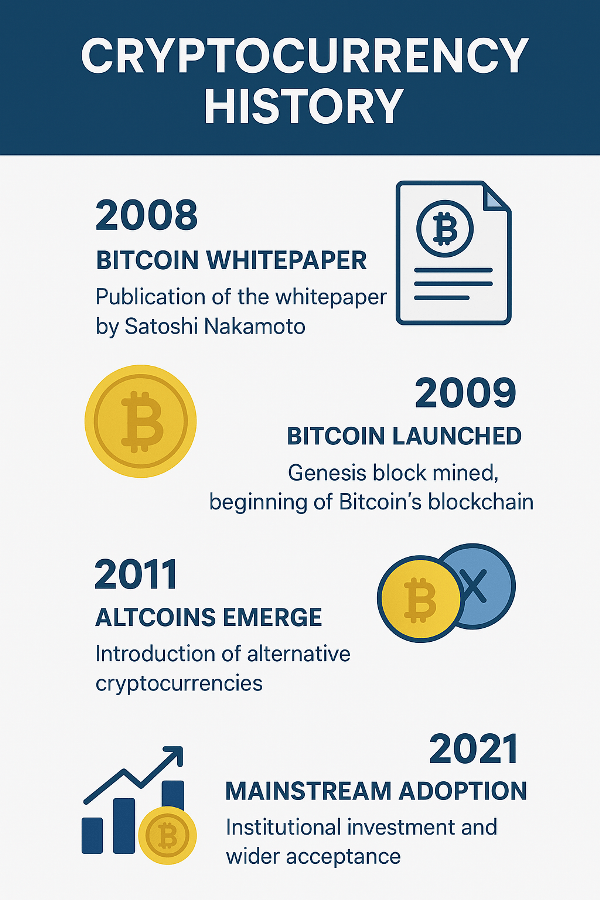

Cryptocurrency History

Satoshi Nakamoto, the alleged creator of the first cryptocurrency, Bitcoin, founded it in 2009. The motivation behind creating this digital currency was to demonstrate that secure and nearly cost-free flows of money could be exchanged without the involvement of banks.

The inception of the Bitcoin blockchain network was marked by the publication of a white paper titled

“Bitcoin: A Peer-to-Peer Electronic Payment System” by Satoshi Nakamoto.

This paper outlined the workings of the network, setting the stage for the events that followed and marking a significant moment in Bitcoin’s history.

The mysterious Satoshi Nakamoto launched the blockchain technology by mining the first block of the Bitcoin network, known as the Genesis block, four months after its introduction. Despite the passage of time, Nakamoto’s true identity remains unknown.

Select Investments When Trading Crypto

Investing in cryptocurrency is gaining popularity due to its unique features. However, it can be complicated and requires understanding of best practices.

Here are four tips to help you invest in cryptocurrency with confidence.

- Set an Investment Budget: To invest in cryptocurrency, setting a budget is the first step. Due to the high volatility of the crypto market, it is crucial not to invest more than you can afford to lose. Risk management is essential, and emotional decisions should be avoided when trading.

- Diversify Cryptocurrencies: With the volatile nature of cryptocurrencies, it is essential to spread out your holdings to minimize risk. By investing in various coins or tokens across different sectors, you can balance out potential losses and protect your investment.

- Invest in Cryptocurrency in DCA: Dollar-cost averaging (DCA) is a smart investment strategy that involves investing a fixed amount of money at regular intervals. This way, you can avoid the impact of market volatility and buy more coins when prices are low and fewer coins when prices are high.

- Keep an Open Mind: The market is new and constantly changing, so keep an open mind, stay up-to-date with the latest news and research, and adapt your strategy accordingly. Be aware of risks such as cybersecurity threats and regulatory changes that can impact the market.

Benefits and Losses of Investing in Cryptocurrencies

Before purchasing cryptocurrency, it is advisable to acquaint yourself with its advantages and disadvantages. Over the past few years, cryptocurrency has been widely discussed in the media, and it is often portrayed as a precarious investment.

Advantages

- One of the most significant advantages of cryptocurrencies is their security. Unlike traditional financial systems that rely on intermediaries to verify transactions, cryptocurrencies use blockchain technology, a decentralized system that ensures that transactions are secure and hacker-proof.

- Cryptocurrencies offer fast and cheap transactions compared to traditional financial systems. Transactions can be completed almost instantaneously, and the fees involved are typically lower than those charged by banks and other financial institutions.

- Another advantage of cryptocurrencies is their anonymity and confidentiality. Transactions made through cryptocurrencies are pseudonymous, which means that they are not linked to the user’s identity.

- Cryptocurrencies are also an exciting investment object that offers the potential for high returns. Over the past few years, cryptocurrencies like Bitcoin and Ethereum have seen significant price increases.

Disadvantages

- One of the most significant disadvantages of investing in cryptocurrencies is their high volatility. Cryptocurrencies are known for their rapid price changes and can experience significant fluctuations in value in a short period.

- Despite the growing popularity of cryptocurrencies, only a few players currently offer it as a payment method. This limited acceptance of cryptocurrencies can make it challenging to use them in daily life.

- Another disadvantage of cryptocurrencies is that they can be used for criminal activities, such as money laundering and illegal transactions. Cryptocurrencies’ anonymity and lack of regulation make it easier for criminals to manage their operations.

- While cryptocurrencies offer a certain degree of anonymity, they are not entirely anonymous. Cryptocurrencies are pseudonymous, meaning that transactions are linked to a user’s public address, which can be used to track transactions.

The Kingdom Bank Make cryptocurrency brokerage account

As cryptocurrency trading continues to gain popularity, more investors are exploring ways to participate in this market. For those seeking to maximize their profits, opening a cryptocurrency brokerage account with a bank such as The Kingdom Bank can be an attractive option.

To open a cryptocurrency brokerage account with The Kingdom Bank, the initial requirement is to become a customer. The bank offers multiple options for becoming a customer, such as online sign-up via their website or visiting their branch office in person.

Once you become a customer, the next step is to fund your account with a deposit of your preferred amount in either fiat currency or cryptocurrency.

After funding your account, you can begin trading cryptocurrencies. The Kingdom Bank provides various options for buying and selling digital currencies, such as using their online platform or mobile app.

Additionally, the bank offers the option to set up automatic buying and selling orders, which can be beneficial for diversifying investments or taking advantage of market opportunities promptly.

In addition, The Kingdom Bank offers traders access to various tools to help them make informed decisions.

The bank’s online platform provides charts and other analytical tools to track price movements and assist users in deciding when to buy or sell. Moreover, The Kingdom Bank‘s customer service team is available to address any queries that traders may have.

About The Author